Pro Forma Balance Sheet Tutorial for Business With Examples

If you run a company of any kind, you understand how important it is to make projections about profit, expenses, and other factors. To gain a better understanding of the business's performance and determine the necessary steps for achieving desired results, businesses use various financial statements.

One of the most used tools for making these projections are the pro forma financial statements. When correctly built, these pro forma balance sheets can be true game changers for the financial modeling of your company and predicting earnings.

In this article, we will show you what you need to do to create pro forma statements that positively affect your business and help with financial accounting. Follow all steps carefully to ensure the effectiveness of your pro forma statement.

Pro Forma Balance Sheet Tutorial for Business With Examples

Understanding What a Pro Forma Balance Sheet Is

Pro forma comes from Latin and can be translated “as a formality.” It is a document used by company owners and financial sector members to calculate financial results using specific projections.

It can be a valuable document for calculating important data like net cash flow and collecting information that can bring capital investment to the company. The pro forma balance sheet also excludes one-time expenses and information that it doesn’t consider relevant for the final results.

The Reason Why Pro Forma Balance Is So Important

Many business owners think the pro forma balance sheet is not a good practice since it only works with projections, and sometimes the values can be drastically different from reality. But this document goes far beyond just showing you numeric values.

Creating pro forma statements can show which parts of the company are not performing as desired, and with this data, you can plan a strategy to change the situation. Pro forma is also one of the primary documents used for deciding a company's next steps and how it will behave in the market from now on.

Moreover, with projections, it becomes easier to anticipate risks and other factors that can negatively affect your projected cash flow and asset value.

But be careful. When using a pro forma document for presenting data to potential investors or the IRS, your sheet must be clearly marked as such. Otherwise, you might be liable and penalized by the SEC (Securities and Exchange Commission.)

GAAP x Pro Forma Statement

Another important concept and its relation to the pro forma balance sheet is the GAAP. It stands for Generally Accepted Accounting Principles and is a standard set of accounting rules and practices.

Most companies use them when making a cash flow statement or a financial forecast of the company, but this doesn’t happen in the pro forma. As previously mentioned, it also doesn’t consider any expense that is not recurrent and related to the company’s operations.

The main objective of this is to eliminate anything that might impact the clarity of the final value. By doing this, you’ll be able to get more precise results when creating a pro forma income statement, for example.

Types of Pro Forma Statements

If you want to create a pro forma document, you should know that there are multiple types, each serving a different purpose and focus. We will show you some of the most used types of pro forma balance sheets.

Make sure to look at each one to understand which is the best for the objective you want to achieve and the data you want to calculate. Here are the most used pro forma sheets:

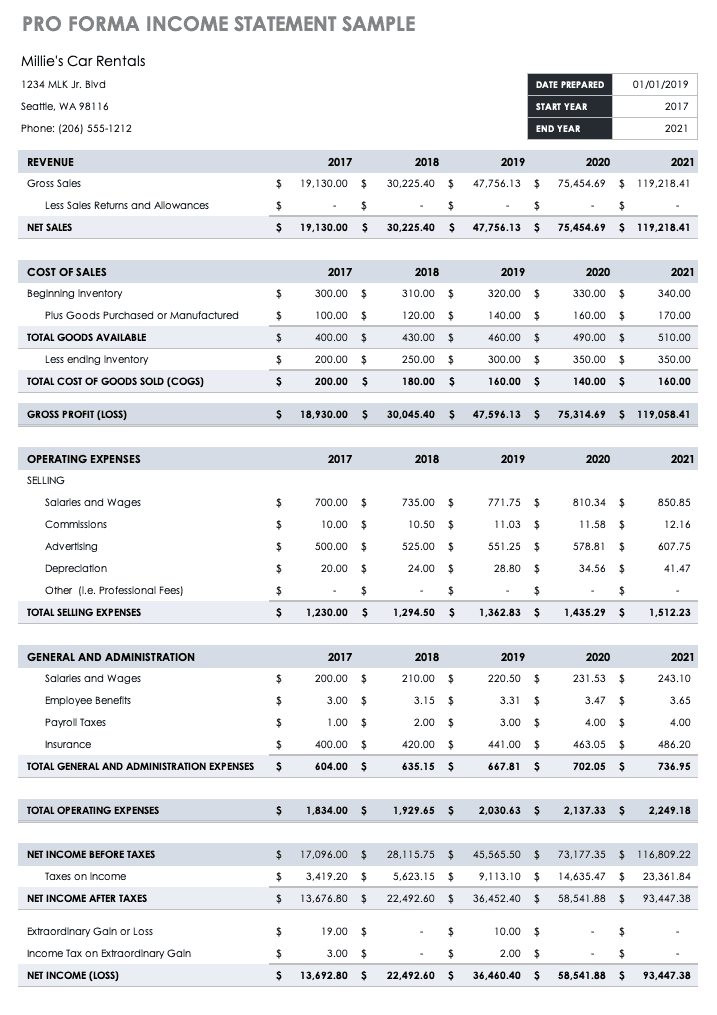

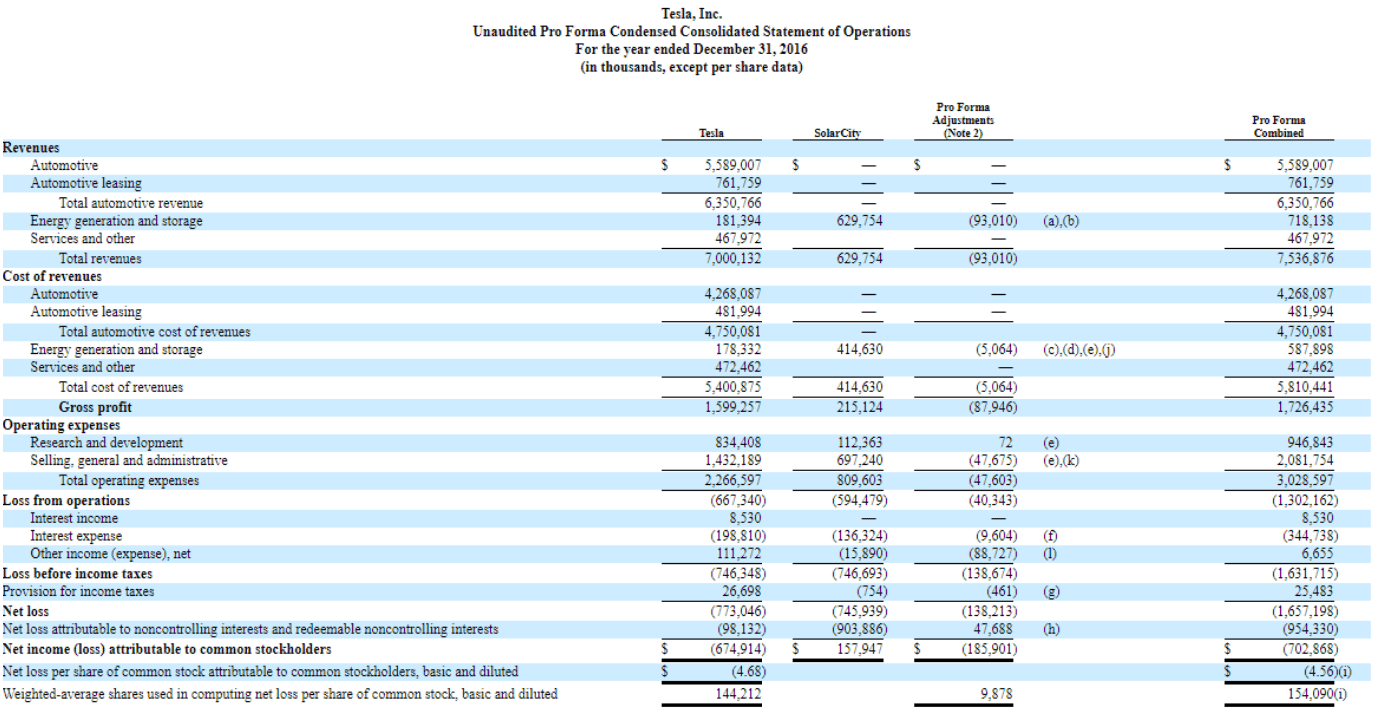

Pro Forma Income Statements

If your main objective is to catch the investors’ attention, this is the perfect document for you. The pro forma income statement uses the traditional pro forma calculation method to make projections about quarterly or semesterly earnings.

You can attract interested investors and companies to these specific numbers with the numbers generated. If the main objective is to attract people and make your company shine for potential opportunities, you should create pro forma statements for income.

Pro Forma Invoice

The main focus of a pro forma invoice is to communicate business decisions regarding a specific service or product. It is a document that precedes the bill of services, and its primary purpose is to present valuable information to the client, such as the shipping method and payment terms.

The pro forma documents for invoices usually show the total assets cost and a brief description of each item, whether they are products or services. They are just like any typical invoice, with the difference that they will usually work with speculations on the values presented (shipping, taxes, etc.)

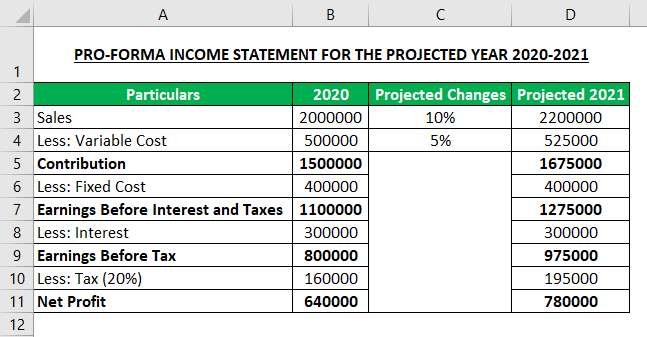

Pro Forma Financial Statement

The most used type of document is the pro forma financial statement. It is a sheet used to summarize and speculate the company’s financial performance in general. It can be extremely valuable for planning strategies for future periods and understanding details that are not going as expected, like declining investment values.

Everything will be speculated, so it might not reflect the final result, but the more organized and complete your template gets, the more precise it will be. When calculating pro forma earnings, you’ll usually not use the traditional methods and steps.

Since they are illustrative, you might use your methods, information, and items to calculate these values. You can include or exclude items depending on their potential impact on calculating your pro forma financials.

Pro Forma Earnings Statement

If you want to inform your investors and stakeholders about your earnings and net profit, a pro forma statement can be a great way to do it. In the pro forma earnings balance sheet, you’ll have projections regarding how much your company is expected to profit before and after taxes.

With this, you can inform your investors of their part in the outcome and determine their individual earnings. It is also commonly presented before trying a new acquisition of any type, whether for equipment or another purpose.

With these numbers, you’ll be able to tell how much of the earnings will have to be spent and if doing this action can cause negative impacts on the company’s financial health. Remember that these values can drastically differ from the final results depending on the categories and calculation method.

How to Make a Simple Pro Forma Balance Sheet

Now that you know the main types of pro forma sheets, it is time to learn how to create a simple pro forma using quick steps. Following each of them will ensure precise results when collecting data from your calculations.

Here are the main steps:

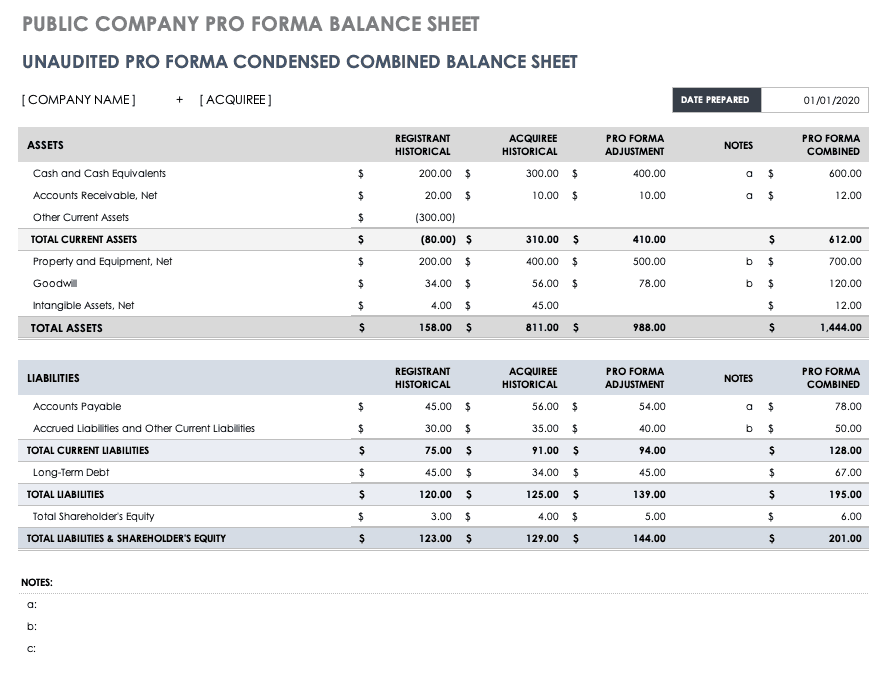

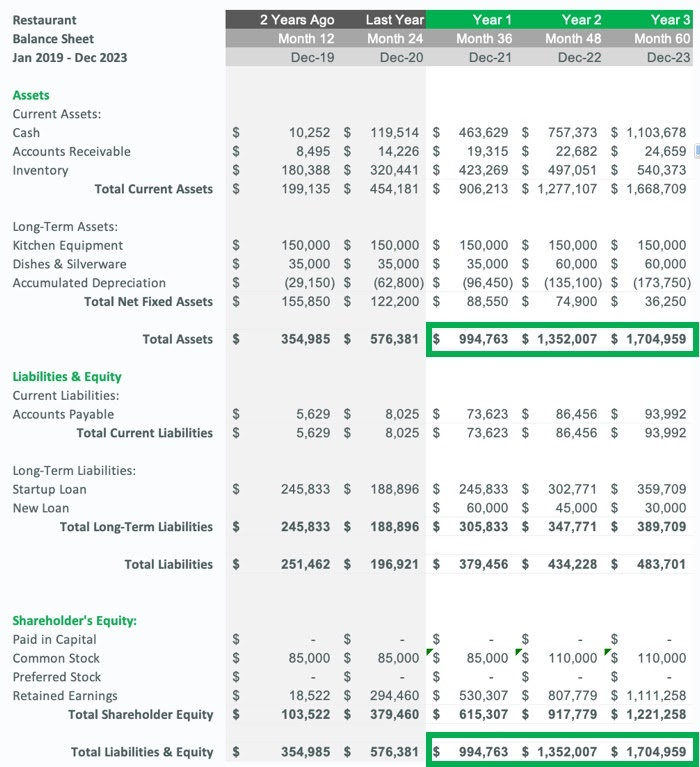

List Your Short-Term Assets

The first items of your pro forma balance sheet will be your short-term assets. They are also called current assets and refer to assets held for less than a year by the company.

It means that in less than 360 days, they are expected to be converted into cash for the business. Depending on the asset and situation, it can also be converted into a liability.

Don’t forget that accounts receivables are also considered current assets and should also be included in this part of the template. Ensuring that you correctly listed each one of the items and their value will make it easier for the document to present you precise values at the end.

List Your Long-Term Assets

The pro forma balance sheet must also feature your long-term assets for the calculation. You can also find some templates indicating them as fixed assets.

These items usually provide profit after a long period of time and tend to last years. The value of these assets can either appreciate or depreciate, and one of the most common examples is if properties and buildings you own.

They usually appear in a smaller quantity in the document, but the assets can have much higher values. Double-check it to see if you listed all the relevant items.

Total Assets

This is the easiest step of the entire pro forma balance sheet. You will simply get your short-term and long-term assets and calculate their sum.

With this, you’ll have the total assets value of your company. Your formula for this step will be:

Short Term Assets + Long Term Assets = Total Assets

Liabilities

Liabilities are almost like your expenses. They regard any value you owe, whether payrolls, loans, etc.

Here you can also have short-term liabilities and long-term ones. The second categories are the one that you should focus on since it can have much higher value and a more significant impact on your business's financial health.

Although it is recommended that you list all your current liabilities, if you find any values that are considered insignificant for the final calculation, you can leave them out of the list. But remember that more complete lists lead to precise results.

Final Calculations

Now you just need to calculate your final pro forma balance using the information provided in the previous items. It is a simple formula, and the calculations can be done in seconds or even automatically if you use the right software for creating your templates.

The formula for calculating these financial statements is:

Total Assets - Liabilities = Pro Forma Balance

The results are your final balance, and you can use these pro forma statements to show your stakeholders and investors how much you expect to profit and grow this year. Remember that complete documentation leads to better results.

Best Tool to Create Pro Forma Documents

When it comes to creating your own pro forma sheets, there are tons of tools you can use. From known software to specialized tools, each one has its own features to help with the task.

Among all the options available, we highly recommend using Microsoft Excel to do this. It not only has the best features and automation tools, but it is also an industry standard. This means you won’t need extra software for other tasks.

If you don’t have a Microsoft Office activation key, you can find one at RoyalCDKeys for a considerably lower price. This way, you get access to all features and still save money.

Ready to Use Templates

If you don’t want to create your pro forma from scratch, don’t worry. Here are some ready-to-use templates you can download and edit using Excel to better fit your needs. Make sure to choose a template that contains all the categories and information you need.

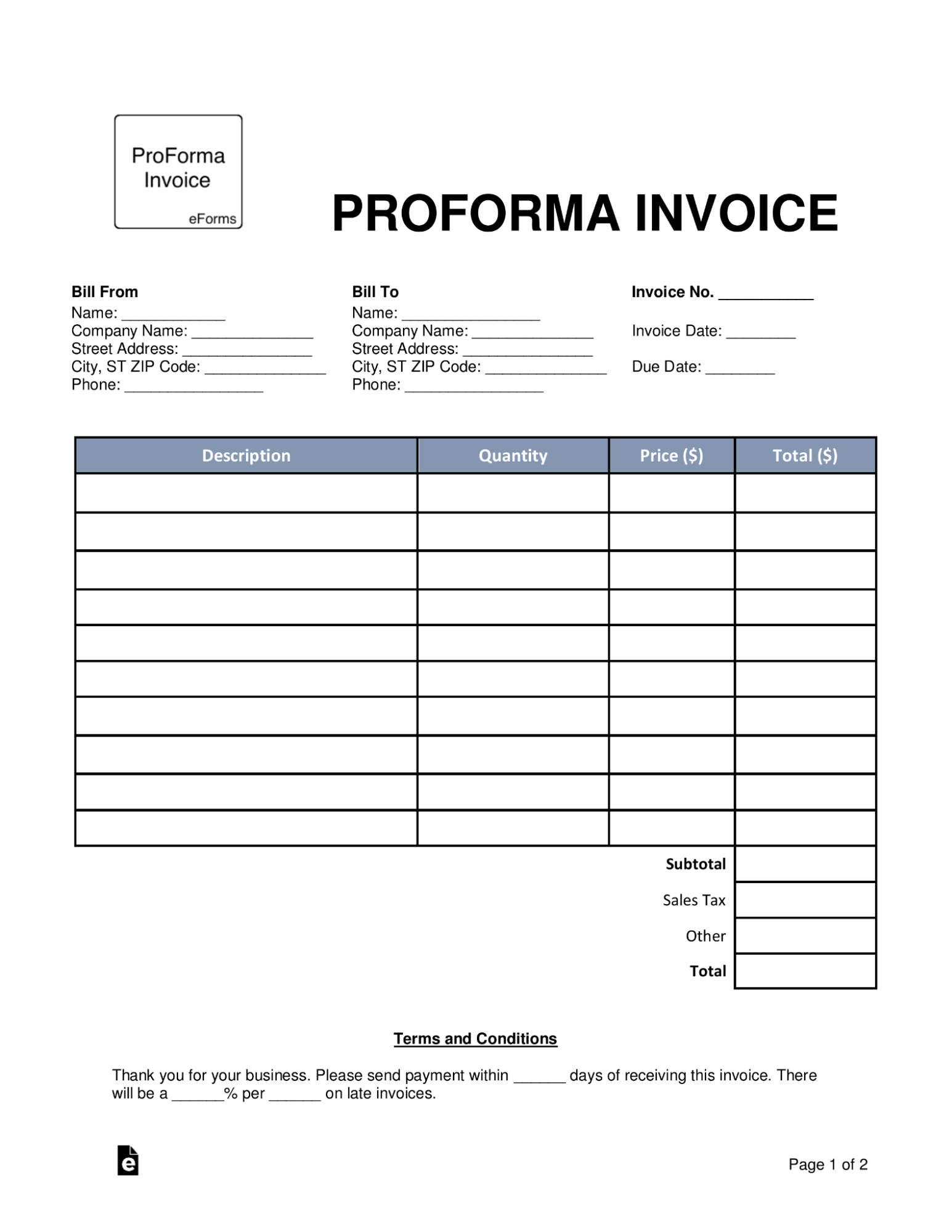

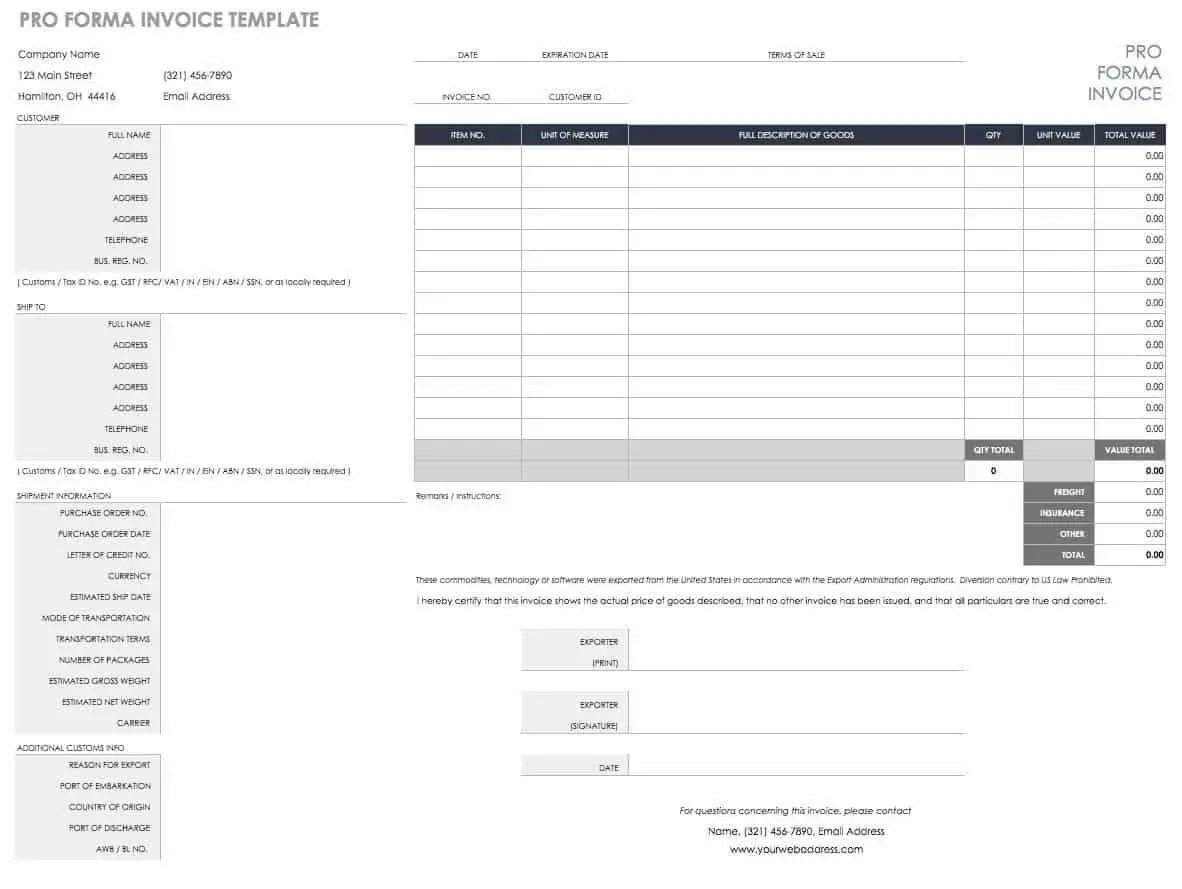

Template #1

Complete pro forma invoice template. Invoice document featuring all categories necessary for handling a complete document for your clients.

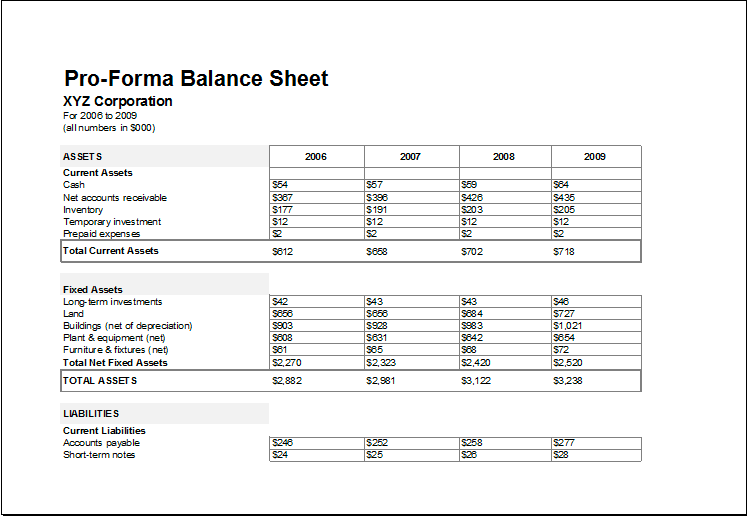

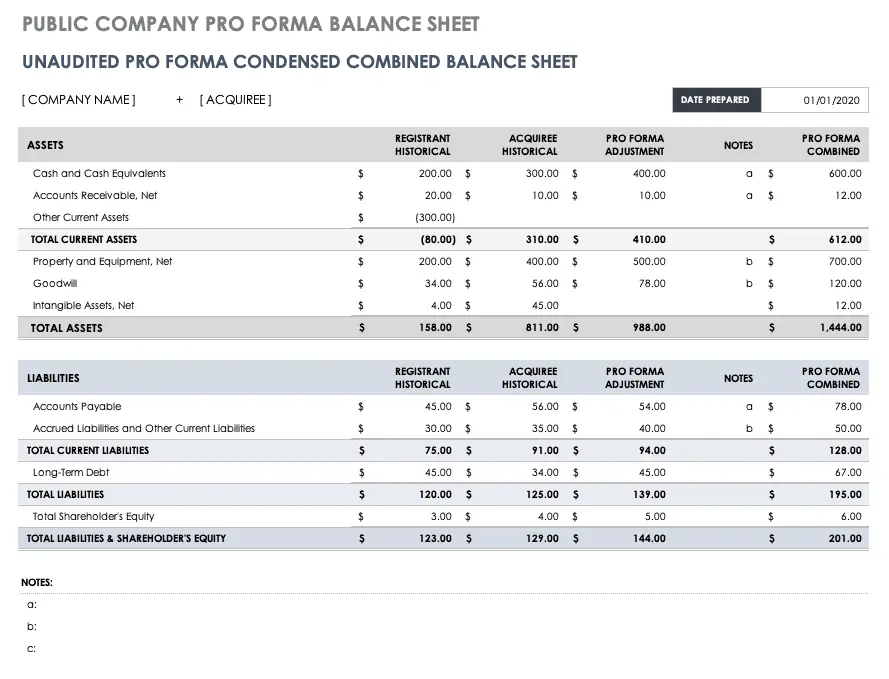

Template #2

Public company balance sheet. Pro forma template dedicated to calculating the balance of public companies.

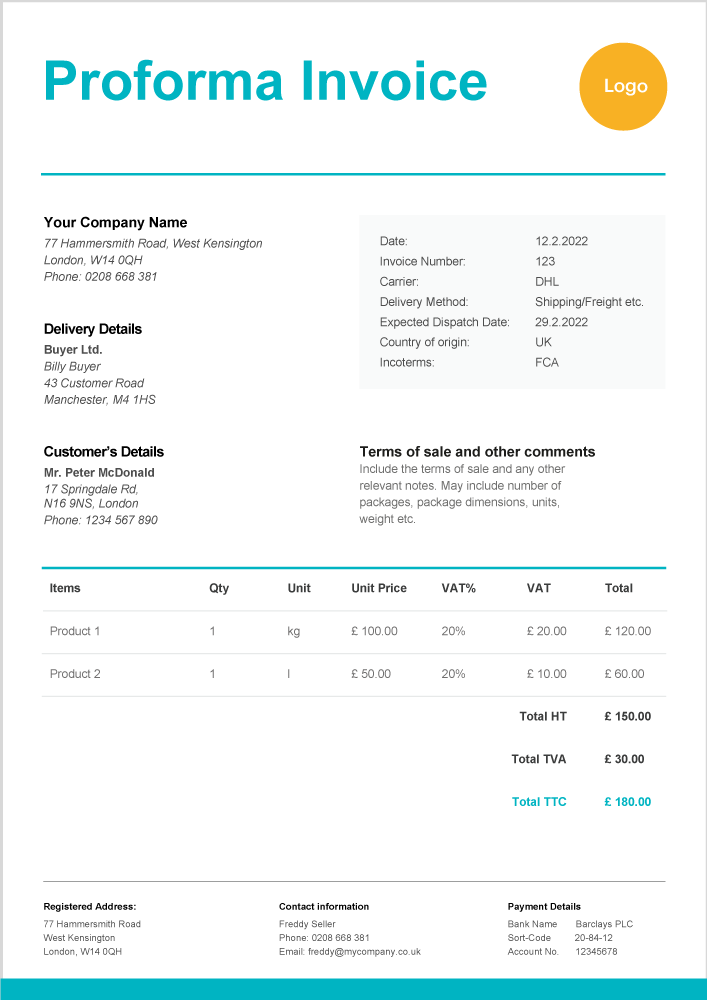

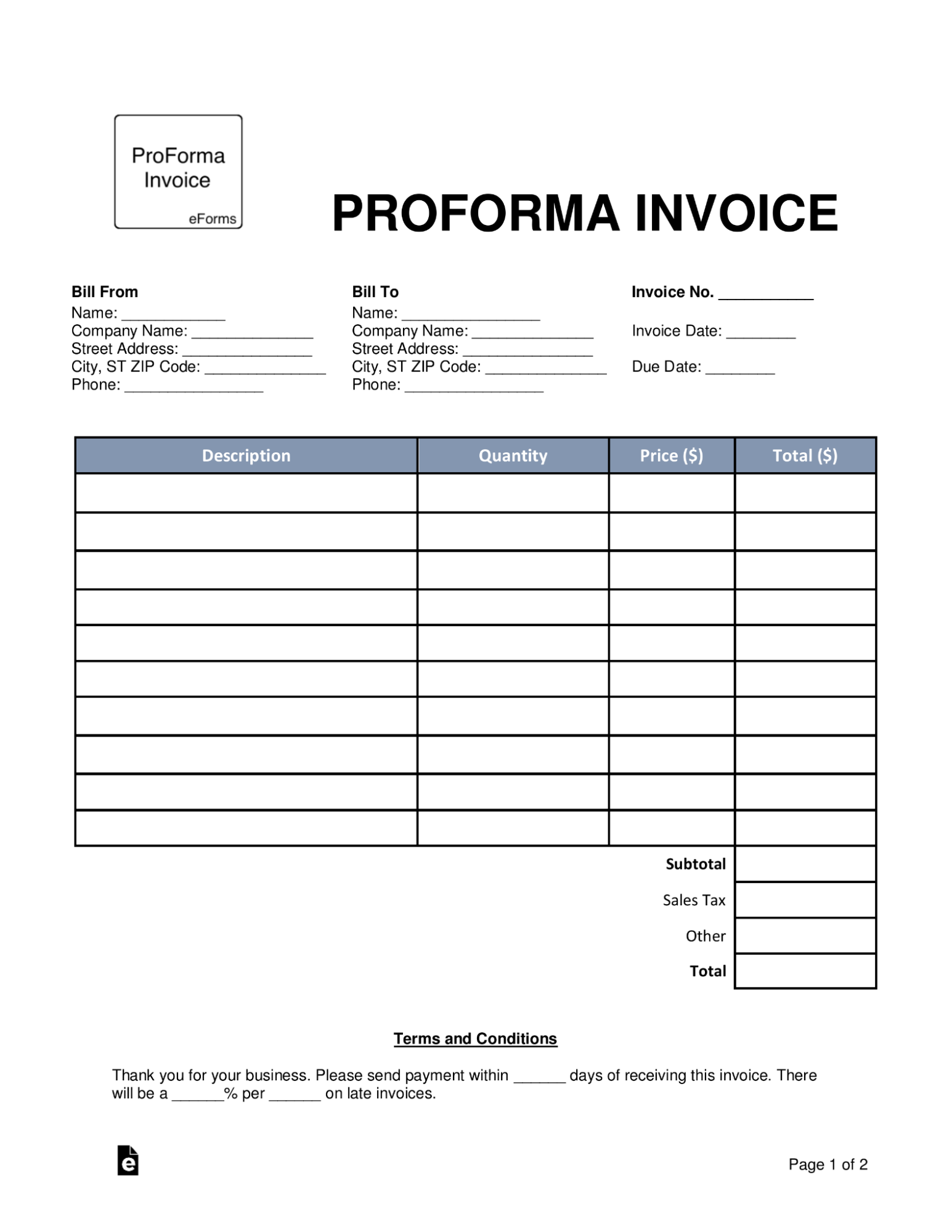

Template #3

Simple pro forma invoice. Minimalistic template featuring all the essential categories for this kind of document.

Now It’s Time to Write Your Pro Forma Statements

Whether for company performance evaluation or predicting profits at the end of the year, these pro forma statements can be helpful tools for any business type and size. But for them to work as expected, everything must be aligned correctly, from the kind of template used to the information contained in the document.

Ensure you understand your objectives and what information you need to know to get closer to these goals. With this, you’ll create a much more solid document that aims at what you want to know.

Now that you have everything you need, it is time to create your own pro forma financial statements. Follow all steps carefully, and you will end up with a document that can help you understand the financial health of your business.