Use Trial Balance Template for Your Accounting Balances!

Your business likely manages multiple subsidiary accounts and journal entries and performs several expenses during a certain period. The Trial Balance's primary purpose is managing accounts and recording debit or credit revenues and costs. It corresponds to a valuable tool which we will explain in this post.

Use Trial Balance Template for Your Accounting Balances!

What Is a Trial Balance?

A working trial balance (WTB), also known as unadjusted trial balance, or adjusted trial balance, or post-closing trial balance, is a document containing all your business accounts with their respective credit and debit balances.

This document is crucial when it comes to preparing your company's financial statements. It's a middle step between the bookkeeping, the final statements and internal control for recording business transactions.

This document serves to detect errors in debit and credit balances before closing, allowing making corrections and adjustments.

Trial balances should be run periodically to verify the accuracy of debits and credits. Any change you make should lead to accurate financial statements. After this, you can perform a post-closing trial balance to verify the numbers for the next day.

What Should a Proper Trial Balance Include?

A proper trial balance that correctly works for your accounting system should contain the following:

The associated account names;

The associated account numbers;

Credits and debits to each account during the accounting period;

The dates of the accounting period;

The total debit and credit balances.

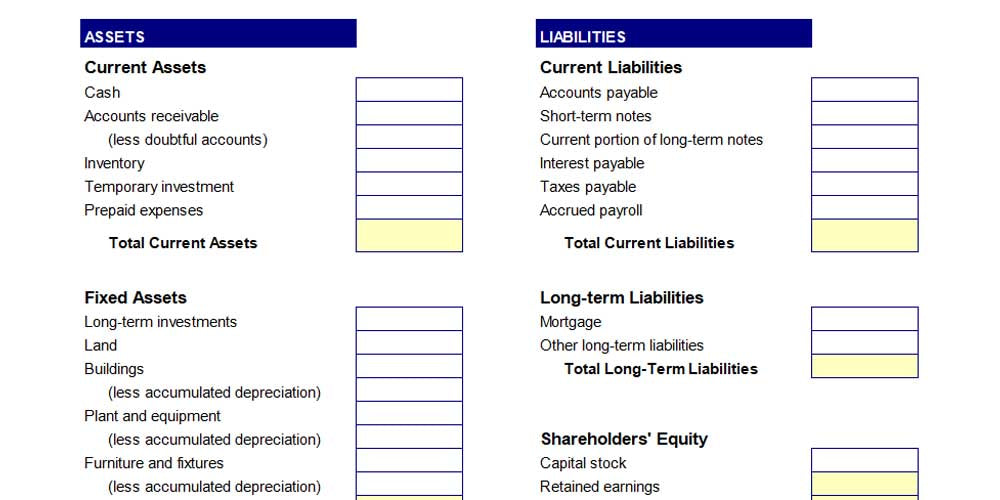

In this sense, below, we're giving you an excellent example of a good balance sheet that includes credit and debit balances.

Now, let's see an example of a trial balance report.

| Trial Balance for period 1/1/2023 to 1/31/2023 | |||

| Account Number | Account Name | Debit Column | Credit Column |

| 101 | Cash | $1,625 | $400 |

| 102 | Accounts receivable | $725 | $625 |

| 107 | Inventory | $400 | $300 |

| 205 | Accounts payable | $0 | $1,725 |

| 304 | Common stock | $0 | $275 |

| 305 | Sales revenue | $0 | $100 |

| 310 | Credit card expense account | $450 | $0 |

| 506 | Utility expense account | $550 | $0 |

| 508 | External services | $100 | $0 |

| Total Credit Balance - Total Debit Balance | $3,850 |

$4,250 |

|

Types of Trial Balances

As we mentioned in the first section of this article, there are different names for a trial balance. Still, each name has its unique trial balance format and characteristics. Below we mention them.

Unadjusted Trial Balance

This trial balance corresponds to a working document in accounting that accountants prepare as a financial statement. It lists the total debits and credits of each general ledger account. This document is crucial to calculate income or loss for a particular reporting period.

As a working document, this is to ensure that all accounts as well as debit and credit amounts have been included correctly. It's excellent to identify account discrepancies before adjusting the account balances.

Adjusted Trial Balance

After adjusting all the ledger accounts and their respective debit and credit balances, this is the document you get. For this reason, the unadjusted trial balance is a priority because you need to identify all accounts and errors to get the adjusted document.

This document confirms all the accounting records and the total debits and credits for the particular period. Previous adjustments will help you get an accurate adjusted trial balance. These adjustments include allocating expenses, fixing errors, adjusting payables, and more.

Once you finish the adjustments and create these financial reports, you should post a list with all the closing entries and balances.

Post-Closing Trial Balance

The post-closing trial balance will help you verify that all the accounts in the general ledger account balances are equivalent to the closing balances.

Post-closing trial balances only include permanent accounts that remain from one period to another. In this category fit liabilities, assets, etcetera.

The primary goal of this document is to offer an accurate financial position report at the end of a certain period by verifying the accuracy of all the accounts and adjustments.

Why Should Your Company Use a Trial Balance?

There are three main reasons why using a trial balance for preparing financial statements is mandatory for businesses. We’ve summarized them below.

It Allows You to Identify Errors

Ledgers are an essential part of financial reporting and the accounting process. In the ledgers, all the income and expenses appear specified. Accountants and bookkeepers use the trial balance to identify accounting errors before they appear in the major ledger. This way, they can adequately maintain their books by adjusting entries and verifying total debits equal and credit entries.

It Provides You With a Summary of Account Performance

Numbers are crucial for any company. The company's ability to attract potential investors and recruit new staff members relies heavily on the company’s financial health.

A company's balance sheet will tell you whether your company is working well or there are potential issues to solve. If you generate profit, it's logical that your company brings positive results. On the other hand, if your company experiences losses, you should consider reevaluating the administration, employees, or products and services to find areas for improvement.

It Helps You Prepare Financial Statements

Financial statements are the definitive documents that accountants and bookkeepers use to fill out financial ledgers; thus, they should be accurate. The financial statement should reflect the final results of all financial transactions. In this sense, the trial balance helps to consider all transactions in different accounts.

In other words, a trial balance shows crucial information to close an accounting cycle and transfer that information to the financial ledgers. This way, your organization can present those books to authorities and comply with legal regulations.

Trial Balance Templates

Below we provide several templates to record any transaction and maintain arithmetical accuracy when preparing your trial balance and financial statements. For a better understanding and editing of these documents, you necessarily must have the Microsoft Office suite.

Luckily, here, on RoyalCDKeys, you can acquire a reliable version of Microsoft Office 2021 Professional Plus Key Retail Global. This suite contains all the essential Microsoft applications you need to manage the templates we share below.

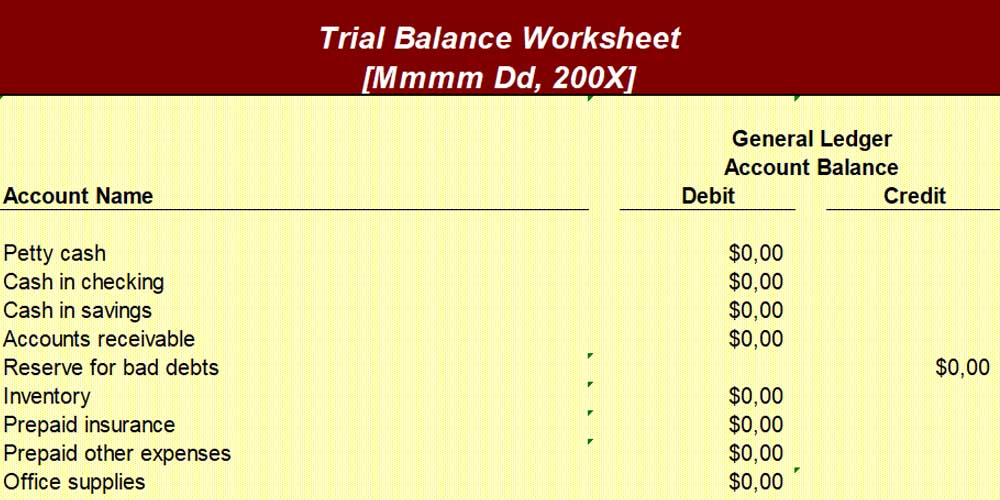

Sample Free Trial Balance Sheet Template

This is a simple document to manage and track the expenses and revenues of related accounts. This template brings predefined accounts, so companies must insert the correct accounting information to calculate the total balances quickly. With this trial balance sheet template, you can easily calculate and confirm profits and losses to determine the success of your business.

Trial Balance Worksheet

Download from Allbusinesstemplates

This trial balance worksheet template is a Microsoft Office document that easily allows you to insert information about debits and credits into columns and rows. This file brings all the possible accounts that your company should manage, so it's prepared to deliver an accurate document efficiently. Of course, if you think there is a wrong account in the list, you can permanently delete it. This way, the document will fit your accounting.

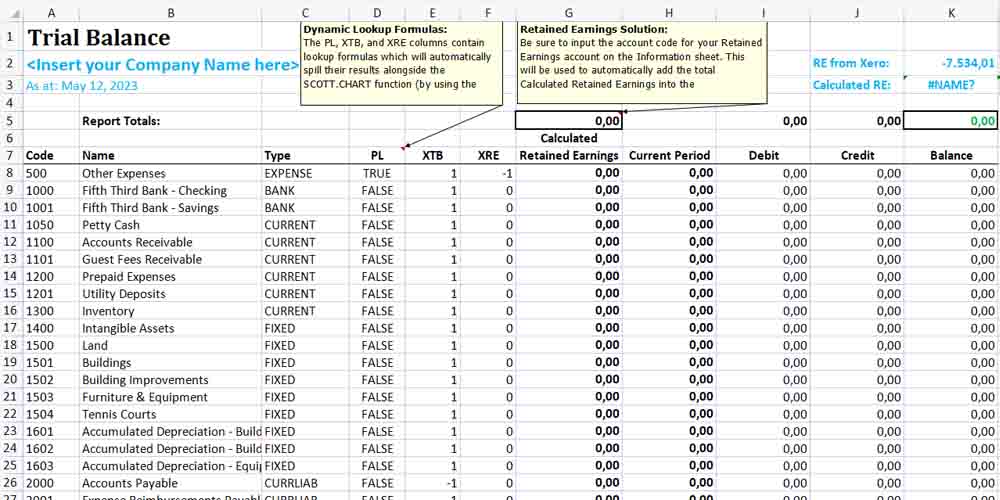

Dynamic Trial Balance Worksheet Template

This template is a Microsoft Excel document with multiple account titles and dynamic information to calculate balances, revenue, and expenses. It contains over seventy individual accounts of the double-entry accounting system.

It also includes dynamic lookup formulas that will automatically spill the results alongside the scott.chart function. Besides using this document to general a trial balance, you can also use it to generate a cash flow statement or income statement. Definitely, this template is a versatile document you can use for tracking and calculating multiple trial balance lists.

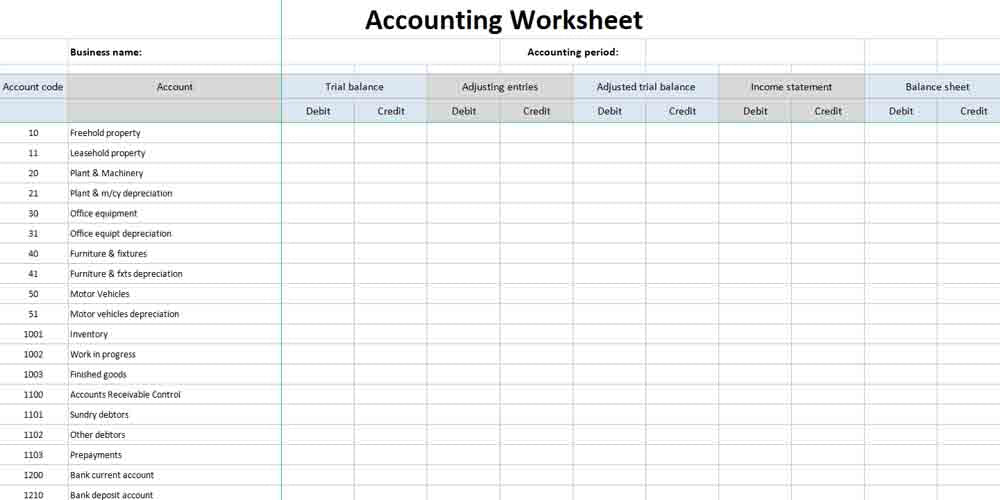

Blank Accounting Worksheet Template

Download from Double-entry-bookkeeping

This is a ten-column worksheet template in accounting to calculate income statements and trial balances. It features an unadjusted trial balance, income statement, adjusting entries, adjusted trial balance, and balance sheet.

It also comes with 147 accounts, each with a unique code and name, most of which you can use in your business. Besides, as it's a spreadsheet document, you can overwrite codes and names if you want. Totals and balances are automatically calculated, and accounts that do not balance are shown as errors. This is a perfect document for different accounting systems.

The Bottom Line

Accounting professionals must build trial balances for their bookkeeping system and deliver accurate principal financial ledgers. When calculating profits and loss, balance sheets containing credits and total debit balances are almost everything. For this reason, preventing mathematical errors in total credits and debits is fundamental to meet the success of your organization.

The templates we provide above will help you with these purposes. They will allow you to keep any accounting entry in order, identifying errors after making necessary adjustments. In this sense, the financial results are expected, and you can develop your business plans as you want.

For getting other vital documents to record financial data, browse our blog and read other articles. We're sharing multiple templates for financial analysis and carrying out different essential processes within your organization.