How to Write an Accounting Worksheet: A Comprehensive Guide

An accounting worksheet is an essential tool accountants use to organize and analyze financial information. It simplifies the accounting cycle process and assists in preparing financial statements. In this article, we will guide you through the steps of creating an accounting worksheet, enabling you to accurately prepare the company’s financial statements and ensure the accuracy of your financial records.

What Is an Accounting Worksheet?

An accounting worksheet is a valuable tool accountants use to streamline the process of preparing financial statements and analyzing financial data. It is an internal document that aids in organizing, summarizing, and adjusting the company's financial information before the final reports are generated.

The accounting worksheet consists of a spreadsheet format with multiple columns. Typically, it includes five key columns: trial balances, adjustments, adjusted trial balance, income statement, and balance sheet. These columns allow accountants to track and manipulate data related to various accounts, such as revenues, expenses, assets, liabilities, and equity.

Additionally, the accounting worksheet includes a column for closing entries, which transfers the balances of temporary accounts (such as revenue and expense accounts) to the retained earnings account. These entries reflect the net income or net loss for the accounting period.

An accounting worksheet simplifies preparing financial statements by organizing and adjusting the company’s financial data. It acts as an analytical tool that aids accountants in identifying errors, making adjustments, and ensuring the accuracy of the company’s financial records.

Why is an Accounting Worksheet Important?

An accounting worksheet plays a crucial role in the financial management of a business. It holds significant importance due to the following reasons:

Organization and Analysis

An accounting worksheet helps accountants organize and analyze financial data effectively. A structured format with designated columns for different accounts allows for a systematic arrangement of information. This organization simplifies identifying and understanding various financial components, such as revenues, expenses, assets, liabilities, and equity.

Accuracy and Error Detection

The worksheet is a tool to ensure accuracy in financial calculations and data entry. Documenting trial balances and adjustments facilitate the identification of errors or discrepancies in account balances. Accountants can compare and reconcile figures across different columns to pinpoint and correct inaccuracies promptly. This attention to detail enhances the overall accuracy and reliability of financial records.

Adjustments and Analysis of Financial Statements

The accounting worksheet enables accountants to make necessary adjustments before preparing financial statements. It provides a dedicated column to record adjustments such as accruals, deferrals, and other corrections. These adjustments ensure that the financial statements accurately reflect the company’s financial position and performance. Additionally, the worksheet allows for the analysis of financial statements by summarizing revenues, expenses, and other key elements in the income statement and balance sheet columns.

Streamlined Preparation of Financial Statements

With the help of an accounting worksheet, preparing financial statements becomes more efficient. The worksheet serves as an intermediary step between trial balances and final reports. It allows accountants to consolidate and organize data before transferring it to the income statement and balance sheet. This streamlining reduces the chances of errors, improves the speed of financial statement preparation, and facilitates timely reporting.

Internal Decision Making

Accounting worksheets are valuable for internal purposes within a company. They provide a comprehensive overview of the financial position, performance, and trends, enabling management to make informed decisions. By analyzing the data presented in the worksheet, stakeholders can identify areas of improvement, evaluate profitability, and assess the business's financial health. This information helps guide the organization's strategic planning, budgeting, and resource allocation.

External Reporting and Compliance

Accounting worksheets benefit external users such as investors, creditors, and regulatory authorities. They provide a transparent and detailed summary of financial information, ensuring compliance with accounting standards and regulations. When preparing financial statements for external reporting, the worksheet serves as a reference to ensure the accuracy and completeness of the data presented.

An accounting worksheet is essential because it promotes organization, accuracy, and analysis of financial data. It aids in making adjustments, preparing financial statements, detecting errors, and facilitating decision-making processes. By serving as a reliable and comprehensive tool, the accounting worksheet enhances a business's overall financial management and reporting.

Types of Accounting Worksheets

Accounting worksheets come in various types, each serving a specific purpose in organizing, analyzing, and preparing financial data. Here are the different types of accounting worksheets commonly used:

General Ledger Worksheets

General ledger worksheets are fundamental tools in accounting. They provide a detailed record of all financial transactions, categorizing them into various accounts such as assets, liabilities, equity, revenues, and expenses. These worksheets summarize the account balances and serve as the basis for preparing financial statements.

Trial Balance Worksheets

Trial balance worksheets play a crucial role in detecting errors and ensuring the accuracy of financial records. They list all the account balances from the general ledger in two columns: debit and credit. The totals of both columns should match, indicating that the accounting equation (Assets = Liabilities + Equity) is in balance. Trial balance worksheets are essential for identifying any discrepancies or errors that must be corrected.

Adjusting Entry Worksheets

Adjusting entry worksheets are used during the accounting cycle before preparing financial statements. These adjustments ensure that the financial statements accurately reflect the company’s financial position and performance. Adjusting entry worksheets typically include columns for the account name, adjustment type (debit or credit), and the amount. This worksheet helps accountants track and document adjustments such as accruals, deferrals, estimates, and reclassifications.

Income Statement Worksheets

Income statement worksheets summarize a company's revenues and expenses over a specific accounting period. They provide an overview of the company’s financial performance by calculating the net income or net loss. Income statement worksheets typically include columns for revenue accounts, expense accounts, and calculation columns to determine the net income or loss. These worksheets help analyze the profitability and operating efficiency of the business.

Balance Sheet Worksheets

Balance sheet worksheets present the financial position of a company at a specific point in time. They provide a snapshot of the company’s assets, liabilities, and equity. Balance sheet worksheets typically include columns for various asset and liability accounts and equity accounts. By analyzing the balances in these worksheets, stakeholders can assess the company’s financial stability, liquidity, and leverage.

Cash Flow Statement Worksheets

Cash flow statement worksheets track the inflows and outflows of cash in a business. They classify cash flows into three main categories: operating activities, investing activities, and financing activities. Cash flow statement worksheets help accountants analyze the sources and uses of cash, assess cash flow patterns, and evaluate the company’s ability to generate and manage cash.

Budget Worksheets

Budget worksheets are used to plan and monitor the financial activities of a company. They assist in setting financial goals, estimating revenues and expenses, and tracking actual performance against the budgeted amounts. Budget worksheets often include columns for budgeted amounts, actual amounts, and variance analysis. These worksheets help managers monitor financial performance, identify areas of improvement, and make informed decisions.

Different accounting worksheets serve specific purposes in organizing, analyzing, and preparing financial data. From general ledger and trial balance worksheets to the income statement and budget worksheets, each type contributes to maintaining accurate records, identifying errors, analyzing financial performance, and facilitating organizational decision-making processes.

Accounting Worksheet Templates

To simplify the process of creating accounting worksheets, we provide some templates that can be used with Microsoft Office. These templates provide a pre-designed structure and formatting, making it easier for accountants to input their financial data and perform calculations. With the templates, users can save time and effort by leveraging the built-in formulas and functions to calculate totals, balances, and other financial metrics automatically.

It is important to note that to use these templates, you need Microsoft Office installed on your computer. To acquire Microsoft Office, the best option is RoyalCDKeys. You can purchase valid and affordable software licenses such as Microsoft Office in order to utilize the accounting worksheet templates effectively.

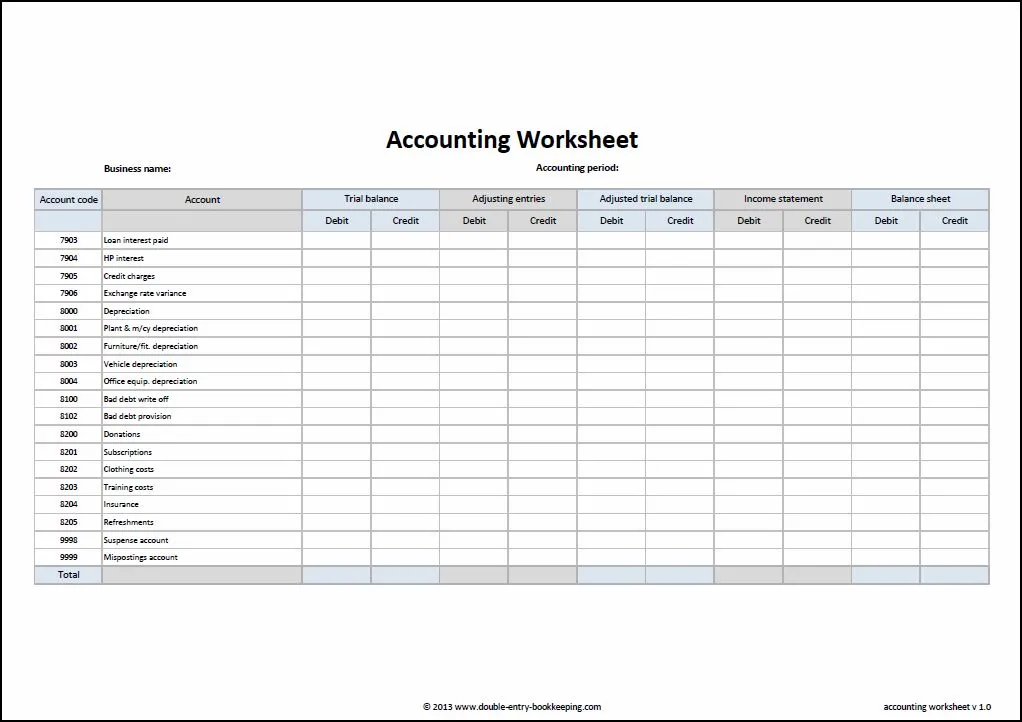

Accounting Worksheet Template

This 10-column accounting worksheet template can be used as a worksheet in accounting to produce income reports and balance sheets from an unadjusted trial balance. The adjusted trial balance and the totals for each column are estimated, and the accounting worksheet shows error notifications if the unadjusted trial balance debit and credit columns and the adjusting entries debit and credit columns do not balance.

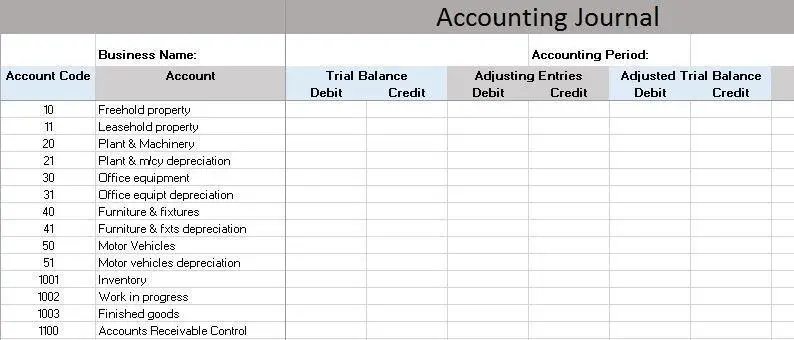

Accounting Journal Template

An accounting journal is an accounting worksheet that lets you track each of the steps of the accounting process. This accounting journal template has each step with sections for their debits and credits and pre-built procedures to calculate the total balances for each column.

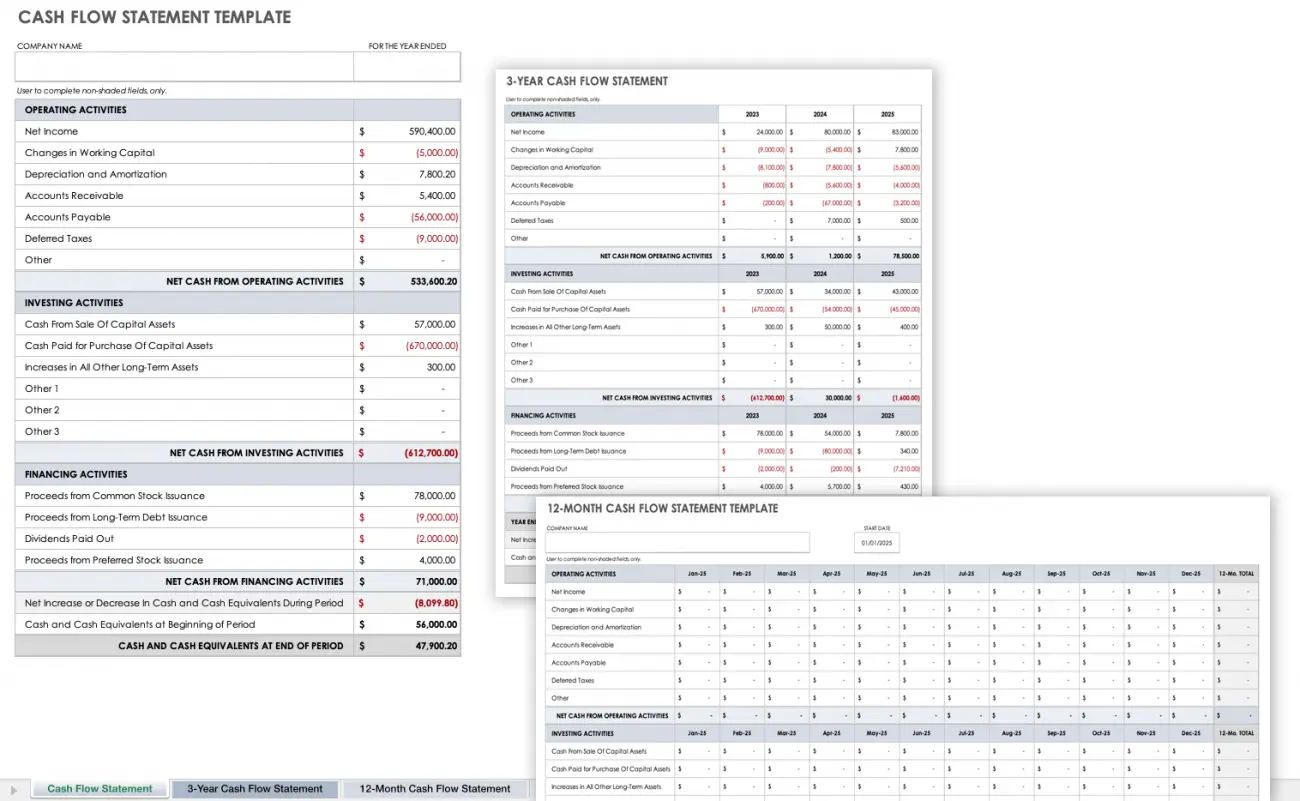

Cash Flow Statement Template

A cash flow statement is essential to provide a good picture of the inflow and outflow of cash within your company. It shows where the money came from (cash receipts) and where it went (cash paid). Use a cash flow statement template, balance sheet, and income statement to provide a complete look into the financial status of your company.

Conclusion

Utilizing an accounting worksheet is advantageous for developing accurate and reliable financial records. By incorporating various columns, such as the income statement column and adjustment column, the worksheet serves as a comprehensive summary tool for all the accounts within a company.

It enables the accounting department to efficiently manage and analyze financial information, including accounts receivable, accrued expenses, and depreciation expense. This streamlines identifying adjustments and ensuring that all necessary information is appropriately recorded.

Accounting worksheets are valuable tools that aid in the preparation and analysis of financial data. They offer advantages such as improved organization, efficient calculations, and generating comprehensive reports. While there are limitations, the benefits of utilizing accounting worksheets, especially when developed with attention to detail and accuracy, outweigh the potential drawbacks. By understanding accounting worksheets' purpose, components, and advantages, businesses can effectively utilize these tools to maintain accurate financial records and support informed decision-making processes.