How To Use a Sales Receipt Template In 6 Steps

Sales receipts are an essential aspect of any business transaction, as they serve as tangible proof of a purchase made by a customer.

They provide a transaction record, including the date of purchase, the item or service bought, quantity, price, and applicable taxes or discounts.

They play a crucial role throughout the accounting process, enabling businesses to accurately track their sales revenue, expenses, and taxes owed.

In today's digital age, sales receipts can be generated and sent electronically, making it easier for businesses and customers to keep track of their purchases. But is it easy to apply in your business industry?

This article covers how to use a sales receipt template so you can start sending helpful bills to your clients!

What Is a Sales Receipt?

The sales receipt is a document that works as transaction proof for purchasing or selling a product.

Business owners use them as part of their business accounting system to track transactions, inventory management, and ensure post-selling service.

You can get both digital and handwritten receipts, and they’ll have the same validity as long as the seller is the one who prepared the document.

Why Should Your Business Use Sales Receipts?

The sales receipt serves as a way to confirm a transaction using a specific payment method. And your business needs it to manage stock rotations and financial statements.

But sales receipts are helpful for much more than that. These documents are often used by a big or small business owner often uses these documents to:

- Determine how much sales tax they have to pay.

- Use them as packing slips when delivering a product.

- Foresee future sales

- Accept reimbursement from unsatisfied customers

- Identify accounting issues

Overall, sales receipts protect both the business and customers while ensuring they have transaction evidence.

Types of Sales Receipts

There are five types of sales receipts that you can use in your business, depending on the situation.

Let’s break this down:

Cash Register Receipts

The cash receipt is the most common transactional document you can see whenever you purchase.

Business owners normally use online filing systems and softwares to automate ticketing processes.

Among the companies you can see this type of receipt are:

- Grocery stores

- Gas stations

- Retail stores

Handwritten Receipt

The handwritten receipt is a more spontaneous business document for personalized and regular transactions.

Some examples of transitions where you may get handwritten receipts are:

- When paying rent

- After paying for a show or a convention

- When you make home repairs

You can see it’s a handwritten document because it uses carbon to create written information. This way, the contractor – or the business owner – can record the payment details into their online filing systems.

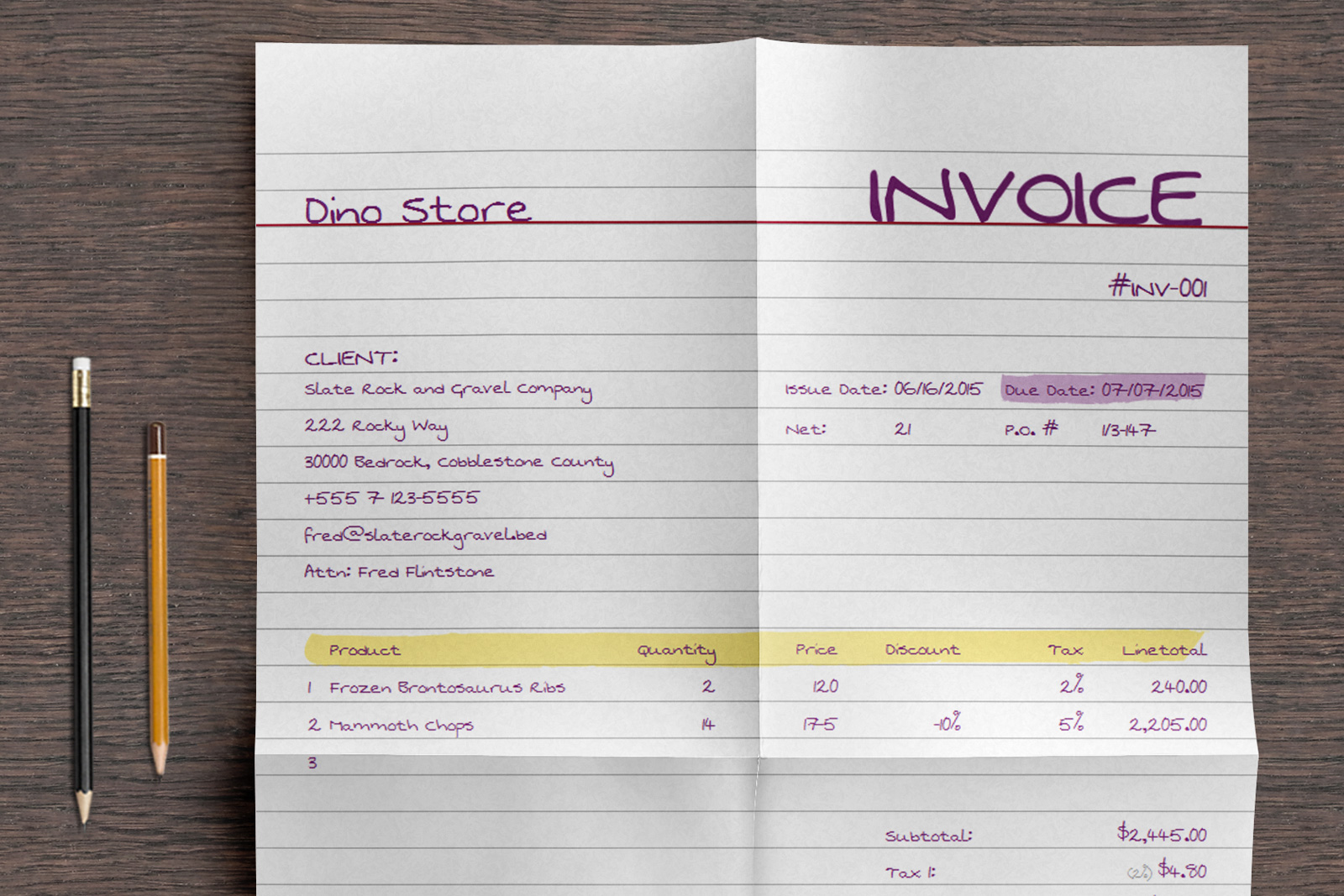

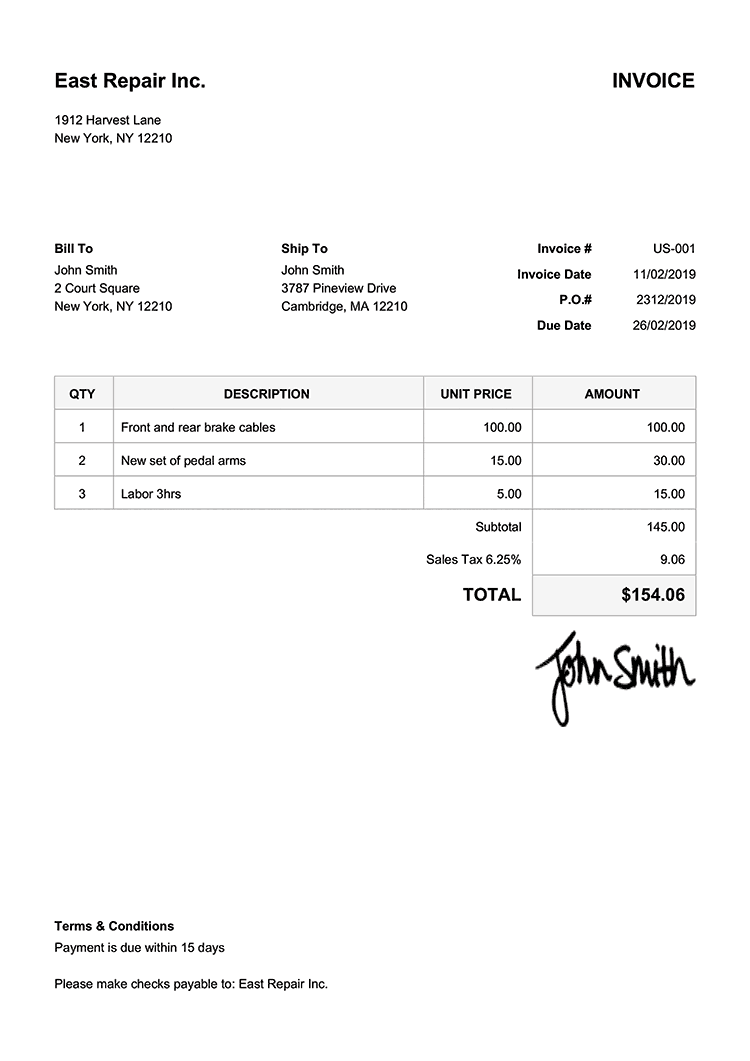

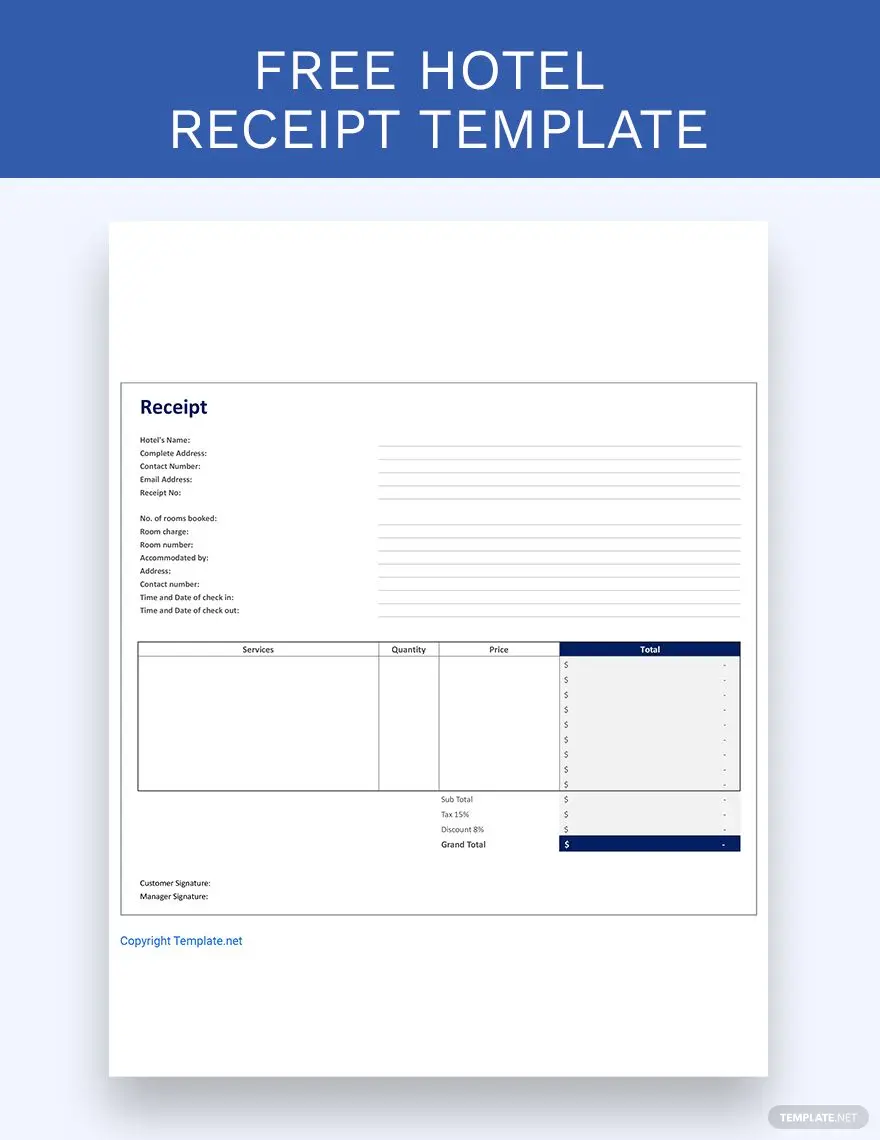

Invoice

The invoice is a more serious transactional document, primarily used in B2B sales. Companies request them for tax and financial records. Depending on their organization's best practices, some businesses even need a specific type of invoice.

Invoices require further processing because they must have legal information from the purchaser and seller, which is why businesses send receipts through email or any other online form.

You can use specialized accounting software to build unique invoices for each client.

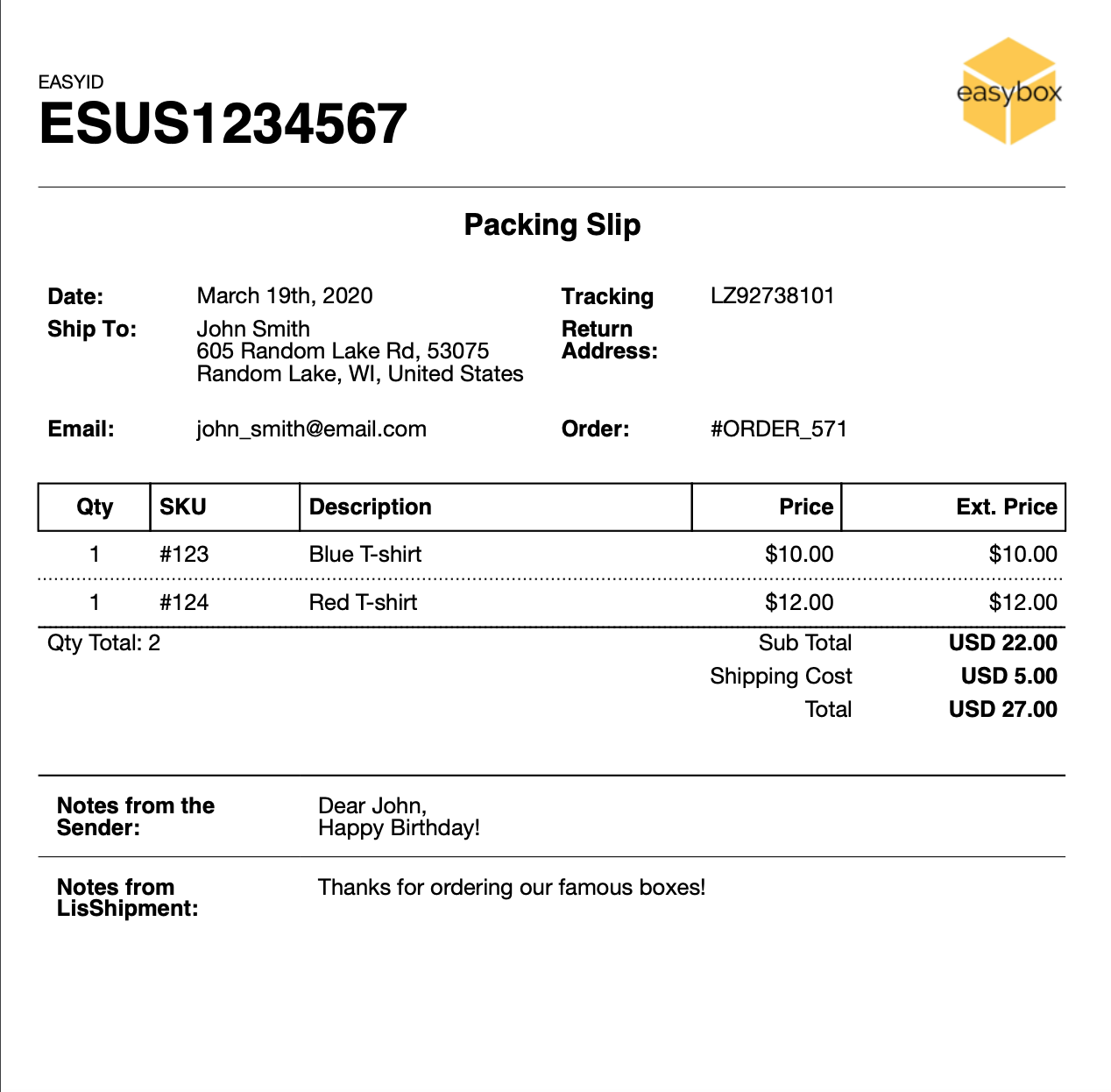

Packing Slip

The packing slips work like the international document packing list but for national deliveries.

This is a single document that includes detailed information about the shipped packages and their owner. The slip is attached to the boxes, so the delivery guy knows where to send it.

Buyers usually receive copies delivered online.

What Is Included In a Sales Receipt?

All receipts need similar customer information to ensure the transaction is completed.

Here is the sales receipt information you have to include:

- The person or business name

- UPC

- Return label – if necessary

- Goods or services quantity

- Price for each item

- Total money paid for the transaction

- Sales tax collected

- Payment terms and method used

Now, if you are issuing invoices, you may need to add extra information such as:

- Company name, email address, number, and website

- Address, time, date, and location

- Seller’s registration number

- The salesperson name

Some organizations may have their own receipts templates where they ask for more information, such as the description of services rendered, if it’s a partial transaction, or if it requires late payments.

Either way, you must speak with the purchaser to receive the suitable receipt model.

Sales Receipts Advantages & Disadvantages

Sales receipts have both pros and cons. You have to consider them when applying this document to your business selling processes.

Advantages |

Disadvantages |

Works as proof of payment and allows customers to get reimbursements. |

Sales receipts are printed on thermal paper. This is a non-recyclable paper that has chemicals. |

It makes it easy to track expenses, inventory, and sales revenue. |

Purchasing sales receipts involves a cost depending on how much a business needs. It could represent a lot of money. |

They are evidence of taxable income and expenses. |

Recording complete or partial receipts into QuickBooks online – or something similar – is time-consuming. |

Reduces audit risks by providing a written record of each transaction. |

Sales receipts contain sensitive information like credit cards, credit accounts, and other personal data. |

They provide a record of purchases to help customer service locate the complete sale. |

They have a few spaces to include information. Businesses need more information to manage operations and retrieve insights from purchases. |

Provides key information about business trends and stock rotation. |

While sales receipts provide important benefits, businesses and consumers should know the potential drawbacks to minimize their impact.

This may include exploring alternative receipt options, such as digital receipts or environmentally-friendly printing methods. You can also start implementing strong security measures to protect sensitive information.

Effective Receipt Management System

When working with a receipt management system, consider the tool’s features and how well it aligns with your company.

Here are the best receipt management systems you can use for your business:

Microsoft Office

Microsoft Office is a productivity tools suite that includes applications like Word, Excel, and PowerPoint.

They help businesses with their sales receipts by allowing them to create professional-looking tickets using customizable templates in Word or Excel.

Microsoft Office 2021 suite also provides you with solid features, allowing you to:

- Start creating visually attractive receipt templates

- Build an automated receipt system with your rendered services

- Share documents in an online and offline format

- Send invoicing and receipts after each completed sale

- Create customized templates that include the remaining balance, the total amount of money, and additional information

Businesses can use PowerPoint to create sales presentations and training materials for their staff.

Wellybox

Wellybox is a digital receipt management tool that allows you to organize and store receipts in a centralized location.

Businesses can easily upload and categorize receipts, track an income account and expenses, and generate reports. This can help their overall operations by providing a clear and organized view of their expenses and sales.

Shoeboxed

Shoeboxed is a digital receipt management tool that helps businesses with their sales receipt. It allows companies to scan and upload their documents and automatically categorize and organize them for easy access.

This software offers features such as expense reporting and integration with accounting software.

Quickbooks

Quickbooks is an accounting software that finances and sales receipts issues. Businesses can:

- Create and send professional-looking invoices with the receipt generator feature

- Track expenses, sales and generate reports.

- Integrate with other tools such as Wellybox and Shoeboxed for streamlined receipt management.

Smart Receipts

Smart Receipts is a mobile app that allows businesses to capture and organize their receipts.

You can:

- Take receipt photos

- Categorize documents according to receipt types

- Generate reports of the received money and other CRA-compliant receipts

With such features, you can provide your company with a convenient and mobile way to track expenses, tax returns, and sales.

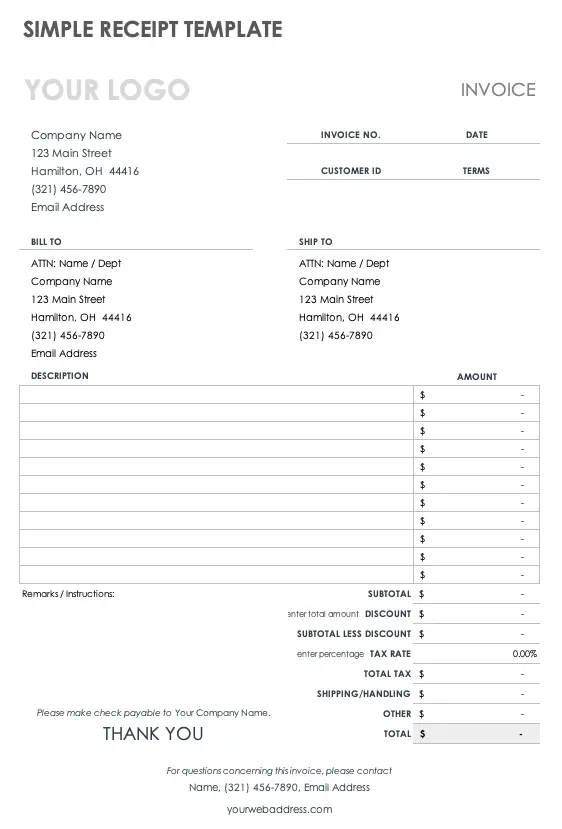

Sales Receipt Templates You Can Use

You can use all the programs above to prepare your sales receipts from scratch. But, if you don’t have time to modify documents, you may want to use online templates.

Here are the best sales receipt templates we’ve found for your business:

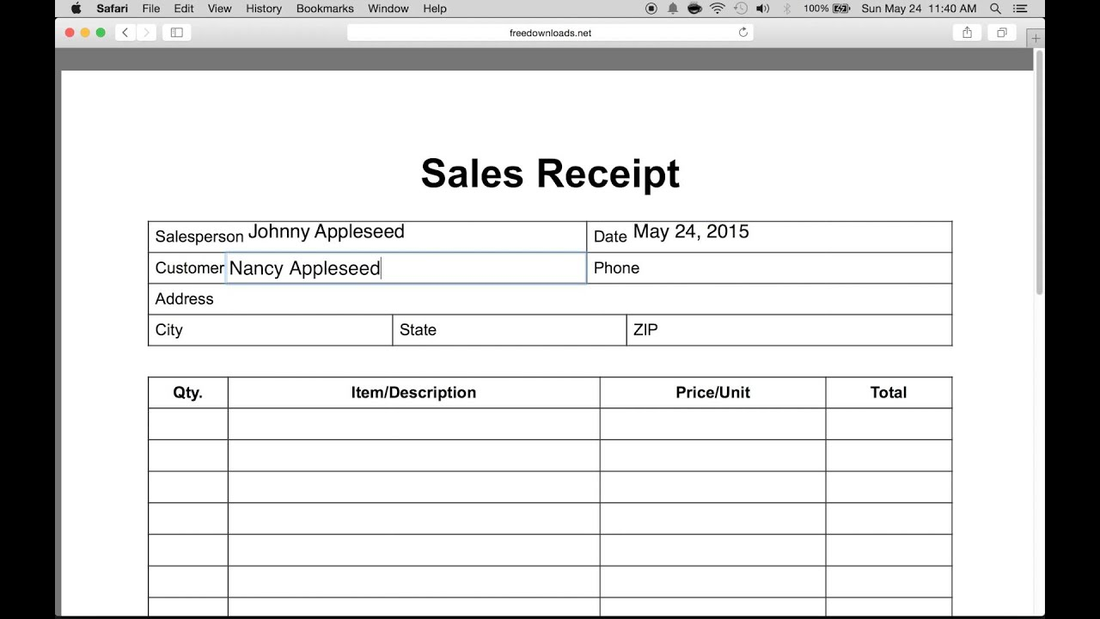

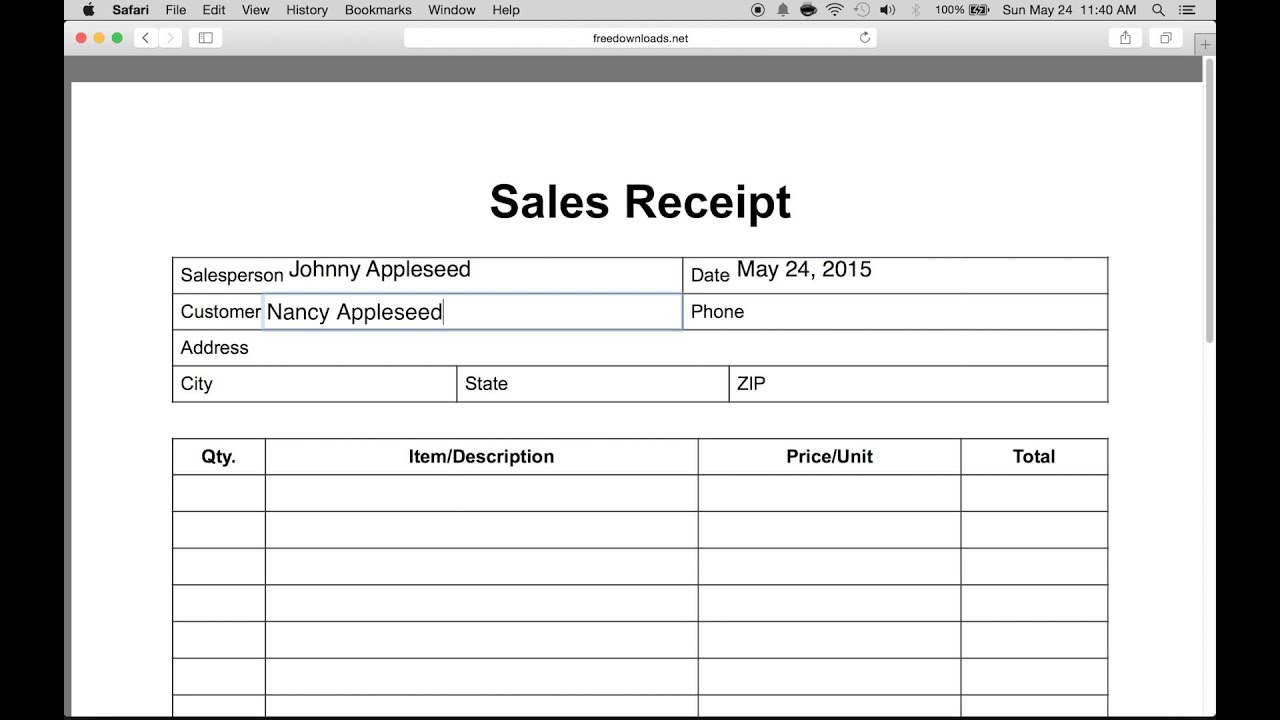

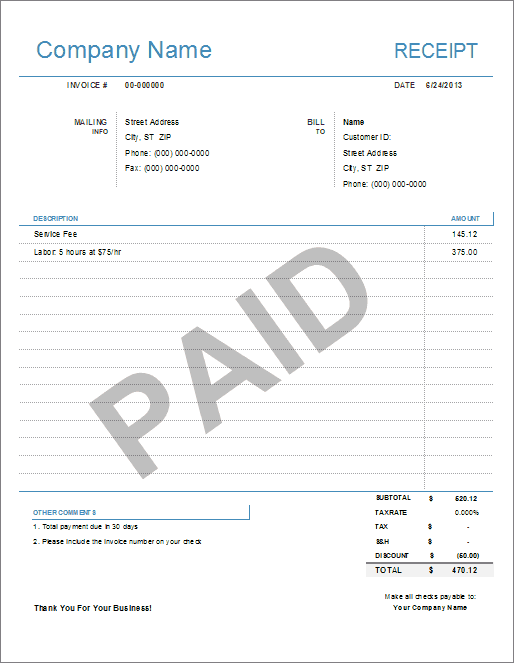

Template #1

Purchased Service Sales Receipt Template, to gather itemized informations for companies - Download Link

Creating a Sales Receipt In 6 Steps

Do you want to create applicable sales receipts for your company? Here’s how you do it:

Go to Excel and open a template you have previously downloaded.

Replace all data with your company’s information.

Add company image, vendor information, and other helpful data.

Verify the report formulas.

Determine payment conditions – installments, cash, etc.

Save the template.

After that, you can print it if needed or send it through email.

Sales Receipt, The Way To Record Business Transactions - Summary

Sales receipts are an essential document that businesses should always pay attention to. They serve as proof of purchase and accounts receivable while ensuring clear transactions between clients and the company. They provide transparency and accountability in business.

It’s also part of the businesses' strategies to submit taxes properly. That’s why using templates for sales receipts can significantly benefit them in various cases like:

Saving time and effort since the format and layout are already pre-designed. Ensuring consistency in all receipts issued by the business. This helps to enhance the brand's image and professionalism.

Helping prevent errors and omissions, ensuring accuracy in the information provided.

Giving clients a way to get refunds genuinely.

Businesses should prioritize using templates for their sales receipts to streamline operations and maintain a reliable registering process.

This is how you establish customer trust and improve financial management for long-term success.