What Is a Bookkeeping Template and Its Importance for Businesses

Creating financial reports is vital for any company that wants to keep track of important information, like profit, expenses, and business health. To accomplish that, business owners in different industries create tools to register these values and analyze them to choose an optimal course of action.

One of the most common tools used for that purpose is the bookkeeping document. It is a powerful tool that can track numerous financial details of your company. But to work properly, every detail included in the template must be well-thought-out.

In this article, we will show you how to create the perfect bookkeeping balance sheet for your business. Follow all the steps carefully, and you’ll have the perfect tool for calculating your cash flow statement and other financial details.

What Is a Bookkeeping Template and Its Importance for Businesses

What Are Bookkeeping Templates

A bookkeeping document is a tool used by companies to track business expenses and measure performance based on values such as net income and direct profit from sales. It is primarily used by small businesses that don’t want to spend money with advanced accounting software, but companies of all kinds and sizes can use it.

It provides an easy way to access all expenses of your business and calculate any financial information you need. Although it is referred to as a bookkeeping document, there are numerous types, such as an income statement template or a balance sheet template.

Each one has a specific purpose that can help your business. Before you start creating the document, you must understand what you want to calculate and your company's objectives.

Why Creating Bookkeeping Templates Is Important

Several reasons make the bookkeeping document a powerful tool that can help you with different tasks of your company. The first one is its versatility.

With a bookkeeping template, you can track numerous pieces of information vital for your business, such as profit and loss, financial position on the market, and other relevant financial data. Everything will depend on the bookkeeping system used and the type of template created.

Along with that, the bookkeeping spreadsheet also allows you to plan strategies and courses of action to achieve better results and make your business grow. These documents provide a deep analysis of different aspects that can be quickly evaluated and even automatically calculated with the help of automation features.

Another reason bookkeeping documents are such helpful tools is that they are easy to use, and anyone at the company can make a template. With a single document, you can access relevant data anywhere and share the document with all involved parties.

Who Uses These Accounting Templates

Different parties can benefit from using these spreadsheets. The first one is the business owner. They can control and keep track of various aspects of their company with a simple document that can be opened throughout different platforms.

Another party that directly benefits from having such a tool is the organization's financial sector. Having a document like this helps them better manage expenses and calculate how much each investment is giving in return. They can keep track of employee payments and other financial transactions.

Lastly, another group of people that use these templates are your stakeholders and investors. They indirectly benefit from your business, so it’s natural that they’ll want to understand your company’s financial health. The bookkeeping spreadsheet is the perfect document to illustrate and show any information they want.

Differences Between Bookkeeping Documents

As we mentioned, you can find numerous bookkeeping spreadsheets to track valuable financial information. Each one serves a different purpose and can be used to calculate additional data.

Make sure to take a look at each one to understand which document best fits your objectives. Here are the main types, along with their differences:

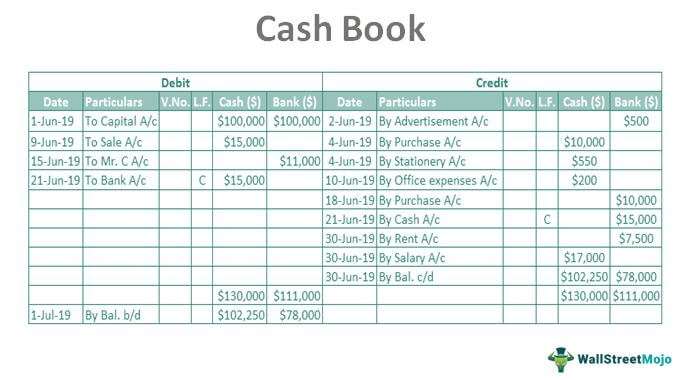

Cash Book Template

The cash book template is one of the most used documents for registering debit and credit transactions of a business. With this tool, you can easily track your cash balance and its main details.

In this kind of template, it is common to include the dates on which the operations occurred, along with a brief description of each item for identification purposes. It is a simple document that can easily calculate your current cash balance.

Most cash book documents are divided into two primary columns, one being the debit and the other one the credit. This helps with visualization and makes the spreadsheet more organized.

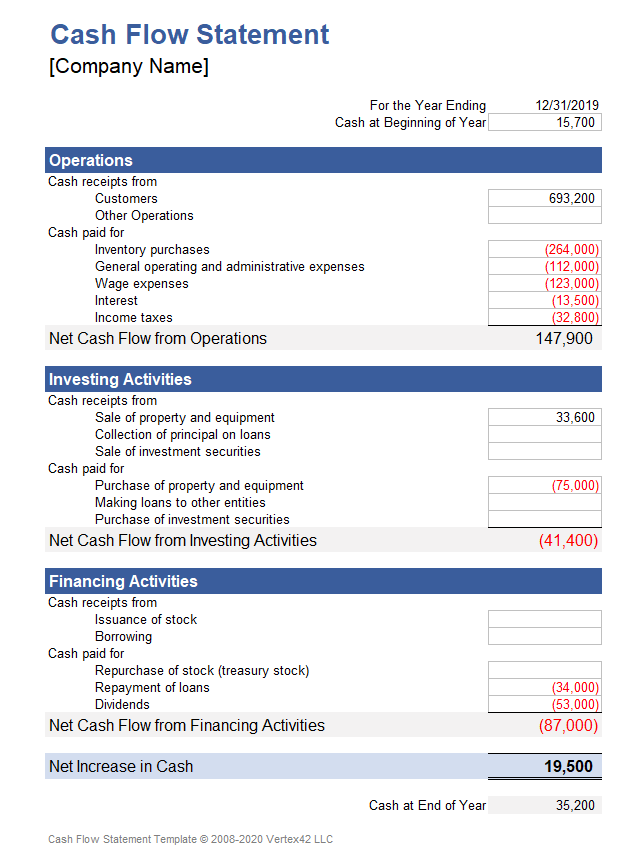

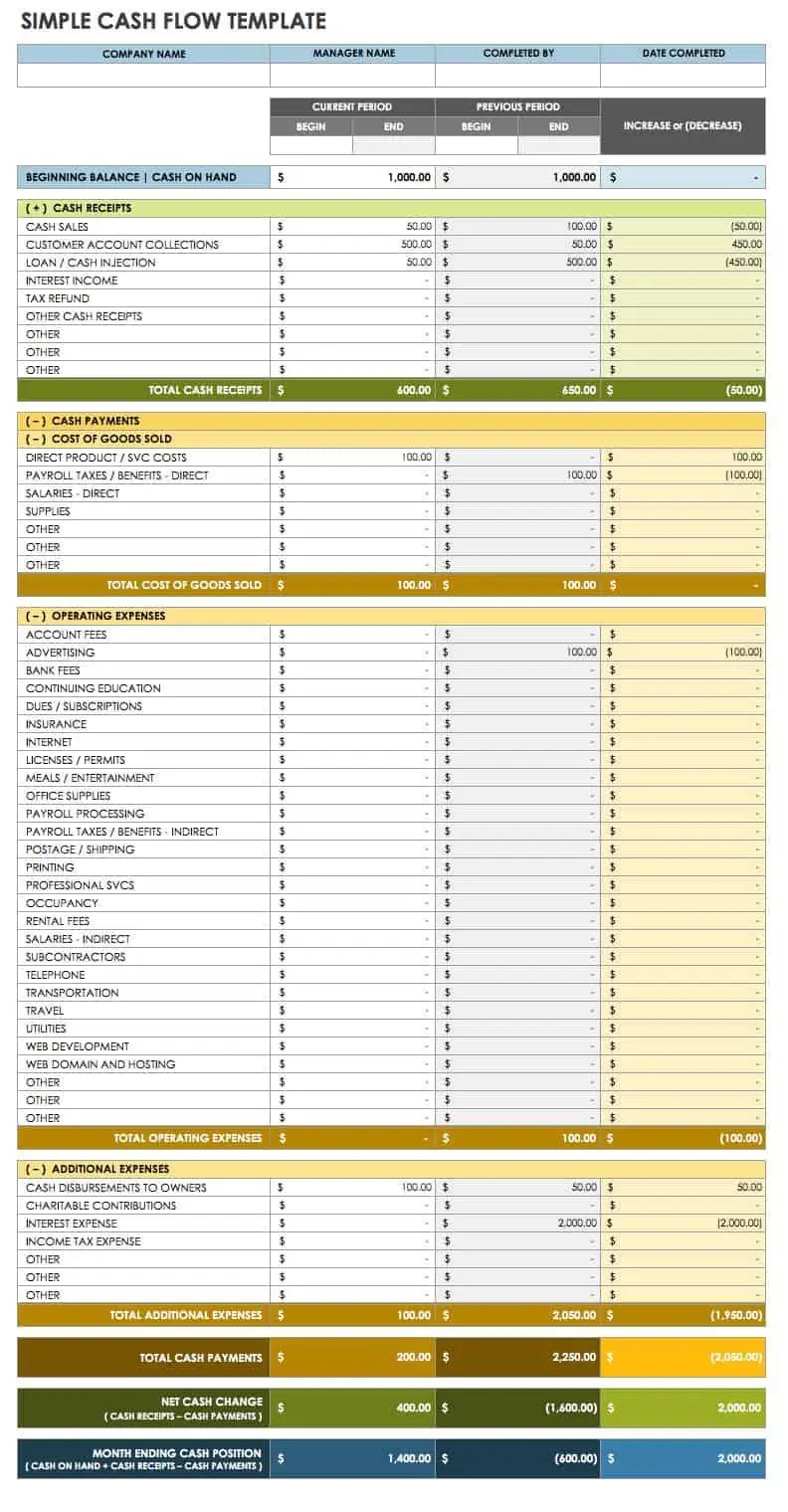

Cash Flow Template

Cash flow is one of the most critical pieces of information for businesses of any kind, and having a well-structured template can help a lot with that. The main objective of a cash flow template is to track every value that comes or goes out of your business. It is also used to make monthly comparisons to see what happened and what course of action needs to be taken.

The cash flow document is similar between small business owners and big companies. The only difference will be the volume of information. You must ensure you list everything necessary for a precise calculation.

The cash flow template should include information like receipts, payments, and all other business transactions directly related to your company.

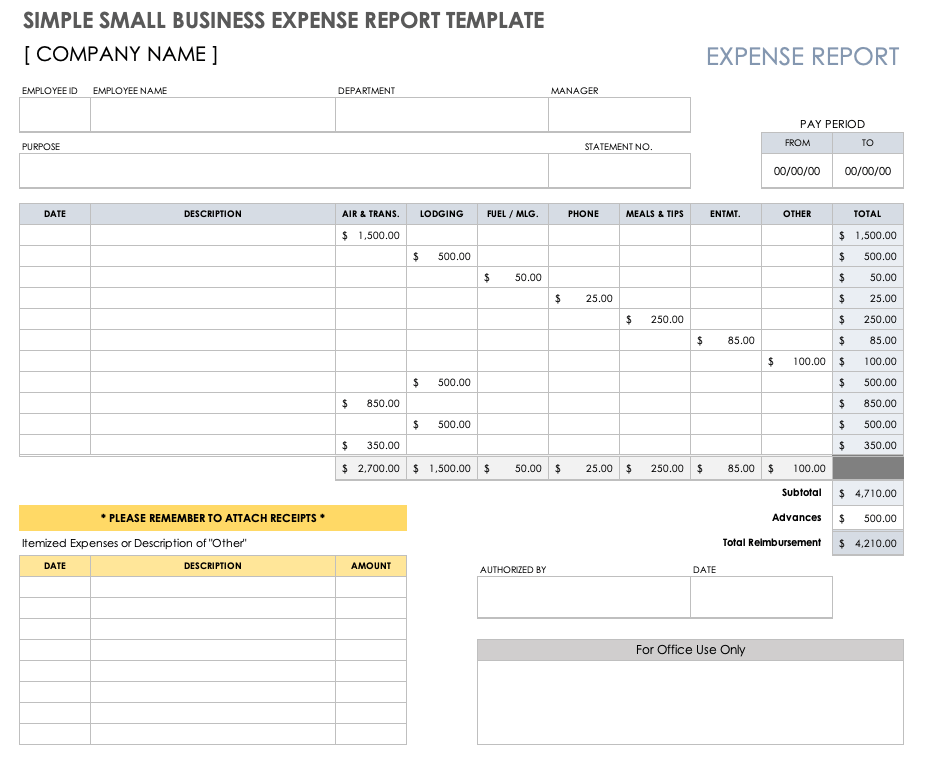

Business Expense Template

Another common type of bookkeeping document is the business expenses template. As the name suggests, the main focus of this document is listing and registering all expenses related to your company.

Everything needs to be properly listed, from water bills to furniture purchases, along with its value for a precise calculation. When building this kind of document, it is recommended to use a tool that allows integration with automation tools.

This way, you can make all calculations automatically. Once you add a new item to the list, the software automatically adds the value to the total amount.

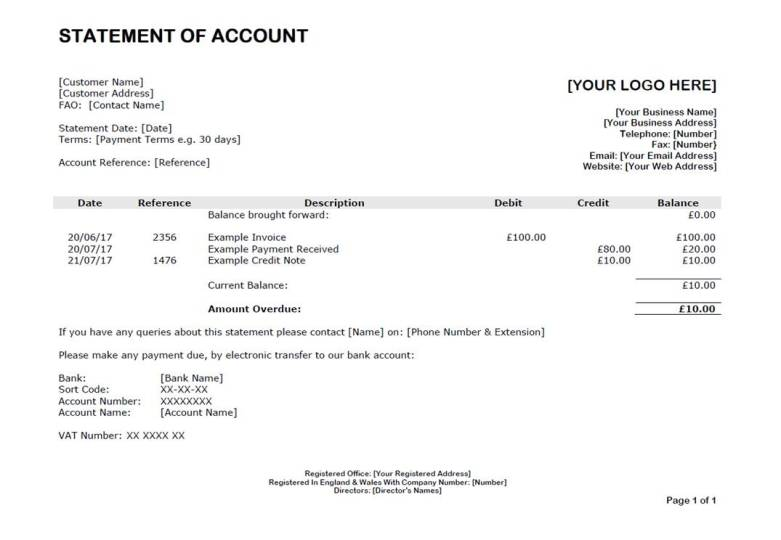

Statement of Account Template

If you’re looking for a template to keep track of all financial transactions between your company and one or multiple clients, a statement of account can be a great option. You can select the period of the tracking tool, which can go from a week to a year, depending on your needs.

If you make an Excel accounting template for this task, for example, you can easily create an account summary with the main information of the client tracked. Some of the typical data included in these templates are previous invoice numbers, credits, and balance owed.

The Excel accounting templates also allow automation, and you can integrate them with your favorite tools to increase optimization and efficiency.

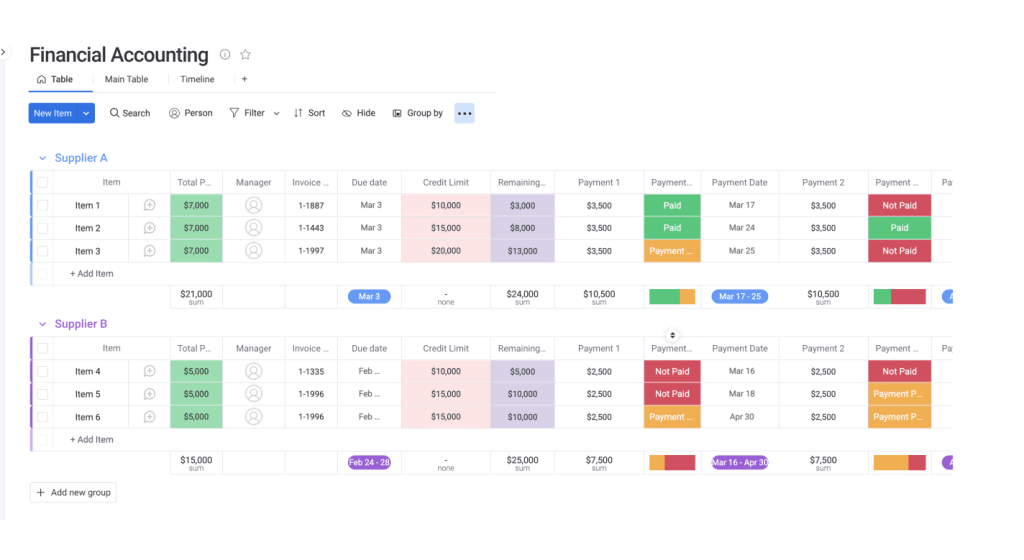

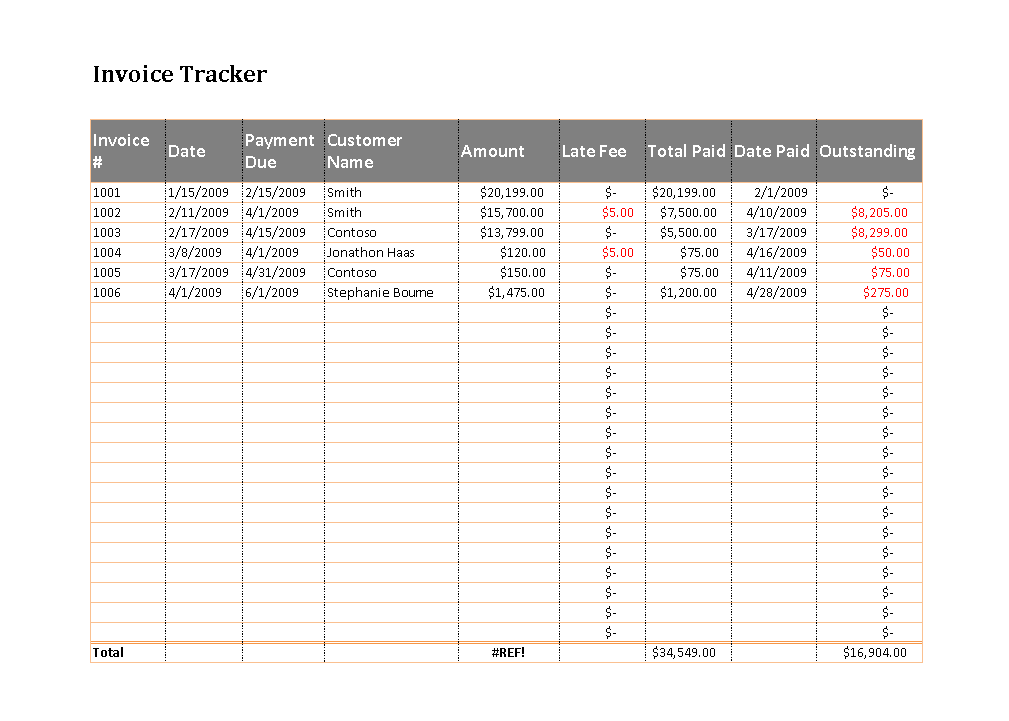

Invoice Tracking Template

Invoice tracking is another common task for any business. With a customized document, this task can become way more manageable. Invoice templates are responsible for showing the client important information about a product or service purchase.

They include the type of payment and its due date. Having these documents landed to the clients ensures everything is correct and both parties agree with the terms stipulated.

Additionally, if you add a space for signing the paper, you can even use it for legal actions if needed. If you provide services or products to a large number of clients, it is an indispensable document.

Some of the most critical information in this document is the total amount to be paid, the due date, and the payment method that will be used. Don’t forget to also calculate the taxes and describe them so that the client has a clear understanding of what they’re paying for.

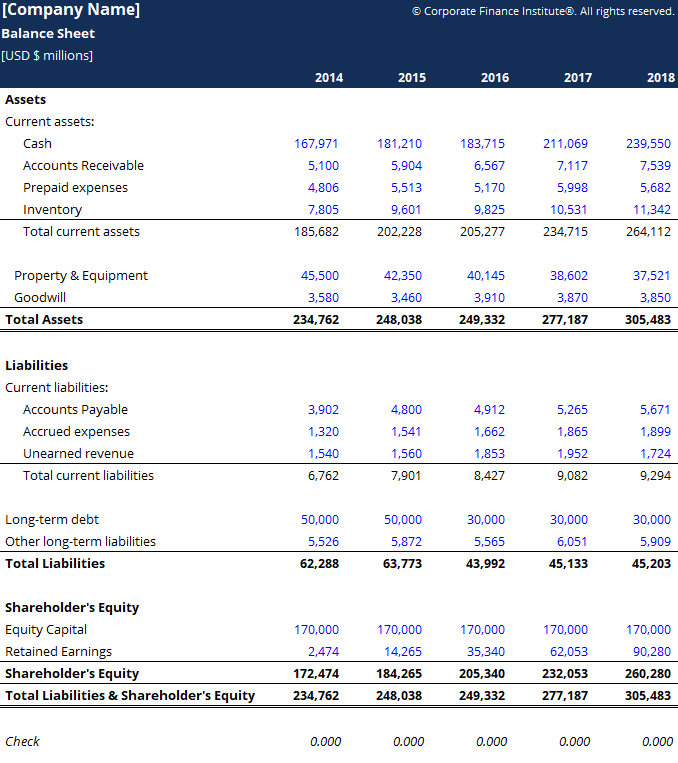

Balance Sheet Template

A balance sheet is essential since it gathers information about your assets, liabilities, and common financial ratios. It is perfect for tracking data about your inventory and the value of each asset.

Although accounting templates are simple to edit, you must ensure to include all items. Otherwise, you might end up with a calculation that is not precise and doesn't reflect the actual state of your company. Double-check each item to ensure everything on your balance sheet templates is correctly listed.

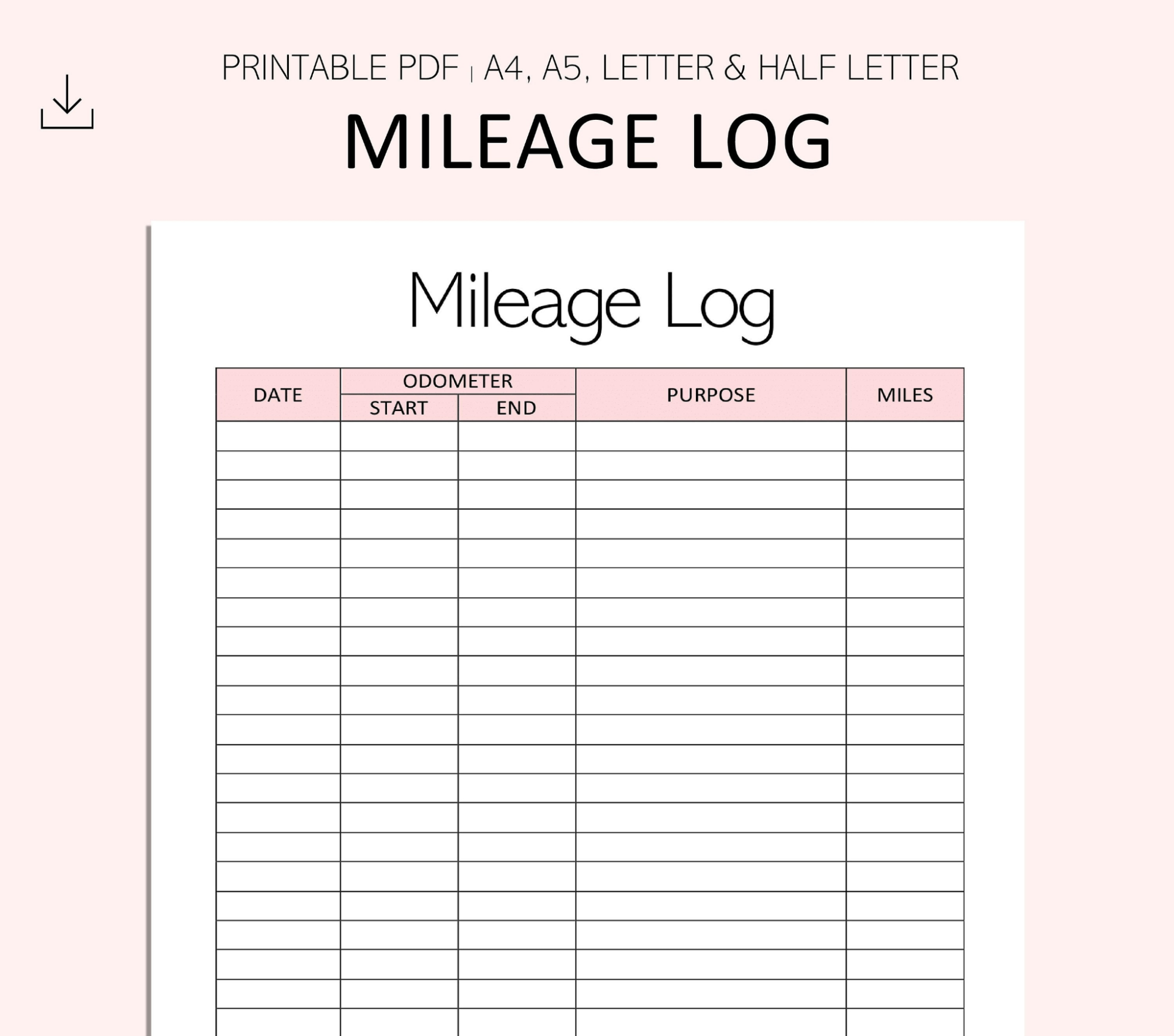

Mileage Log Template

If you run a travel business, the mileage log can be a game changer for registering essential data regarding your trips. It is responsible for keeping track of the date each trip occurred, along with the total miles traveled between the starting and ending points.

Unlike an accounts template, for example, it usually won’t feature financial values, but your Excel template can comprise the total cost of each trip if you want. The leading information featured in a basic template for tracking mileage is date, purpose, total miles, and odometer values.

It’s not a document for tracking a business’s financial health like the previous ones. Still, if you’re an Uber driver or run a travel company, it is indispensable for tracking everything properly.

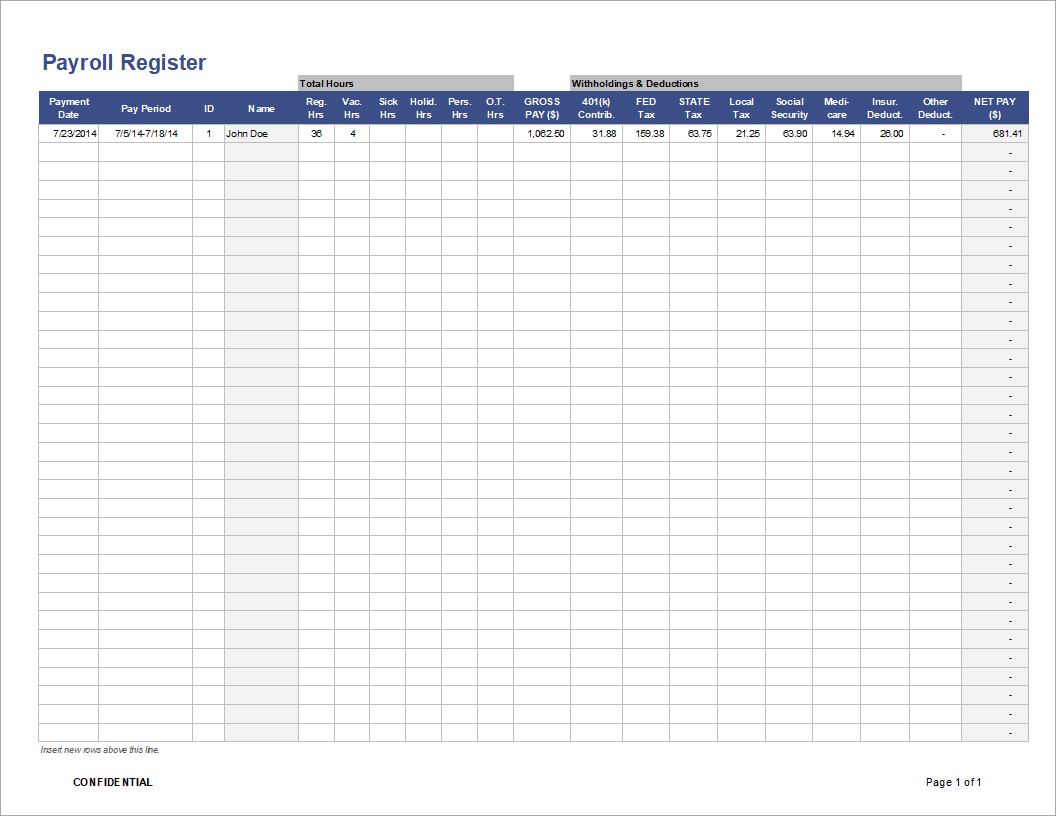

Payroll Template

The payroll template is also an extremely helpful tool, especially if your company has a more significant number of employees. With this document, you can gather all relevant information about each employee’s payroll, including name, ID, pay period, and any other data you need.

The main objective of this template is to optimize the payment process and avoid any mistake, like transferring the wrong amount. Companies of all sizes can use it, but it is more common among small and medium-sized businesses.

The template can also be edited to fit specific needs, depending on your goals and business type.

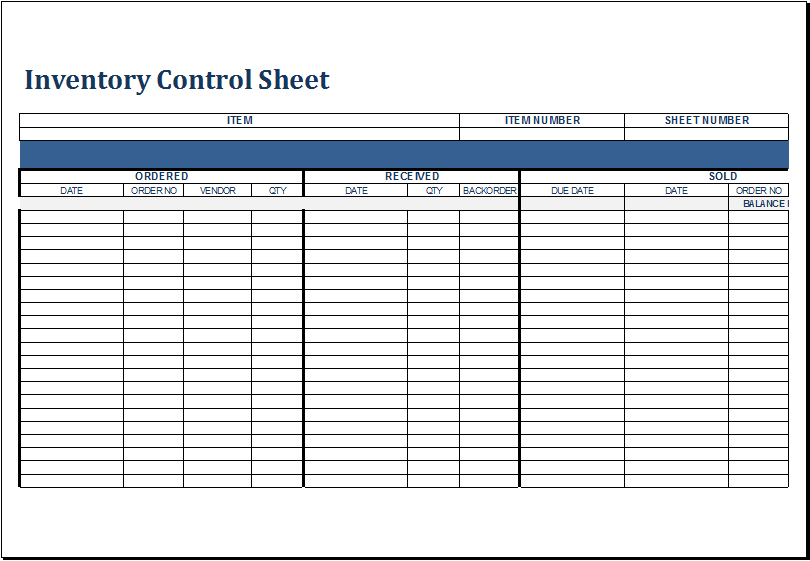

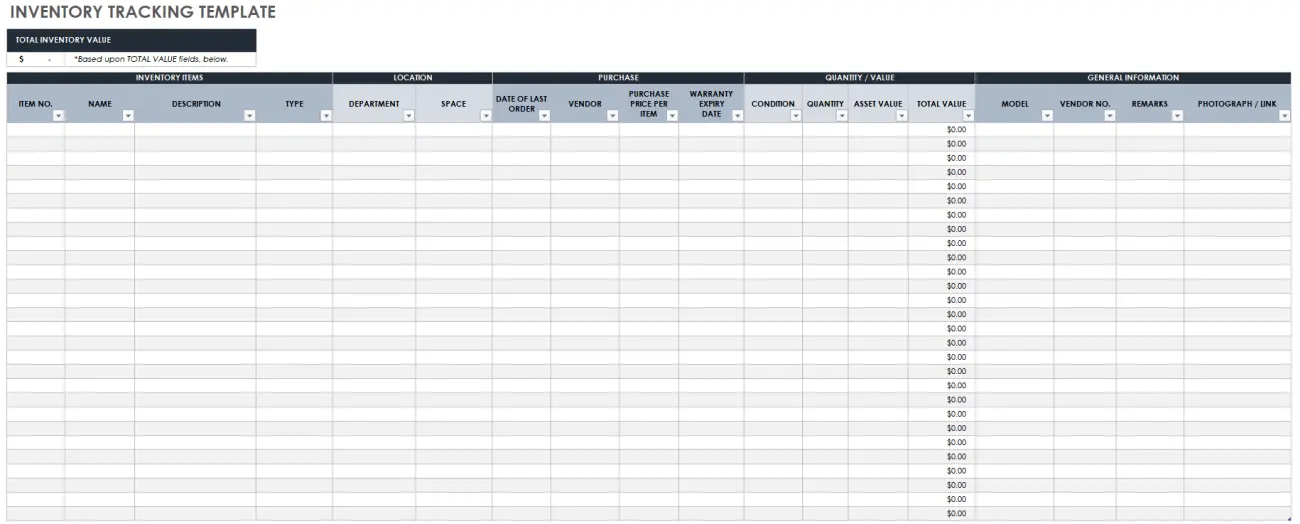

Inventory Template

Tracking the value of your inventory is also good practice if you run a business that sells different types of goods. To facilitate this task, you can use an inventory template to evaluate your stock and gather other relevant details.

You can add a field dedicated to the item number so it gets easier to track physical items. Along with the item number, it is also recommended to add information like the item's location, name, type, and a brief description.

The more complete your template gets, the easier it will be to track the goods and keep a precise register of the total inventory value.

Where to Create Bookkeeping Templates

When it comes to creating your own bookkeeping documents, there are tons of options available. From known software to specialized programs, each one has its own tools and features to help you create the perfect document.

Among all the options available, we highly recommend using Microsoft Excel for this task. It not only has the best features but is also an industry standard. This means that you won’t need extra software for any business task.

If you don’t have a Microsoft Office activation key, you can find one at RoyalCDKeys for a considerably lower price. This way, you can access everything you need to create perfect Excel bookkeeping templates and save money.

Free Excel Bookkeeping Templates for Download

If you don’t want to create your document from scratch, there is no problem. Here are some free examples you can download and use.

Make sure to choose a bookkeeping spreadsheet that fits your needs and objectives. Each Excel bookkeeping template is fully customizable, and you can edit them to suit your activities best. Here are some examples:

Template #1

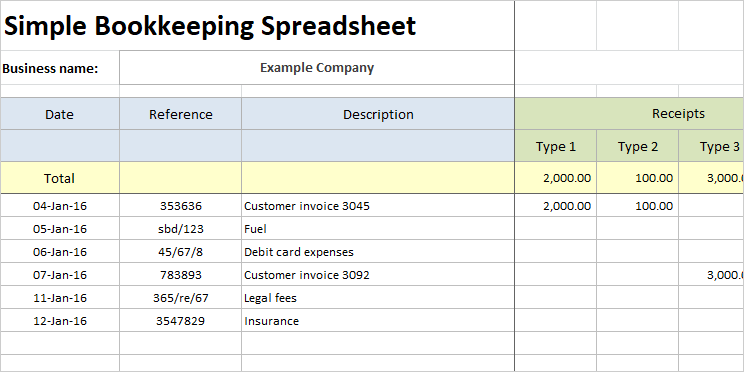

Cash flow document. Bookkeeping template focused on calculating the cash flow of your business precisely.

Template #2

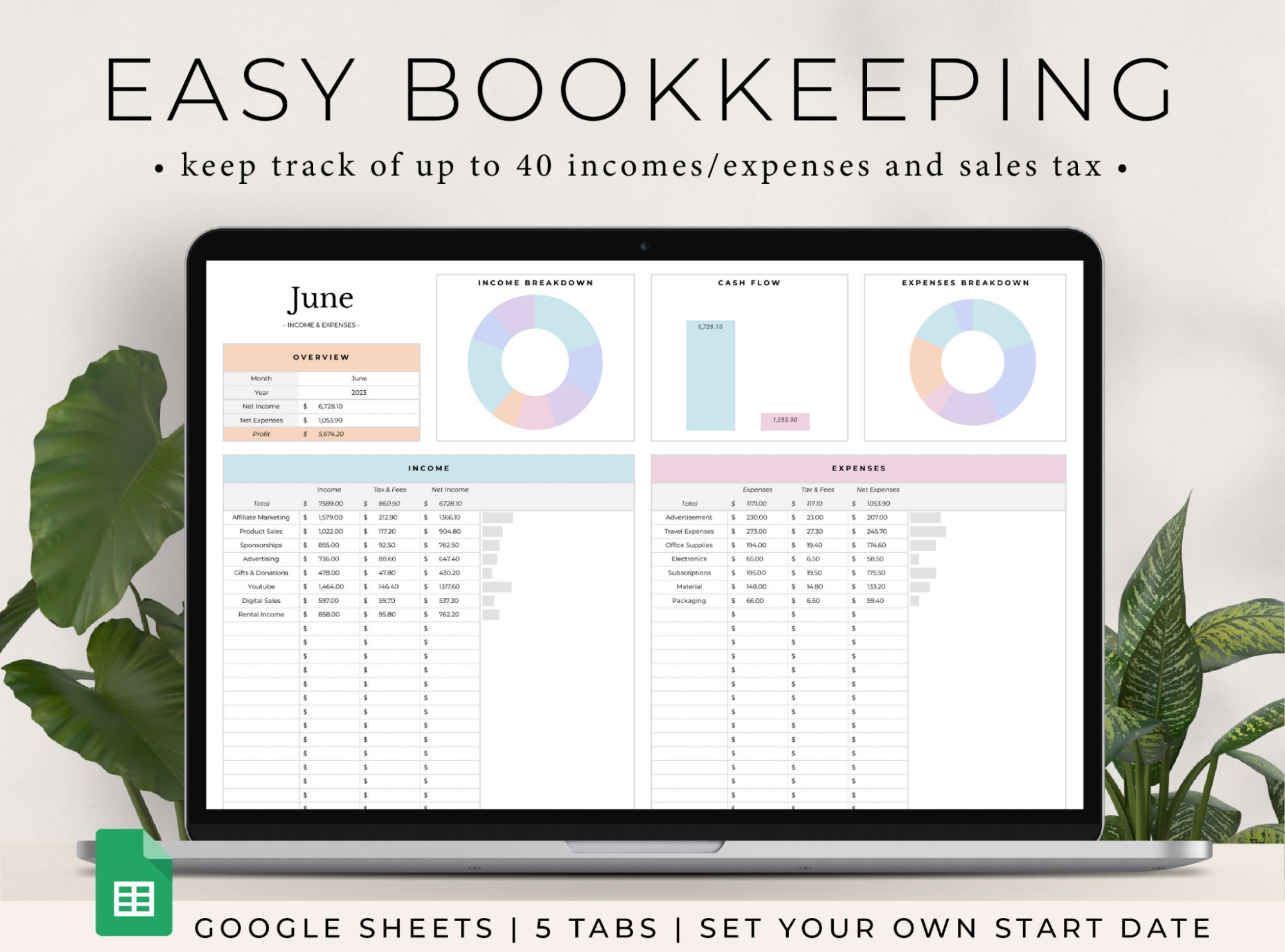

Inventory tracking template. Bookkeeping document for keeping track of your goods and the total value of your inventory.

Template #3

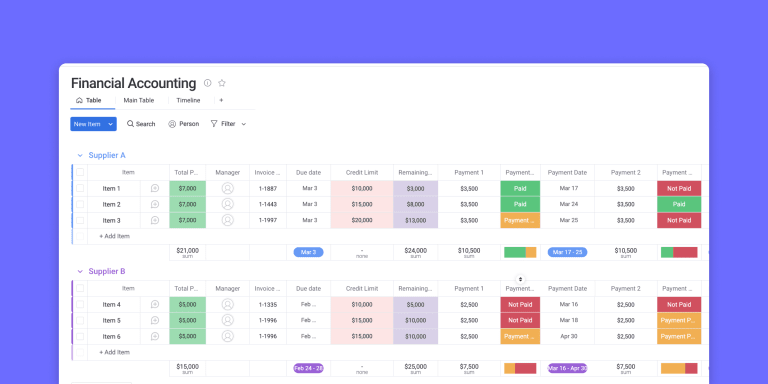

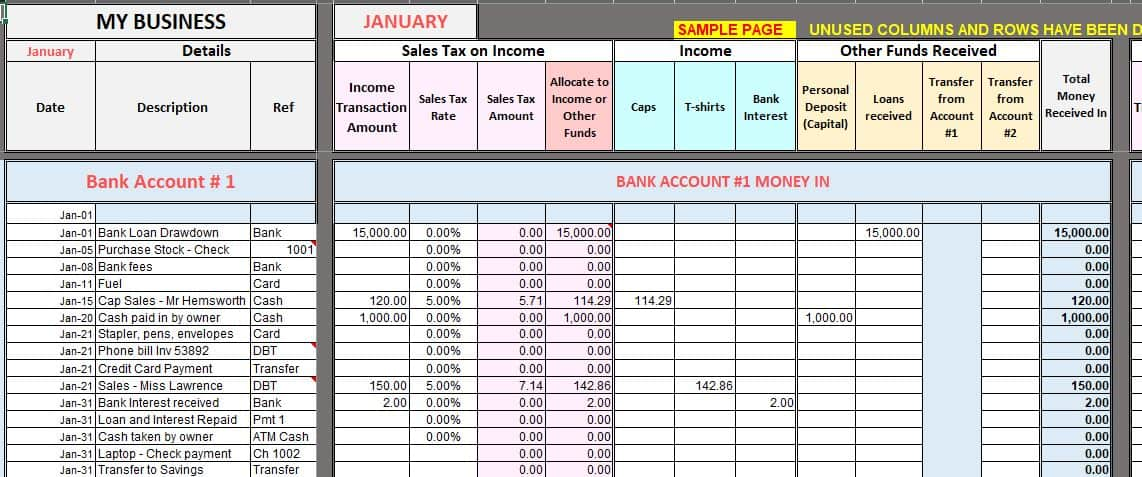

Accounting Excel template. Bookkeeping document for tracking the multiple bank accounts of your business.

Conclusion on Bookkeeping Templates

Running a business requires the owner to constantly track and calculate numerous pieces of data to ensure that the company keeps healthy. Everything must be reviewed and analyzed, from the cash flow to the payroll, to ensure you’re not losing money or making an investment that doesn’t give a return.

The best way to do these calculations and analyses is through a well-structured bookkeeping document. It is a versatile tool that helps control expenses and values regarding all main sectors of the organization.

Now that you know everything you need about bookkeeping documents, it is time to start creating your own Excel bookkeeping template. Make sure to take a look at each category to understand which one fits your needs better. With this, you’ll be able to get the most out of your documents.