Master Your Finances with a Comprehensive Bill Pay Checklist

Keeping track of monthly bills and managing finances can often feel like a juggling act. The constant stream of household expenses, due dates, and financial responsibilities can easily become overwhelming.

However, with the help of a well-designed and efficiently implemented bill pay checklist, you can take control of your financial life and ensure that your bills are paid promptly and without stress. In this comprehensive guide, we will provide invaluable insights and step-by-step instructions on creating, utilizing, and maximizing the benefits of a bill pay checklist.

Whether you’re dealing with utility bills, mortgage payments, car loans, credit cards, or any other regular financial obligations, a bill pay checklist is your reliable companion, helping you stay organized and on top of your monthly expenses. By incorporating a systematic approach and utilizing this powerful tool, you can minimize late fees, avoid missed payments, and have a clear overview of your financial commitments.

Throughout this guide, we will delve into various aspects of bill pay checklists, from their importance to structuring an effective checklist, managing due dates, and ensuring accurate record-keeping. We’ll also explore the advantages of using printable bill pay checklists, discuss tips for optimizing your bill payment process, and highlight the role of technology in streamlining your financial management.

What is a Bill Pay Checklist?

A bill pay checklist is designed to help individuals and households manage their monthly expenses effectively. It serves as a comprehensive guide and organizational system to keep track of all the bills that need to be paid, ensuring that no payment is missed or overlooked.

At its core, a bill pay checklist is a detailed document that lists all the bills and financial obligations that need to be addressed within a given period, typically on a monthly basis. It acts as a centralized hub where you can record essential information related to each bill, such as the name of the bill, the due date, the amount due, and the date of payment.

The Benefits of Using a Bill Pay Checklist

Managing monthly bills and staying on top of your financial responsibilities can often feel like a daunting and overwhelming task. However, incorporating a bill pay checklist into your financial routine can bring numerous benefits and significantly simplify your financial life. Let’s explore how a bill pay checklist can make a positive impact on your financial management:

Organization and Clarity

A bill pay checklist provides a centralized and organized system for managing your monthly expenses. Having all your bills listed in one place, along with their due dates and amounts, gives you a clear overview of your financial obligations. This organization helps you stay on track, ensuring that no bills slip through the cracks and all payments are made on time.

Avoiding Late Fees

One of the primary advantages of using a bill pay checklist is preventing late fees and penalties. By noting the due dates of your bills and consistently referring to your checklist, you can ensure that payments are made before the deadlines. This timely approach helps you avoid unnecessary expenses and frees up your hard-earned money for other financial goals.

Financial Planning and Budgeting

A bill pay checklist is a valuable tool for financial planning and budgeting. It lets you see your monthly expenses at a glance and helps you allocate funds accordingly. By understanding your financial obligations in advance, you can plan your budget more effectively, ensuring sufficient funds are available to cover all your bills.

Enhanced Financial Control

With a bill pay checklist, you gain greater control over your finances. It helps you track your bill payment history, providing a record of your financial activities. This record-keeping can be invaluable for budget analysis, identifying spending patterns, and making informed financial decisions.

Reduced Stress and Peace of Mind

Juggling multiple bills and due dates can be stressful, leading to anxiety and worry. However, you can alleviate this stress with a bill pay checklist and enjoy peace of mind. By having a structured system, you can confidently navigate your financial responsibilities, knowing that you are organizational and in control.

Improved Financial Communication

A bill pay checklist can also foster better communication between household members or partners. It is a shared resource that everyone can access and contribute to the bill payment process. This transparency and collaboration can help ensure all bills are accounted for and prevent misunderstandings or missed payments.

Efficient Expense Tracking

By using a bill pay checklist, you create a convenient way to track your monthly expenses. As you mark off bills once they are paid, you can monitor your spending habits and identify areas where you can save money. This awareness and accountability enable you to make more informed financial choices and work towards your financial goals.

Incorporating a bill pay checklist into your financial routine offers numerous benefits. It simplifies your financial life by providing organization, helping you avoid late fees, aiding in financial planning and budgeting, enhancing financial control, reducing stress, improving communication, and facilitating efficient expense tracking. By harnessing the power of a bill pay checklist, you can streamline your bill payment process, gain peace of mind, and take charge of your financial well-being.

Creating a Bill Payment Checklist Schedule

Managing monthly bills can be complex, but with a well-structured bill payment schedule, you can simplify the process and stay on top of your financial obligations. A bill payment schedule acts as a roadmap, providing a clear plan for paying your bills on time and avoiding unnecessary stress. We will walk you through the process of creating an effective Bill Pay Checklist. Let’s get started:

Gather Your Monthly Bills

Begin by gathering all your monthly bills, including utilities, rent/mortgage payments, credit card bills, loan payments, insurance premiums, and any other regular financial obligations. Make a comprehensive list of these bills to ensure that nothing is overlooked.

Note the Due Dates and Amounts Next

Carefully note the due dates and amounts for each bill. This information is crucial for creating an accurate payment schedule. You can find this information on the bills themselves, online statements, or by contacting the respective service providers. Be sure to record these details in a format that is easy to reference.

Determine Your Preferred Payment Method

Decide how you prefer to pay your bills. Whether it’s through online banking, automatic payments, or mailing physical checks, choose a method that ensures timely payments. Consider setting up automatic payments for bills that have consistent amounts to streamline the process further.

Choose a Bill Payment Schedule Format

Select a bill payment schedule format that works best for you. This could be a digital spreadsheet, a dedicated budgeting app, or a printable template. Choose a format that aligns with your preferences and makes it easy for you to access and update your schedule regularly.

Organize Your Monthly Bill Payment Schedule

Using your chosen format, organize your bill payment schedule. Create columns or sections to include the bill name, due date, amount, payment method, and a checkbox or space to mark when the bill is paid. This format will help you track your payments and have a visual representation of your progress.

Set Reminders and Alerts

To ensure that you never miss a payment, set up reminders and alerts. Use the calendar app on your phone, task management tools, or dedicated bill reminder apps to receive notifications in advance of each due date. These reminders will help you stay on track and avoid late fees.

Regularly Update and Review Your Schedule

Make it a habit to update your bill payment schedule regularly. As new bills arrive or due dates change, promptly make the necessary adjustments. Additionally, set aside time each month to review your schedule, confirm payments, and make any necessary updates or changes.

Track Your Payment History

Keep a record of your payment history within your bill payment schedule. This will help you monitor your financial progress, track your spending, and have a reference for any future inquiries or discrepancies. Add a separate column or section to track payment confirmation numbers or receipts.

Adjust and Refine as Necessary

Periodically assess your bill payment schedule and make adjustments as necessary. Over time, your financial situation or bill structure may change. Stay flexible and refine your schedule to accommodate these changes and optimize your bill payment process.

By following these steps and creating a monthly bill payment schedule, you can effectively manage your bills, avoid late fees, and maintain financial control over your money. Remember, consistency and regular review are key to ensuring the success of your schedule. With a well-organized bill payment schedule in place, you can navigate your financial obligations with ease and enjoy greater peace of mind.

Bill Pay Checklist Printable Templates

To help you stay organized and better manage your finances, bill pay checklist templates can be a valuable tool. These templates provide a structured format for tracking your bills, expenses, and payments throughout the year. While there are various free printable templates available, you need Microsoft Office to access and customize them. If you don’t have Microsoft Office, you can obtain a genuine MS Office key from RoyalCDKeys, a trusted source for software licenses.

The free printables bill pay checklist templates allows you to track your financial obligations better. With features like monthly bill payment logs, bill calendars, and customizable sections, these templates provide a comprehensive solution for keeping your bills organized. You can track your bill payments for the entire year, ensuring you never miss a due date or forget to pay a bill.

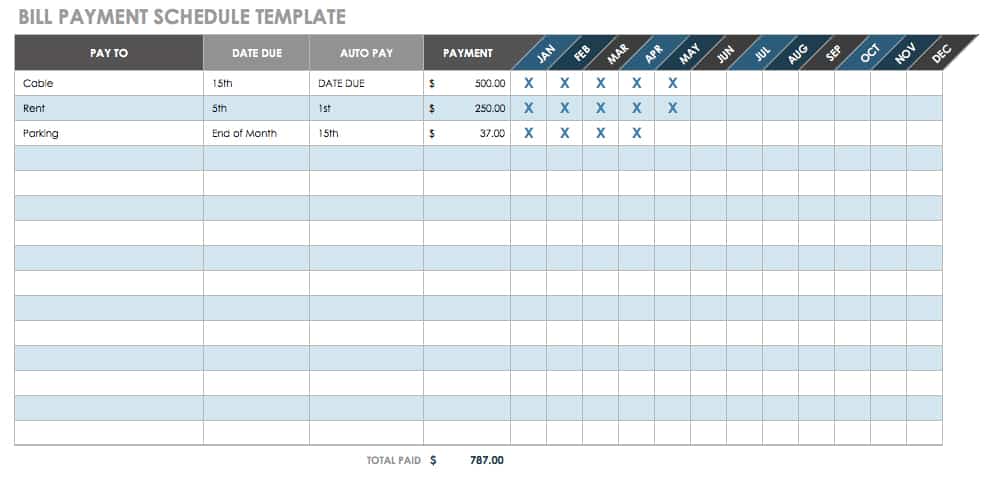

Bill Payment Schedule Template

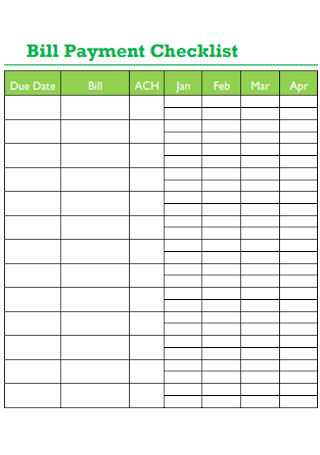

Plan your designated monthly expenses with this bill payment template. As you mark off bills paid for each month, you end up with an annual overview of which bills were paid and when. This is a simple way to create a payment program while tracking how your money is being spent. Easily edit the spreadsheet to include the billing details you want to follow.

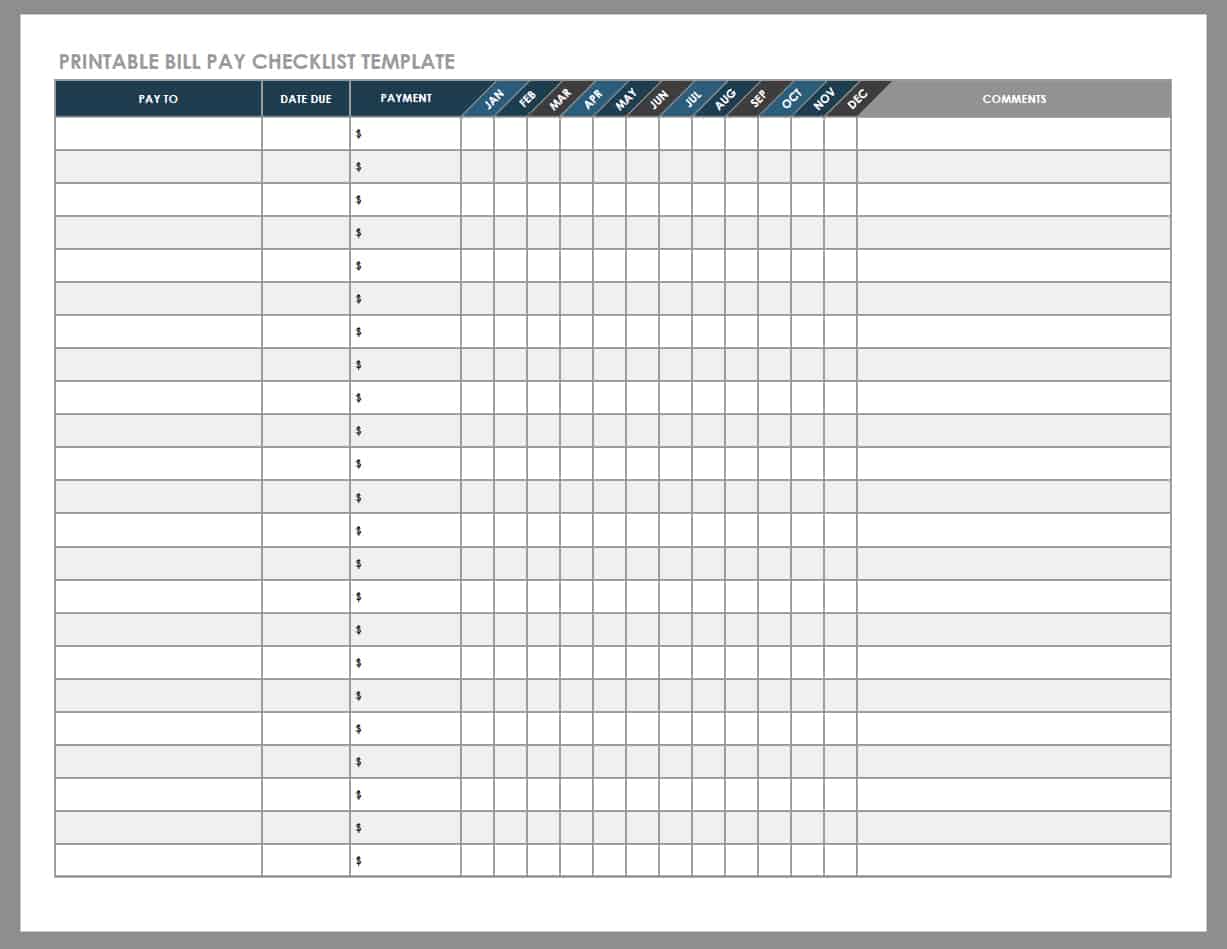

Printable Bill Pay Checklist Template

This PDF bill pay template provides a brief reminder of when bills are expected and what has been paid. Print and use the template as a paper calendar, or save it on your computer as a digital reference. Bill paying is more pleasant with an organized and easy-to-use checklist template.

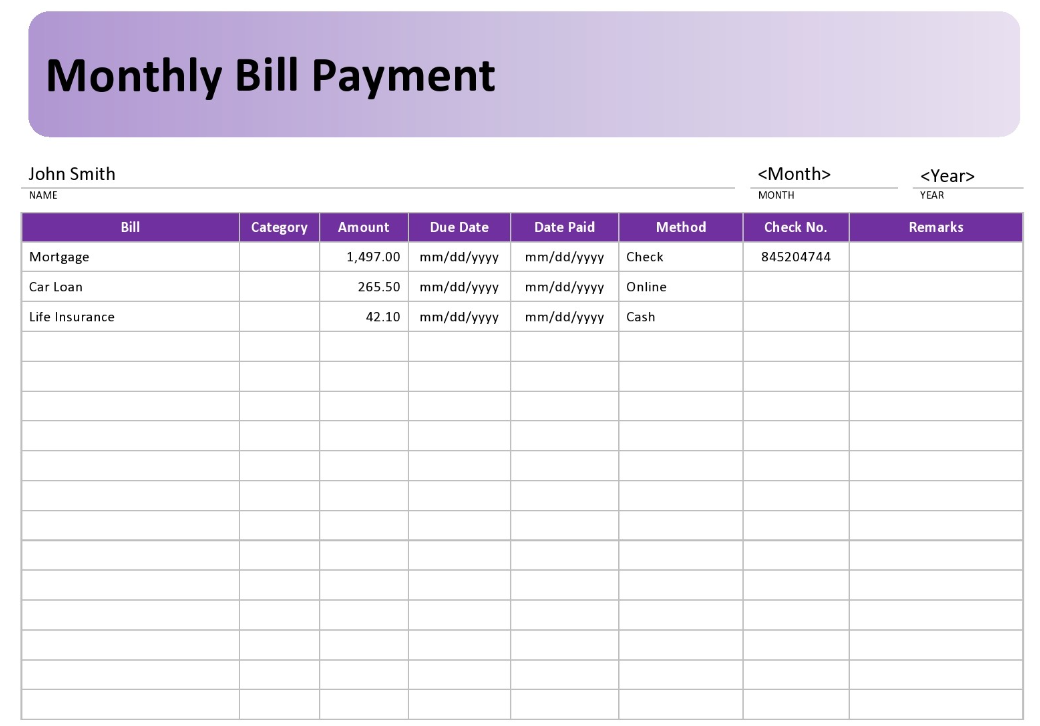

Monthly Bill Pay Checklist

This user-friendly monthly bill payment log is designed to help you keep track of your household bills payments efficiently and effectively. With sections to log each bill’s due date, payment amount, and status, you can easily monitor your monthly expenses and ensure timely payments.

Free Bill Payment Checklist Example

This handy, monthly bill payment checklist template is designed to help you manage your monthly bills effectively, ensuring you never miss a payment again. With sections to track bill due dates, payment amounts, and payment status, this checklist simplifies the bill-paying process and helps you stay on top of your financial responsibilities.

Conclusion

In conclusion, having a comprehensive bill pay checklist is crucial for managing your finances effectively and ensuring timely payments. Whether car payments, utility bills, or taxes, staying on top of your financial obligations is your only option to avoid late fees and penalties. A reliable bill tracker that covers all the months of the year allows you to write down and sign off on each payment, providing a clear record of your financial transactions.

By diligently tracking your expenses and savings, you can make informed decisions about your budget and identify areas where you can cut back or save more. In recent years, saving on electricity and taxes has become a priority for many households. With each paycheck, you can allocate the necessary funds to different accounts, managing your debt and ensuring your bills are paid on time.

No matter how busy life gets, a well-organized bill pay checklist is your go-to tool. You can designate a specific weekly time to review and fill in the checklist, ensuring nothing slips through the cracks. It’s important not to wait until the last minute or rely on hope when it comes to bill payments. Instead, take control of your finances and be proactive. A well-arranged checklist can be your constant reminder of pending bills, urgent matters, and important mail.