![Sales Invoice - [3 Free Templates and Some Advice]](http://royalcdkeys.com/cdn/shop/articles/image6-1682519532307.jpg?v=1719562383&width=1100)

Sales Invoice - [3 Free Templates and Some Advice]

Invoices are more than essential documents in the sales process. A purchaser will need them to clarify their expenses, and your organization will need them to order your accounting, inventory, and pay expenses. In this sales invoices article, we address everything about these documents.

Sales Invoice - [3 Free Templates and Some Advice]

What Are Sales Invoices?

Sales Invoices are documents that a vendor issues when a customer pays for a specific service or product.

Sales invoice serves essential functions such as controlling the number of transactions a company makes and organizing accounting.

The invoicing process lets companies get an overview of the sale they made and the income they will receive in the next few days.

Invoices will also allow you to forecast how much revenue you will get in future months and how many items you will need for the coming days and months.

Besides, invoices enable you to record all your sales transactions for bookkeeping purposes.

Why Are Sales Invoices Important?

In the first place, invoices are legal documents that all companies must issue to track their transactions and pay the applicable taxes. Still, invoices provide several benefits for planning, sales operations, and forecasting.

A well-organized Accounting Department

Sales documents are essential to organize accounting records and books. This way, up-to-date documents through invoices are critical to your organization's cash flow.

Furthermore, invoices will help you to track outstanding payments and keep the others of any business transaction. These documents will also notify you when to follow up with clients.

A well-managed Inventory

You can check your physical products and track inventory with information on all the goods and services sold to customers. This way, you can know how much stock there is for incoming orders.

The information provided for invoices also helps plan marketing campaigns since you can know which products are bestsellers.

Better and Accurate Analytics

The information in careful invoicing is crucial to organizing data and insights for business plans and development. This information allows you to study income and outcomes and predict future cash flow. With payments coming, you can plan new movements for subsequent sales.

Types of Sales Invoices

Below you will find the most common sales invoices to deliver to your clients. This way, you can ensure you get the net amount owed when the delivery takes place.

Standard Invoice

The standard invoice is the most basic and is used for all transactions. This template includes all the essential information, although it may also contain something additional.

Recurring Invoice

As its name indicates, this invoice is used for regular buyers who often purchase goods with a subscription or membership. Providers use a recurring invoice system to facilitate this operation or automate consistent payments.

Commercial Invoice

This type of invoice is used for international transactions. It includes more complex information, such as valuation for products crossing international borders, product weight, country of origin, and more.

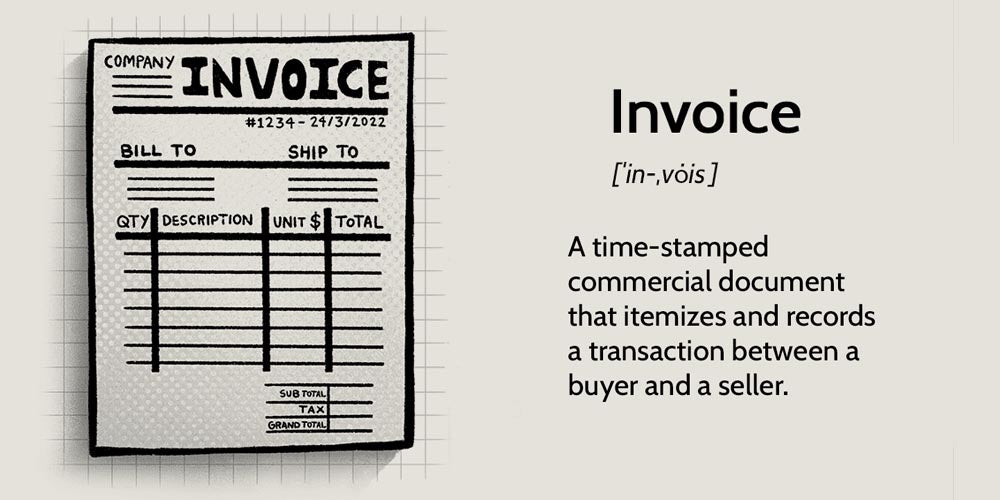

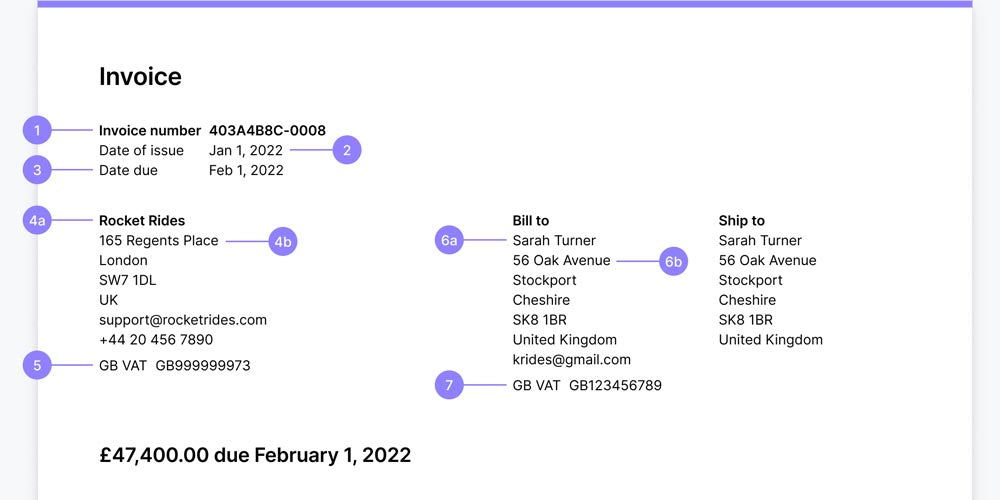

The Contents of Competent Sales Invoice

Generally, an expected sales invoice has five main pieces of information. When you use a template from the web, confirm that it has these sections.

- Contact information. Contact information is crucial in invoices, especially two pieces of information: the customer’s info and the seller’s info.

1. The seller’s info appears in the header, which, at the same time, includes a logo.

2. The customer’s contact information commonly appears beneath the header. It’s always desirable to include a phone number and a physical address.

- Invoice number and date. Each invoice has an identification number that helps both parts of the transaction to track the document. The invoice date is also helpful for identifying and understanding payment terms.

- Description of goods or services rendered. A professional sales invoice includes all the details of the product or service provided to the customer in its main body. Each item should appear in an independent bullet point, including the quantity and price.

- Payment terms. Payment terms in this accounting document are relevant since they tell customers when and how to request payment. This section also should include the payment method, such as debit or credit card, cash, cryptocurrencies, etc. This part of the sales invoices consists of a payment time frame. Remember that some companies issue invoices that are "due upon receipt."

- Amount due. The sales receipts must always include the total amount due. Taxes, prepayments, and discounts should be detailed as well.

How to Create Sales Invoices?

Next, we describe the six steps you should follow to create or simply fill out sales invoices. Please read each of them carefully to have a good record of your transactions.

1. Keep the Document Clear

Invoices must be distinguishable from other sales documents. For this reason, you should include the word "Invoice" at the top of the page to clearly label the document. If you manage a large number of invoices, it's recommended that you include the date and the company logo.

2. Insert the Relevant Contact Details

Another piece of relevant information you must include when you create an invoice is your organization name, email, and phone number. In this part, you can add a customer service number if a client needs to contact you for more deals or other information.

Regarding customers' contact information, it is crucial when issuing invoices for specific clients. This info is commonly located beneath the header.

As you're using a template to send invoices, be sure the template includes all the sections you need to correctly contact the customer, especially when you get it for payment. A good decision here is to have a physical address for any emergency.

3. Date and Number of the Invoice

All sales orders or invoices have a unique number, and it's dated to a specific date. Then, the third step is to generate and assign the number to the specific invoice. The best practice here is beginning with a sequential system. i.e. , Invoice #001, #002, #003, etc.

Be aware of different date systems around the globe in case you have international customers. Try to make sure everything is clear between days and months. It will help you and your customers when payments are due.

4. List Services or Items Provided

Describe the goods and services you've provided or delivered to your customers. It would help if you did it point by point for clarity. Just be brief and detailed enough to facilitate the identification of the products.

When you send the invoice, remember to attach all the documents relevant to the transaction, like the sales order, agreements, etc.

5. Explain the Payment Terms Clearly

Customers and clients must know how much they must pay for the item, mainly when your business sells physical products. Describe the payment methods you accept and the late fees you charge for overdue invoices.

6. Establish a Clear Payment Due Date

Most sales invoices must be paid in a certain period, generally from 10 to 30 days. Besides, some customers or clients can accumulate several invoices; they are happy to know how much they own and see the breakdown of their debts.

When you write the invoices, be transparent by providing a brief description of the deposits made by the customer, the applicable taxes, and if these are applied discounts.

Sales Invoices vs. Purchase Orders vs. Bills

Typically, sales invoices are confused with other transactional correspondence and documents, such as purchase orders and bills. In a few points the main differences are:

- A sale invoice indicates how much your client must pay on a specific date.

- A purchase order is strictly the opposite. An invoice is an entry to the seller indicating what products or services the buyer wants. In this case, the sale has yet to take place.

- Sales orders are similar to sales invoices since the seller creates both. Otherwise, sales orders come first. The vendor indicates that they can provide the goods and services requested in this document.

- Regarding bills, they are usually interchangeable with invoices. But the main difference lies in the data that the documents contain. Invoices have more detailed information than bills. For example, a bill does not have phone numbers. Besides, the vendor hopes that their bill is paid right then and there.

Sales Invoice Templates

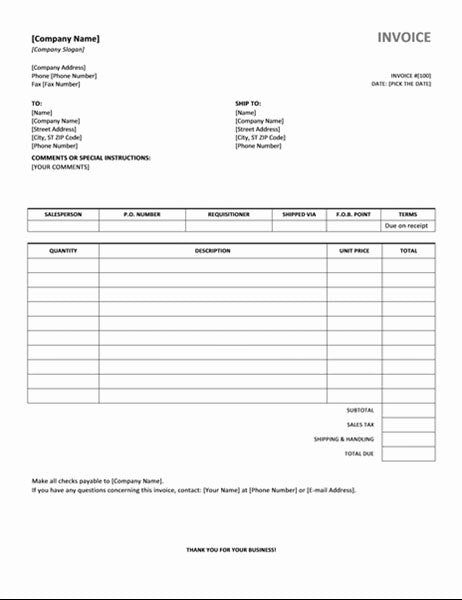

All sales invoices work the same way and do not differ much. Most free templates on the web contain all the sections and information we've mentioned above.

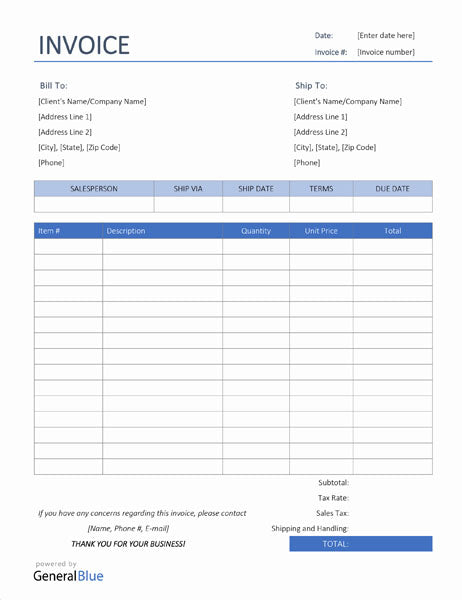

Free Basic Sales Invoice Template

This first free template is the perfect sample of what an invoice document should look like. It's clearly labeled with "Invoice" at the top of the page. It also contains all the relevant information for the sales process, such as the issue date. It also includes the sales tax and the total due at the bottom. This template is for Microsoft Word.

You can download this free sales invoice template from templates.office.

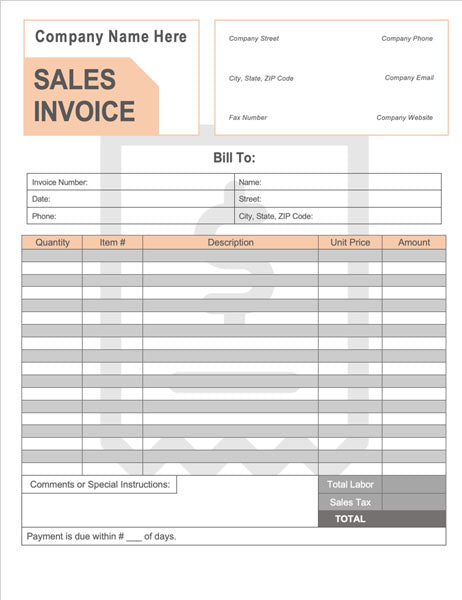

Free Elegant Sales Invoice Template

This template is very similar to the previous one. The main difference is the latter highlights sections with a blue color. This template is also perfect for managing budgeting by clarifying the quantity supplied and the money you charge for each.

You can download this free sales invoice template from Generalblue.

Another Free Sales Invoice Template

This third alternative is also very similar to the previous two. Still, the top has more space for a large company's data, and the customer's data is clearly separated. This template also integrates a bottom area for possible comments related to past data. This template comes in doc format, but you can also use it in Google Docs.

Suppliers can get this free template from opendocs.

Getting the Right Software to Fill out the Templates

Microsoft Word is the primary software typically used for filling out or editing the templates mentioned above. Creating a new one is also very simple in this application. As it's costly to get it from the official Microsoft Store, you can get it on RoyalCDKeys by purchasing a Microsoft Office 2021 Professional Plus Key Retail Global CD Key at €11,05.

Final Thoughts

Invoices are necessary for controlling your organization’s revenue, taxes, and the amounts companies owe in exchange for services. They're also great for building excellent customer relationships and getting paid quickly.

If you're starting in the business world and expect to succeed in the medium and long term, we recommend paying attention to invoices and the numbering system.

If you're interested in reading more about selling, purchasing, and getting any or another resource for your small business, browse our blog. Here you can find several other templates to facilitate your business operations.