Petty Cash Log: Easily Keep Track Of Small Expenses

Keeping track of every penny spent is crucial as businesses grow and evolve. From office supplies to parking fees, every small expense can add up quickly. Without proper monitoring, it can be easy to overspend or lose track of where the money is going.

That's where a petty cash log comes in handy. This record-keeping tool helps organizations track and manage their small expenses. It’s an essential tool for any business that wants to stay organized, control their spending, and ensure accuracy in their financial reporting.

This article covers all you need to know about petty cash logs and how to build one on your business and jumpstart your operations.

Petty Cash Log: Easily Keep Track Of Small Expenses

Understanding Petty Cash, Basic Business Management

Petty cash is a fundamental business management tool that helps the office manager solve unexpected situations. It’s a small portion of cash kept in a box that pays small expenses.

This fund undergoes constant reviews and conciliations to see if all expenses add up. And depending on the business’s size, each department could have its petty cash.

Some of the unexpected expenses include:

- Groceries

- Gas

- Reimbursements

- Cash withdrawals

- Credit cards

- Lunches

- Office Supplies

These are called miscellaneous expenses. You should record all the transactions into a simple petty cash log that you – or your superior – can understand. After spending petty cash funds, you must make a petty cash reconciliation to restore the money.

Petty Cash Account Requirements

Managing a petty cash fund needs internal controls to ensure that only one person is in charge of the physical cash. Why? Because having a petty cash box doesn’t mean you’ll be taking money from it for any situation.

So, what are the requirements for using petty cash?

The office manager must authorize its use

Petty expenses must be accounted for with a receipt

Petty cash custodians must change with every shift

There must be audits to ensure accountability

There should be a fixed amount of money in the petty cash

Each person authorized to use the petty cash must submit receipts

If you are the business owner or the custodian, you can’t give money to anyone who asks for it. Disbursements must be expenses related to the company activity.

Advantages & Disadvantages of a Petty Cash

Using petty cash transactions to manage unexpected expenses has its advantages and disadvantages. Let’s break them down.

Advantages |

Disadvantages |

The petty cash is a simple and fast way to pay expenses. |

It’s not the safest method to secure cash. |

It covers unexpected situations that don’t require large sums of money. |

You lose track of expenses and can quickly lose a petty cash voucher. |

Avoids direct reimbursements. |

You need a custodian in charge of all the petty cash log work. |

Managers have immediate access to it. |

Requires manual work without the possibility of automating processes. |

It’s an outdated technology. |

As you can see, petty cash can resolve small payment situations and other miscellaneous expenses that could happen during daily operations. However, even if you use a bookkeeping system or a locked file cabinet to manage your petty cash system properly, it’s still an insecure way to handle cash.

Petty Cash Management Systems

There are two ways you can manage your petty cash. This depends on the type of system you use to record and print logs:

Ordinary petty cash fund: This is the traditional method where the business gives a cashier a small amount of money in a petty cash box to cover the expenses. The worker will then reimburse each backed expense and submit a report after the petty cash fund goes dry to obtain another float – if the receipts and logs are correct.

Advanced petty cash fund: The petty cash cashier receives a sum of money – float – during their working period. After finishing, the worker submits a report of all the money spent, and if the receipts are correct, they receive a reimbursement to begin the next period with the same float.

Each system works best with a specific type of company. For example, the ordinary system is better for a consolidated company that doesn’t have a lot of unexpected expenses to cover. On the contrary, the advanced method could be crucial for a small business that struggles with its main supply chain.

How To Create and Reconcile a Petty Cash

Follow the steps below to learn how to create a petty cash and use it for your business.

Get a Petty Cash Box

Go to Walmart or online and purchase a box with locks and keys that you can use on a regular basis. You can decide its size, design, and model.

All you need to ensure is that it’s secure enough to deposit money and delegate its management to the petty cashier. You should also consider getting a box with a compartment where you can store coins and vouchers for future audits.

Establish The Petty Cash Float

The petty cash float is the initial amount you’ll have available in your box. You need to decide how much money is enough to cover unexpected situations. Let’s say you set up a $100 fund.

Once you determine the cash received by the cashier, it’s expected that the petty cash ending balance is the same if there hasn’t been any withdrawal authorization. The head cashier must report the money received and give the responsibility to the next custodian.

Get Petty Cash Vouchers

You need a way to control all the small transactions your petty cash may have. The best way to do it is using vouchers that cashiers will compare during the reporting period to ask for reimbursements.

You can find templates online or get one in a store.

Prepare a Petty Cash Log

Finally, you need a petty cash log to control and manage your vouchers and expenses. This document will help you track the credit side and the debit side of your petty cash.

A petty cash form records all you do with the remaining money. You can determine the current balance and get detailed information without seeing physical papers.

Petty Cash Reconciliation

The petty cash reconciliation process works exactly the same way as you could expect.

Open the petty cash box and count the total amount of money

Check vouchers, bills, and other documents that require payments

Compare the withdrawals with the petty cash log

Reimburse all transactions that make sense and are properly backed up

Check the new total amount. It must be the same as the initial petty cash float

After a reconciliation process, the petty cash must return to the original amount of money. This process doesn’t take a lot of time, especially if you have a cash log for recording purposes to check all your receipts and expenses.

Considerations When Managing a Petty Cash

After establishing a petty cash, you must follow the best practices to ensure each transaction is accounted for.

Prepare a System To Track Withdrawals And Deposits

The mind is fragile. You can easily forget the small amounts of money you gave, which will bring an imbalance in your petty cash.

To avoid unwanted situations, you need to use vouchers. It's a reliable way to record specific amount – whether it’s a big or small amount – and control that you’ll get a reimbursement later on.

You should also use your log to enter details and maintain a second record. For example, you can give an employee $5 for purchasing office materials. The worker must give you back the change and a voucher that backs it up.

Update Your Petty Cash Log Regularly

Whether on a daily basis, weekly, or monthly, ensure you update your petty cash log to have everything related to your withdrawals or deposits.

Reconciliations Are Necessary

As the petty cash log updates, you can prepare daily, weekly, or monthly reconciliations. The idea is that the custodian and the office manager – or business owner – confirm that all spent from the petty cash is accounted for.

After the reimbursement, the petty cash log balance and the physical cash should match.

Petty Cash Log Templates

Google is a source of limitless documents. That’s why you can easily find free petty cash log templates online to use in your business.

You don’t need to spend time creating your own petty cash log, and you move straight to management.

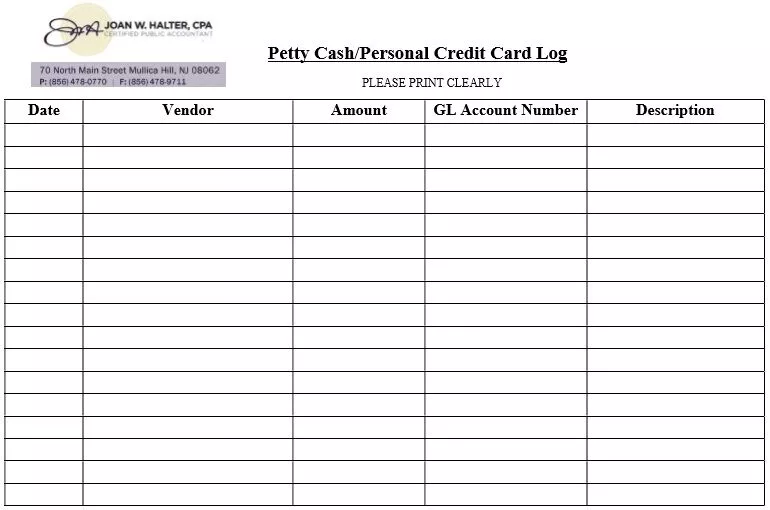

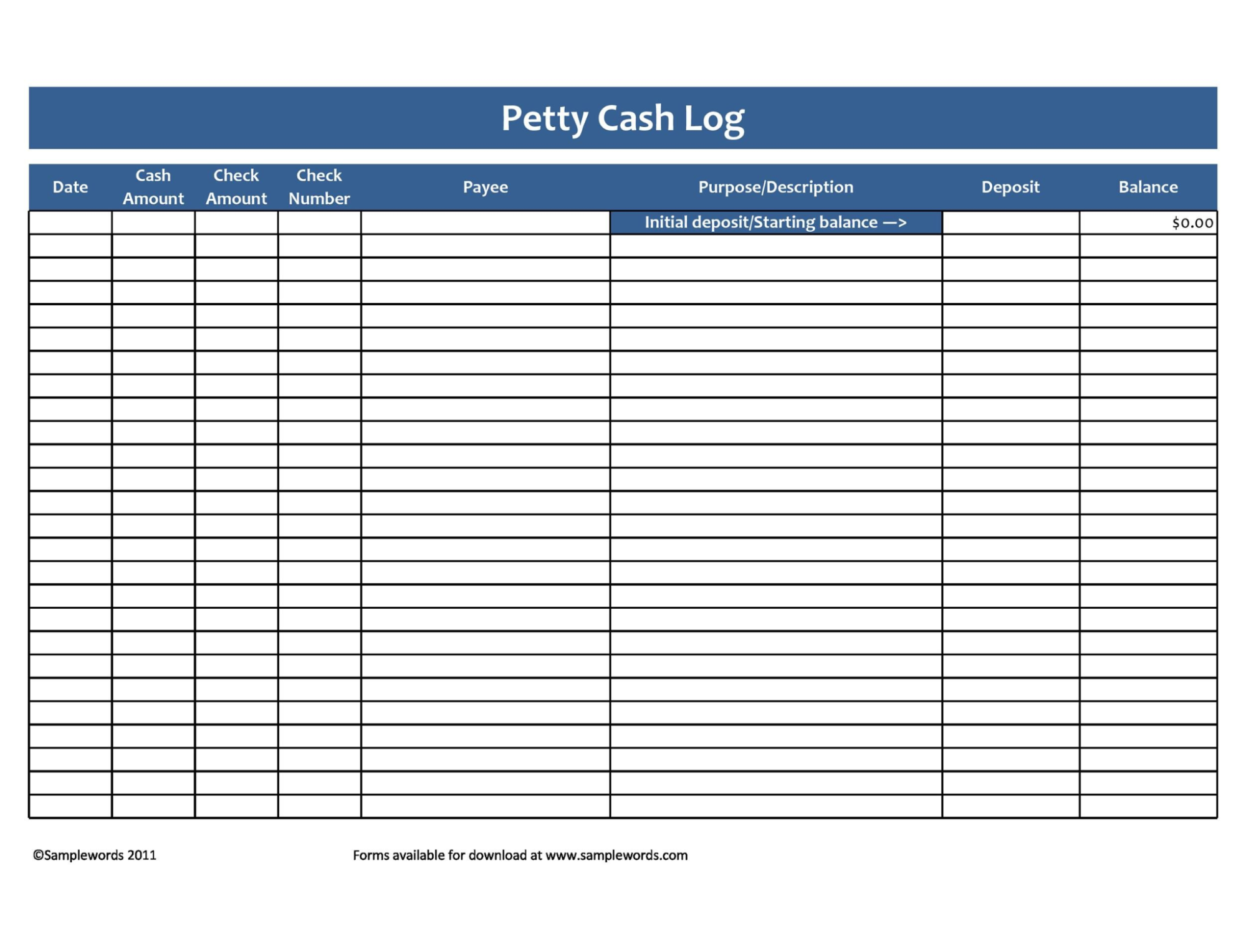

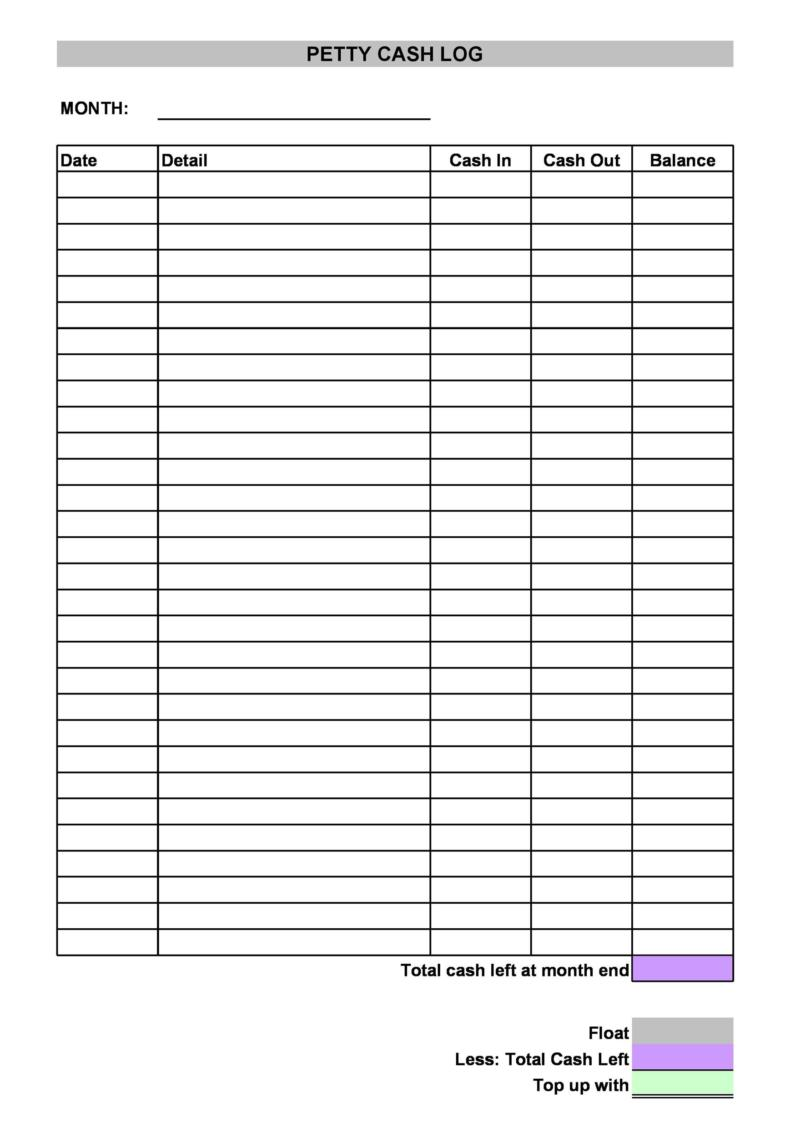

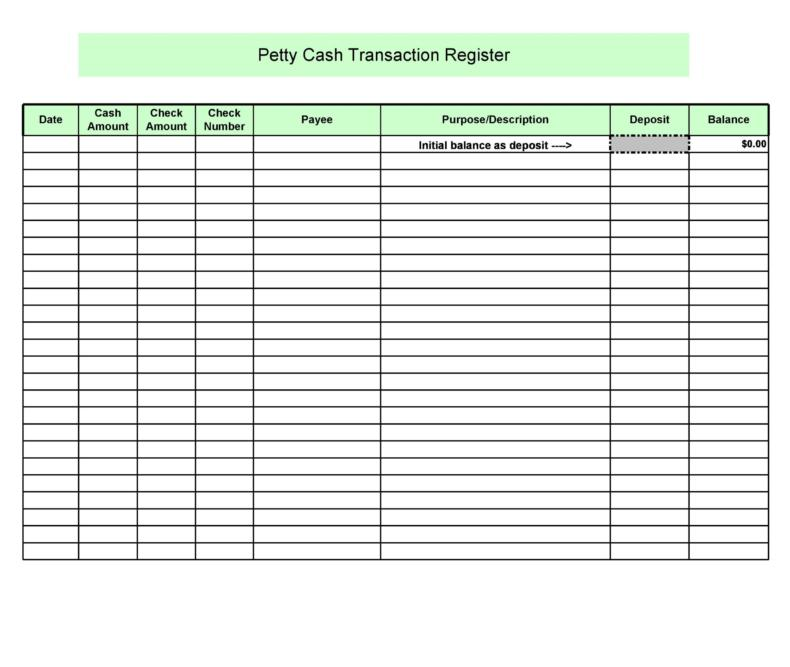

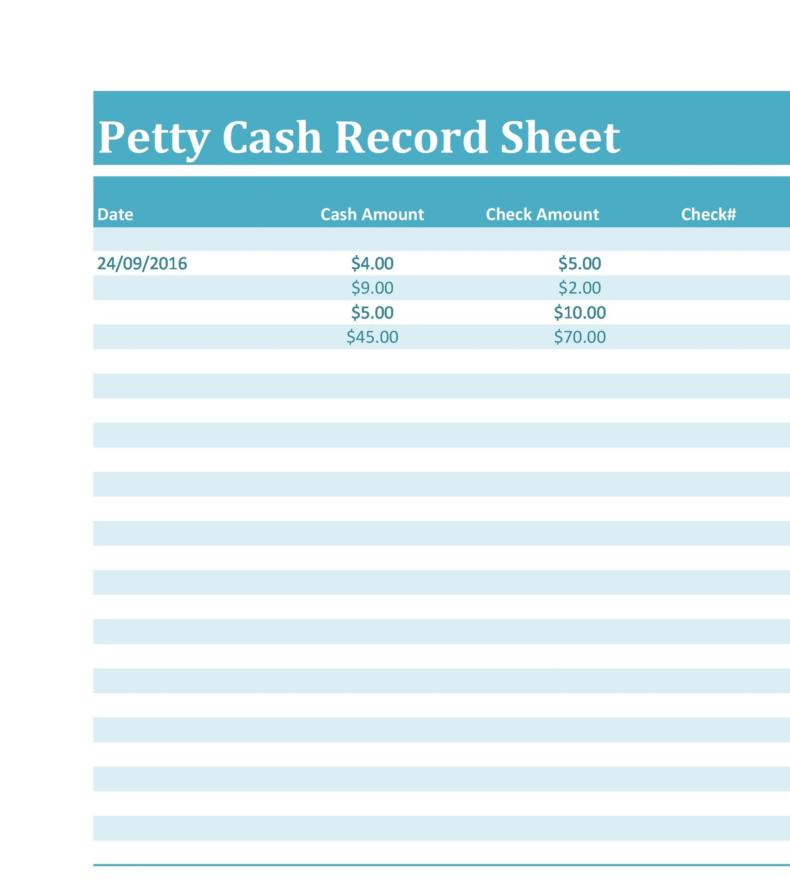

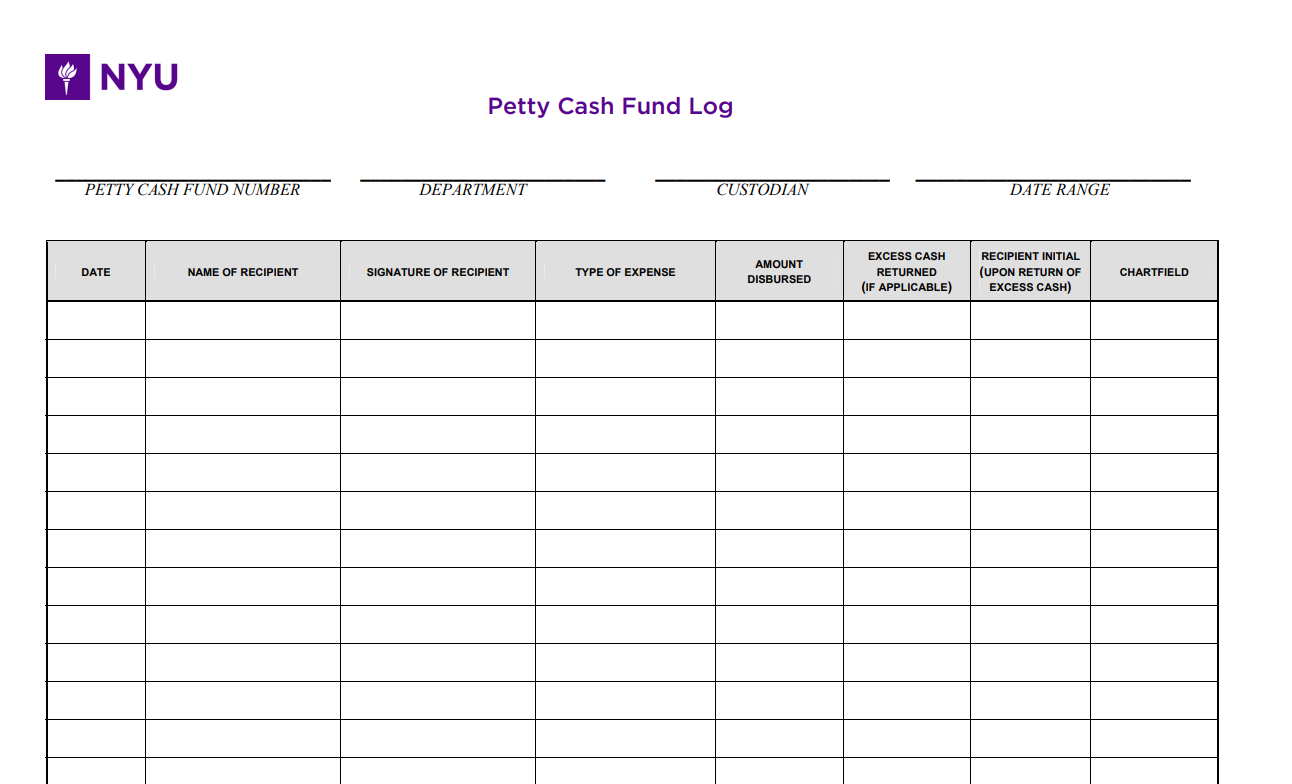

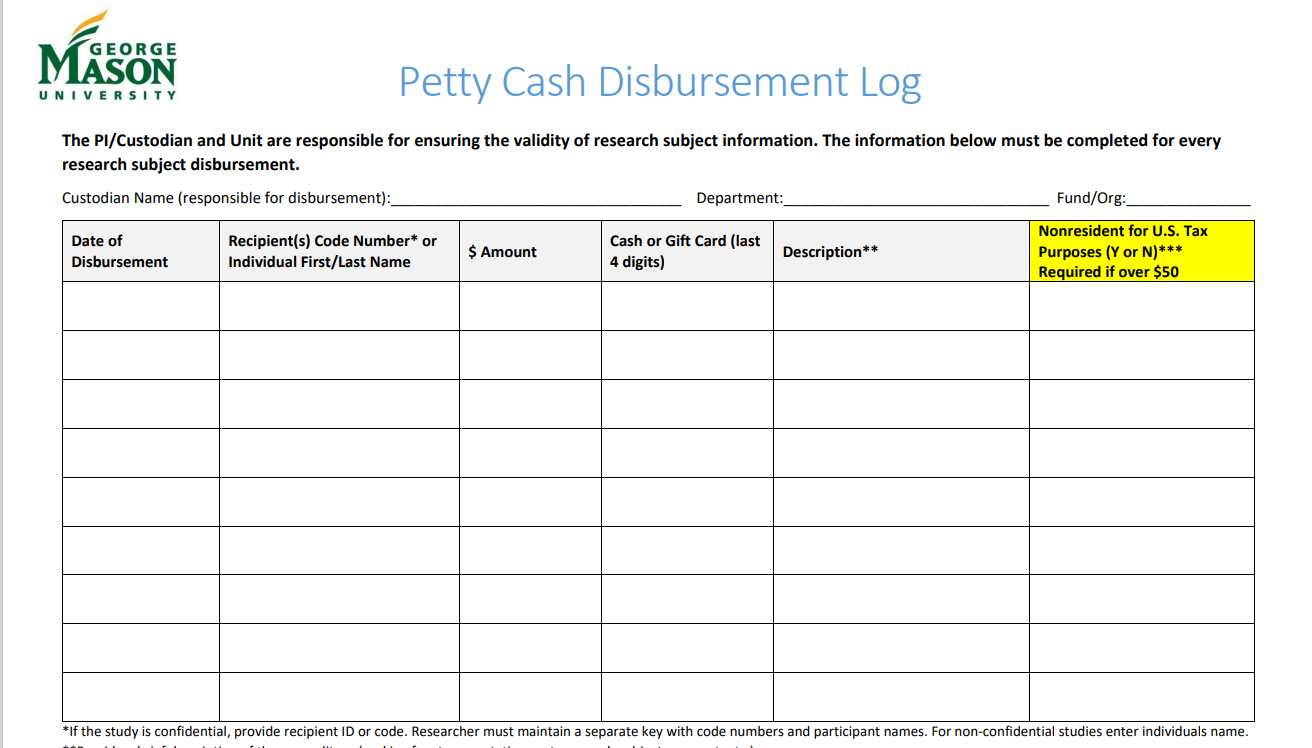

A good petty cash template includes columns for:

- The transaction date

- Amount spent

- Expense description

- Employee’s name

- Remaining balance

Fortunately, you can customize each template to suit your needs by adding or removing columns, changing the layout, or adding your company logo.

Here we’ve gathered valuable templates that small or bigger organizations can use to drive their petty cash logs.

Template #1

Petty Cash Change Log Template - Download Link

Petty Cash Template Software

You need a productivity software to create, read and edit petty cash templates. You can use Microsoft Office 2021 for this purpose. This suite will give you programs like MS Word, Excel, publisher, and more so you stop preparing petty cash logs and saving them in a manila envelope.

Use Microsoft Office 2021 to create the best log your organization needs to keep track of your petty cash expenses.

Excel will allow you to:

- Set up a columnar log

- Include one column at a time

- Add date and personalize information for employees' reimbursements

- Use different types of formulas to automate responses

- Use various forms and templates

RoyalCDKeys gives you access to the complete set of programs for a low price. You can get an original Microsoft Office 2021 CD Key for less than $20 and build a proper template for your business.

Petty Cash Log Example

Now that you know how to create and reconcile petty cash, you could use an example to put you in perspective on how to use it.

You’re the business owner of a coffee shop. You suddenly realize you’re out of napkins, and you call one of your employees and ask them to get a few packages. You mention you need a receipt and to give them a reimbursement without having to prepare an expense report.

You’ve set up a petty cash float of $200 in case something like this happens, so you’re already prepared.

Once they get to the shop, you take the napkins and check the receipt. Your employee brought ten packages and spent $50.

So, here’s what you do:

- Take the receipt

- Open the petty cash and save the paper

- Open the petty cash and take $50 for reimbursement

- Update the petty cash log

Now you have a $150 petty cash, a receipt, and an updated log with documentation to replenish the petty cash once it goes dry.

You must keep control of all receipts and maintain the log updated with detailed information.

Petty Cash Log Template - Summary

A petty cash template is a pre-designed spreadsheet that helps you keep track of your small cash transactions. This includes office supplies, parking fees, and other miscellaneous expenses.

With a petty cash template, you can record all your petty cash expenses, monitor your spending, and reconcile your petty cash account successfully.

Using a petty cash template helps you to stay organized and avoid losing receipts or forgetting to record expenses. It also allows you to monitor your petty cash spending and avoid overspending or running out of cash.

You can also reconcile your account accurately. This is essential for financial reporting and auditing purposes.