Payroll Report Template: Automate Monthly Payments Now

Companies worldwide are accountable for how they pay their employees and the taxes they withhold. They must disclose this to the local government to show they comply with national regulations. Fortunately, the payroll report template boosts this document’s creation.

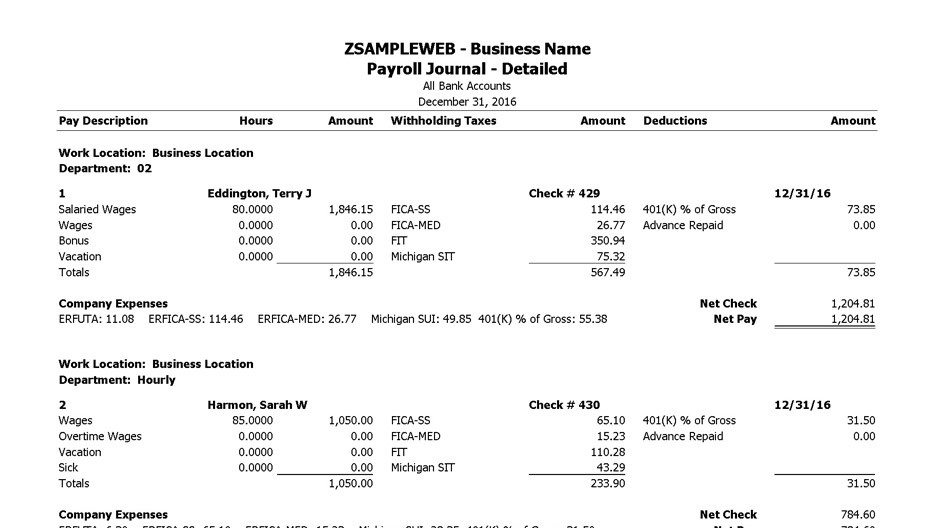

The payroll report summarizes all the payments and deductions made to employees for a specified period of time. It tracks and records employee earnings, taxes, and other deductions, such as insurance and 401(k) contributions.

You can create a consistent and accurate record of payroll information, making it easier for HR departments and finance teams to manage and track employee payroll data.

This article covers all you need to know about the payroll report template. Learn how to create one and discover if your budget is being used correctly.

What Is a Payroll Report?

The payroll report is a financial document business provides to governmental agencies to inform them about their payroll information. This includes:

- Pay rate

- Gross pay

- Net pay

- Taxes withheld

- Overtime

- Benefit costs

- Pay period

Companies must deliver the payroll data each time they pay their employees.

Businesses must comply with national regulations such as the Federal Insurance Contributions Act. With the payroll reports, governments also receive information about employer taxes and taxes withheld by businesses. Authorities can also verify tax liabilities and other employer/employee information.

Payroll Report Benefits

A good payroll report includes a payroll summary, federal income taxes, and more. This helps you save time and ensures the government that your business is doing things correctly. So, not only you’re protecting your company from potential lawsuits, fines, and penalties, but you also get these benefits:

1. Reporting taxes is easier: With a payroll system, you can file payroll tax forms and avoid penalties.

2. Helps budget management: When you use these reports, you can track payroll expenses. This means you control and predict how much it will cost your employees during a period.

3. Gives you more information about your employees: Payroll details help you obtain data about your staff. This includes turnover and how much you’re spending on their benefits. Overall, a payroll summary report gives you insights into how much labor costs.

4. Improves tax deductions: When you generate payroll reports, you can obtain payment details and pay all withholdings simultaneously. This will avoid tax withholdings and other fines.

5. Measures paid time off: With a payroll register or report, you can track how much time off you’re paying your employees. This is extremely helpful for small businesses looking to optimize their budget.

Types of Payroll Reports

When preparing a payroll report, you must consider the type you want to make. Each has a specific purpose, so you must understand them before making one.

Traditional Company Payroll Report

These are business-specific reports that you can use for internal purposes. They are monthly or quarterly reports that help you understand the overall status of your company. A complete payroll report should include:

- Employee compensations

- Salaries

- Employee time clock

- Pay type

- Pay rates

- Total hours worked

- Total payments that an employee receives

- Overtime

- Hourly rates

- Paid time off

- Payroll register

- Voluntary deductions

- Other deductions

- Pay stubs

Companies use these reports in a given period to get detailed information about their expenses and predict budgets. As a business, you could use it on a half-yearly or annual basis. It is also a great tool for calculating governmental reports such as wage and tax statements or FICA taxes.

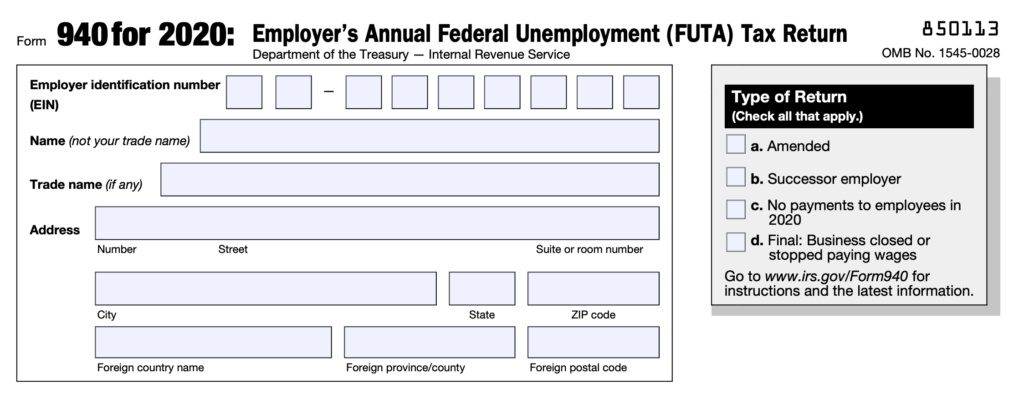

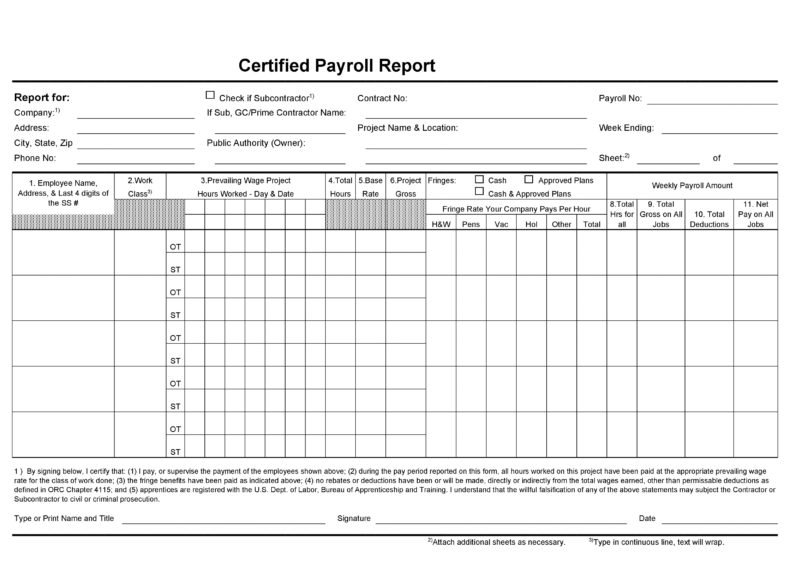

Federal Payroll Report

Federal payroll reports are meant to explain the public administration about business responsibilities. What this document does is that it collects all accounting information about taxes so you can send it properly to your country’s tax organization.

You prepare a Federal Payroll report monthly, quarterly, or annually, depending on the document you issue. Here are a few examples:

- Form 941 and Employer’s Quarterly Federal Tax Return are filed quarterly

- W-2 and W-3 forms are filed annually per employee

State And Local Payroll Report

Local and state payroll reports vary according to your state and where your business is located. Organizations must also consider where their employees live to send the correct information to the local administration.

Some of the reports include:

- Income taxes

- Employer’s annual federal unemployment

- Nonemployee compensation

Whenever you set up your company in a state, you should check the local administration website to confirm if you need to declare payroll reports.

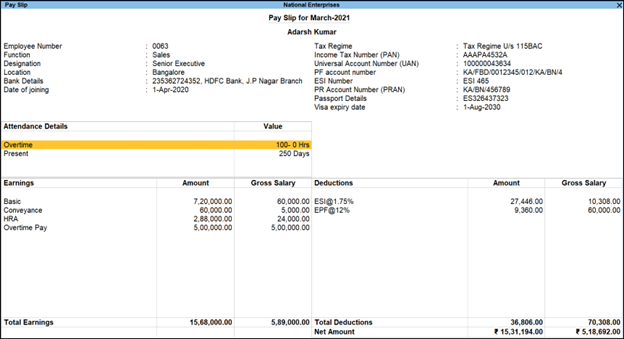

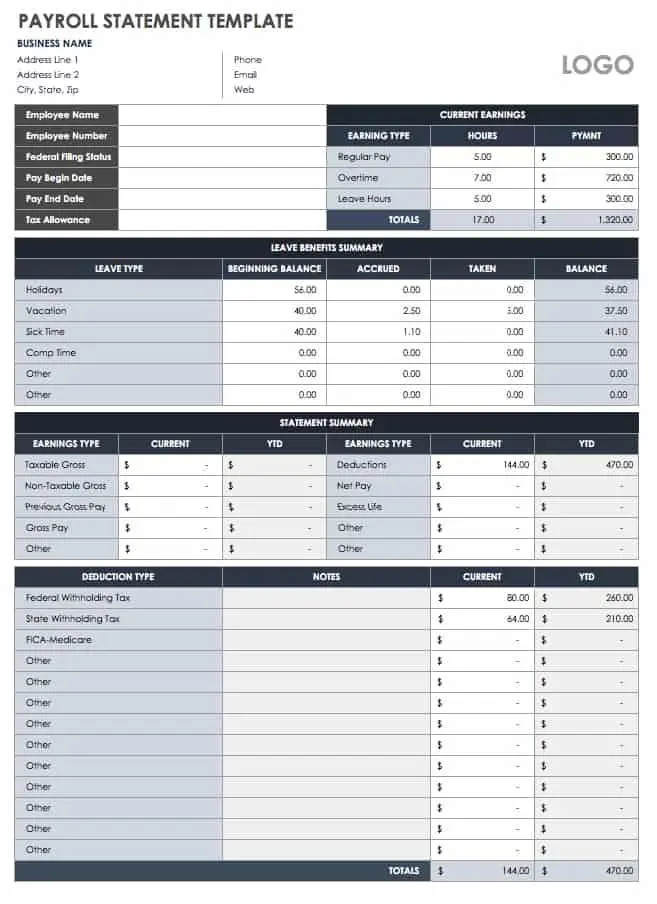

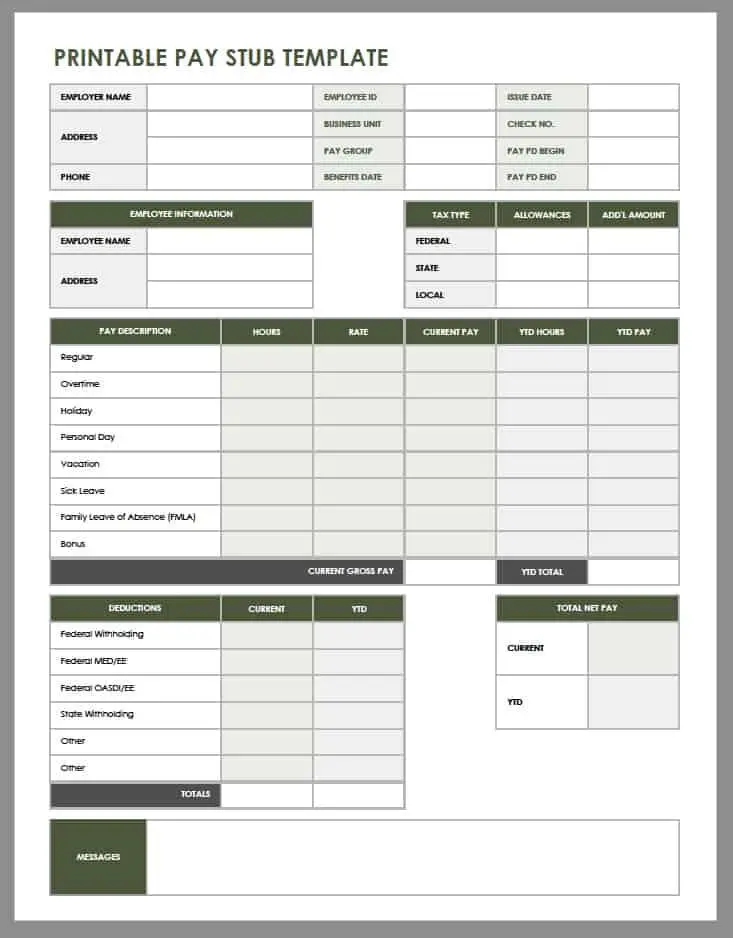

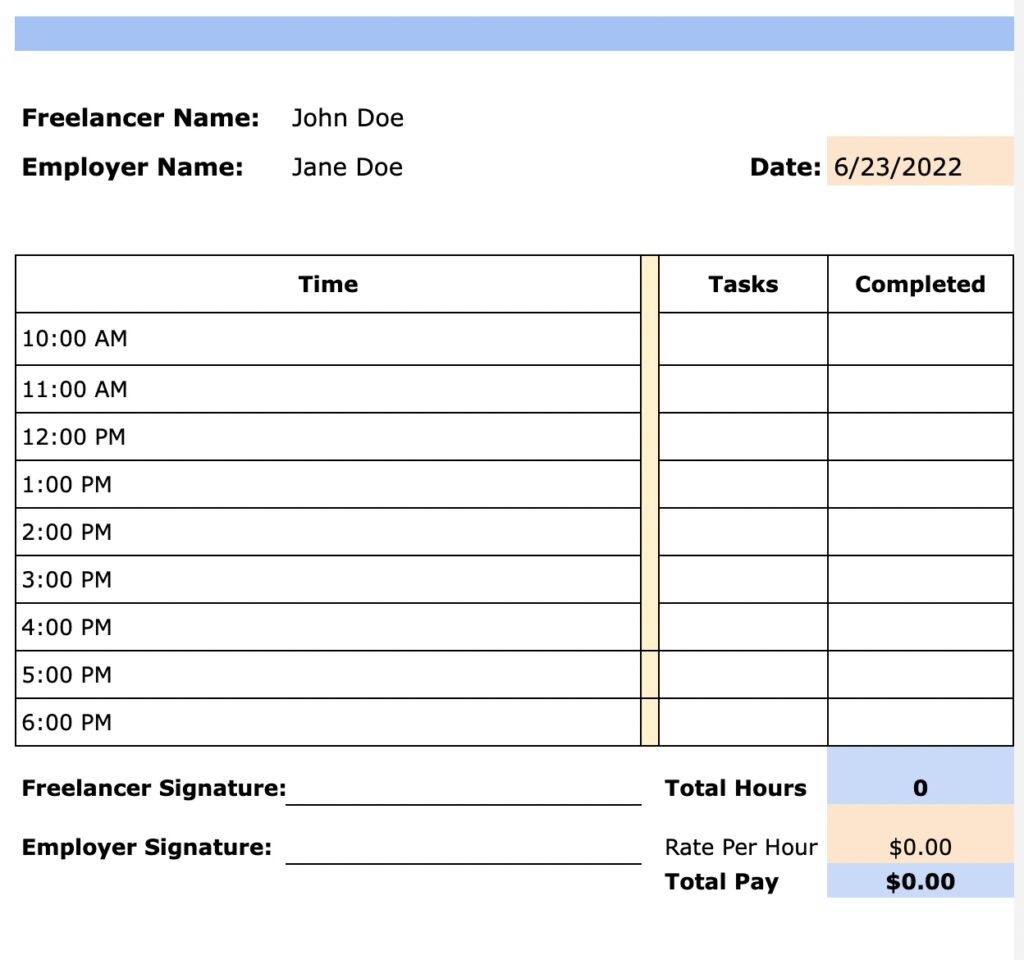

Employee Payroll Report

The employee payroll report brings individual employee details throughout a period of time. Companies deliver this document to each worker to show:

- The hours worked

- How much they’ll get paid

- Taxes withheld

- Benefits withheld

- Reimbursements for paid time off

Businesses should keep each report to deliver a general document with a tax statement at the end of the year.

Payroll Tax Report

This report is used for tax filing purposes and internal use. There’s a lot of information included that you can also find in employee and federal reports.

Companies can use this to fill the FUTA tax, the wage and tax statement, and the other payroll reports above. Social security administration could also require it when a business files its annual documents.

Why Is a Payroll Report Important?

A payroll report provides the government and your business with payment and taxed information about your organization's operations. The report helps local governments double-check that your company follows all regulations.

This also affects employees' feelings and reactions to their fringe benefits, wages, and overall business stability.

Key Considerations For Optimal Payroll Reporting

When preparing your payroll reports – a pay statement, employers payroll report, etc. – you need to think about optimizing your processes.

Set Up Frequent Report For Your Business

As a business owner, you need to have your taxes in check. That’s why creating frequent annual and quarterly payroll reports will help you present federal income taxes and easily track your expenses.

Optimize Reports To Measure Performance

When preparing your payroll reports, you should always look for performance optimization. The payroll records how many days and hours an employee worked, so you can see if your business is being charged extra hours.

You can also figure out if you are suffering from time theft during a specific period.

Use Payroll Report Software To Release Burden

Using modern software to help you prepare payroll reports is a game changer. You can forget about doing this process manually and spending days finishing a single report.

The human hand can make mistakes, and with all the information you have to include, you may forget a few things.

Software like Microsoft Excel prevents mistakes and ensures you submit complete documents to the IRS.

Hire a Decent Accountant

Accountants are the people you go to when you want to prevent errors in your federal taxes reports and audits. They make accurate calculations on your taxes so you can save money once your reports are submitted.

What Is a Payroll Report Template?

The payroll template is a document that allows companies to prepare their payroll reports in a predetermined format and avoid preparing one from scratch.

With payroll templates you:

- Save time with each payroll process

- Find free payroll templates that adjust to what you’re looking for

- Include all the necessary information about each employee

- Decide when to prepare the report

- Schedule payments and prepare team bonuses

- Control cash flow

- Manage deducted taxes from your employees

- Avoid fines, citations, and penalties for missing other relevant information

Payroll report templates ensure you include every information about your payroll that the government needs to know.

You can find free templates online. That’s why we have gathered the best examples so you can download them for free:

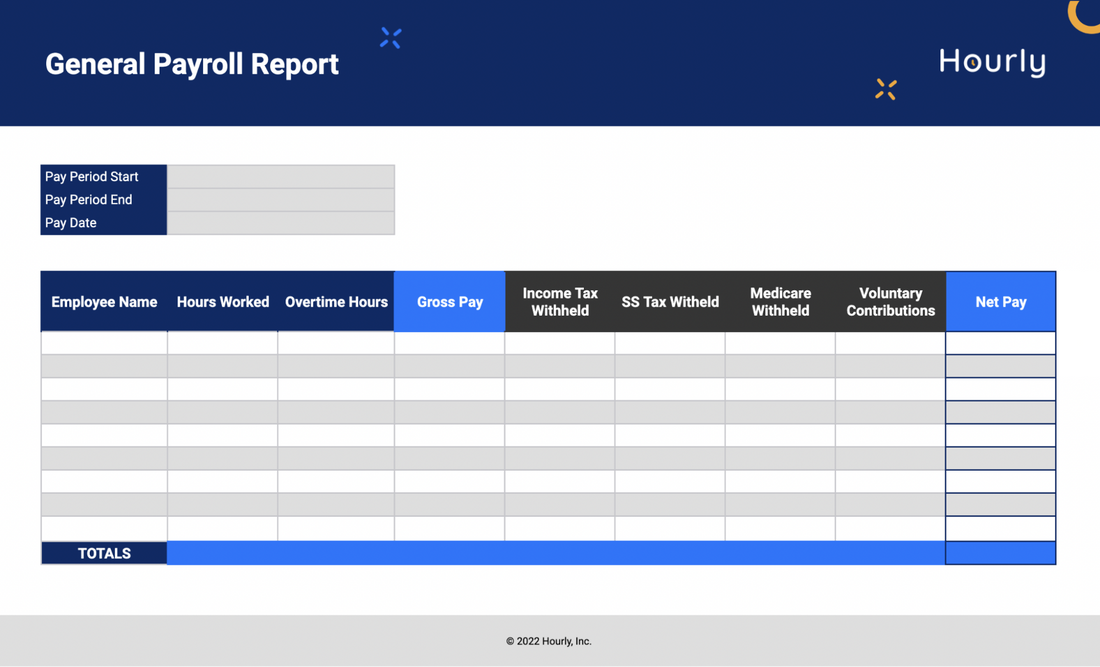

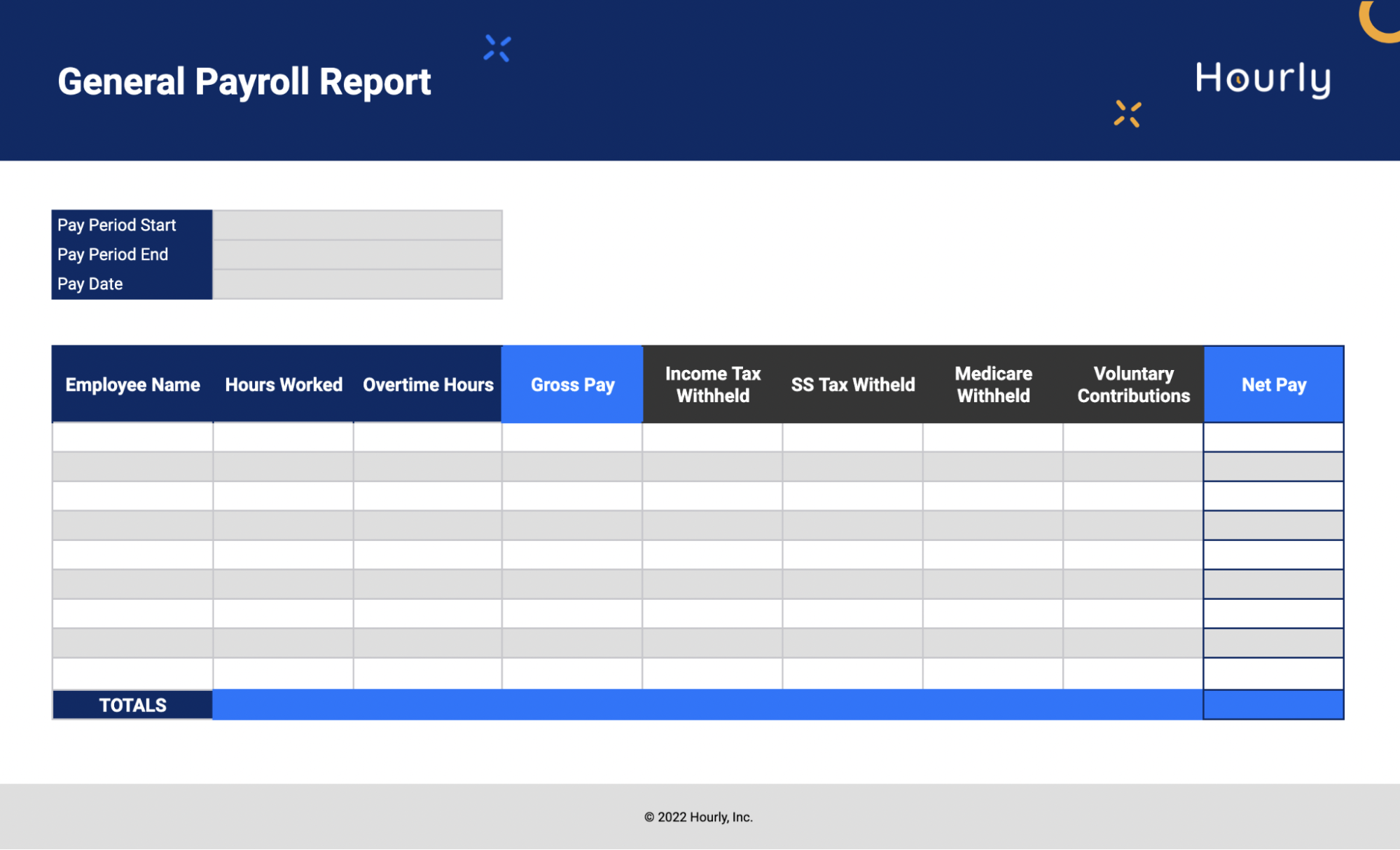

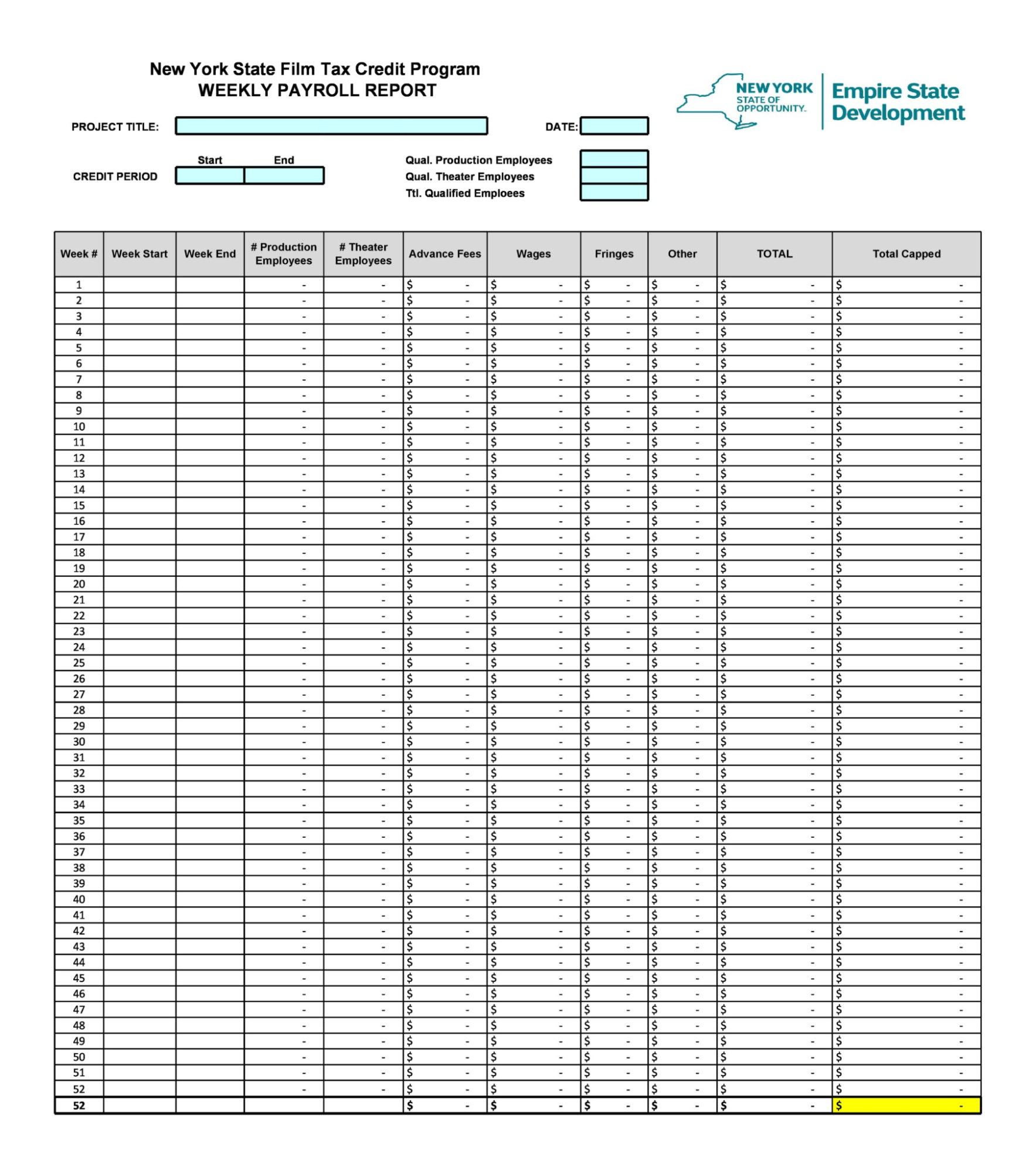

Template #1

Certified Payroll Report Template - Download Link

Payroll Report Template Software

You need a productivity software to open payroll report templates, edit them or create your own report templates.

Microsoft Office 2021 suite does the job. It brings multiple software you can use to prepare, save and share payroll reports while saving time. You can use Microsoft Excel to create formulas that fetch information and automate processes.

You can also draft charts and graphics to measure your business’s stability and identify where your budget is going.

You can get a Microsoft Office 2021 CD Key for a low price and prepare your spreadsheet in no time. Boost your workforce productivity with all the programs available here!

How To Create a Payroll Report In Excel

Now that you know what program you should use for your reports, here’s how to create a report tailored to your business.

Analyze Your Report Requirements

Consider what’s the objective of your report. Is it for tax purposes?

You need to establish if the document you create will be for internal use or if you’ll present it to the public administration.

Edit The Payroll Report Template

Once you have defined the objective, choose a template and modify it accordingly. You may need to:

- Add or remove columns

- Change names

- Remove formulas

Since the template brings standard information, you may need to take a bit of time to edit it.

Prepare The Payroll Report For Each Employee

Once you have updated your template, it’s time for you to add information about each staff member. This includes:

- Employee name

- Hourly rate

- Salary

- Department

- Federal and State Income Tax Rates

- Social Security and Medicare Tax Rates

- Benefits like sick leave or loans

- Deductions

- PTO and other information

- Allowances

You have to do this with every worker hired. If any information is missing, you should collect it and reflect it correctly in your report.

Prepare Your Business Payroll Tax

Besides all the previous information, the report also includes your payroll taxes. Templates include an Employer Payroll Taxes section you must complete for federal and state taxes. You have to consider that percentage applied in taxes and declare it through your payroll.

This is a monthly process you need to complete for each employee.

Insert Hours Worked, Duties, And Income Details

Payroll staff and managers are responsible for adding all the hours worked and duties carried out by the employees.

You must use the details entered in step 3. You must add the following information for each employee:

- Pay date

- Number of hours worked

- PTO

- Overtime hours

- Hourly rate

Before finishing this step, ensure all the information matches.

Review All And Proceed To Pay

You must check all calculating formulas and ensure the working hours match the respective names. You must generate the payroll perfectly to avoid underpayments and keep your employees happy.

After that, select how you’ll pay your staff. You can either:

- Give them checks

- Deposit money in their accounts

- Prepare pay cards

You shouldn’t pay in cash because this could be considered tax evasion.

Payroll Report Template - Summary

Payroll is an important part of a business’s operations. It’s responsible for paying each employee and managing their productivity monthly.

Without it, companies wouldn’t know how many taxes to withhold and what to declare to public administration.

That’s why a payroll report template is important. This document ensures the correct functionality of your entire payroll system and automates calculations. Get the templates above and start running your business correctly!