How to Make a Statement of Cash Flows with Templates

The statement of cash flows is an essential financial statement that helps businesses and investors understand the inflows and outflows of cash during a particular period. This statement is crucial because it provides a real-time view of the company’s cash position and helps determine its financial health. This article will discuss how to make a statement of cash flows with templates.

What is a Statement of Cash Flows?

A statement of cash flows is a financial statement that reports a company's cash inflows and outflows of a company during a particular period. It is one of the three main financial statements alongside the income statement and balance sheet. The statement of cash flows tells the story of how much cash a company generated or used during the period, and what it did with the cash.

Why is a Statement of Cash Flows Important?

The statement of cash flows is important because it provides valuable information about a company’s cash flow, which is essential to its financial health. The statement of cash flows helps investors and analysts understand the company’s cash position, which can be used to assess its liquidity and ability to pay its bills and financial obligations. Moreover, it helps identify potential risks and opportunities, such as new investments or the need to raise capital.

How To Create a Statement of Cash Flows?

Creating cash flow statements can seem overwhelming, especially for small businesses needing an accounting department. However, creating a statement of cash flows can be a straightforward process using templates. Here are the steps to create a cash flow statement:

Gather the Necessary Financial Data

Before making a statement of cash flows, you need to gather the relevant financial data from your company’s accounting records. This includes information about cash inflows, cash outflows, and other relevant financial data for the period under consideration. The financial data you need to collect include the following:

Balance Sheet: The balance sheet provides information about the company’s assets, liabilities, and equity at the beginning and end of the period.

Income Statement: The income statement provides information about the company’s revenues, expenses, and net income or loss for the period.

Cash Receipt: This includes the cash paid to suppliers, employees, lenders, or other expenses.

Cash Paid: This includes the cash paid to suppliers, employees, lenders, or other expenses.

Other Investments: This includes any investments in long-term assets or business acquisitions during the period.

Separate the Financial Data Into Three Categories

The statement of cash flows is broken down into three main sections, including operating activities, investing activities, and financing activities. You need to separate the financial data you gathered into these three categories. Here’s what each type includes:

Operating Activities: This section includes cash inflows and outflows related to the company’s operations, such as cash received from customers, cash paid to suppliers, operating expenses, and interest paid on loans.

Investing Activities: This section includes cash inflows and outflows related to the company’s long-term assets, such as cash used to purchase equipment or cash received from selling assets.

Financial Activities: This section includes cash inflows and outflows related to the company’s financing activities, such as cash received from issuing stock, repaying loans, paying dividends, or lending money.

Cash Flow Statement Template

You can create a cash flow statement from scratch or download a free template to save time. If you’re a small business owner, using a template specially designed for small businesses is essential since it can help you manage your cash flow more efficiently.

When creating your template, ensure it includes the three main sections: operating, investing, and financing activities. You should also include a section for each category's beginning cash balance, net cash flows, and closing cash balance.

Please note that in order to use the Statement of Cash Flows Template, you will need a copy of Microsoft Office installed on your computer. Microsoft Office is a paid application with several programs, including Excel, which is essential for creating and using the cash flow statement template.

However, you don’t have to spend a lot of money to get Microsoft Office 2021 Professional Plus Key Retail Global. You can purchase a product key for a reasonable price from online retailers such as RoyalCDKeys. With a valid product key, you can activate and use Microsoft Office on your computer, including Excel, to create and analyze financial statements like the statement of cash flows.

Here are some cash flow statement templates for free:

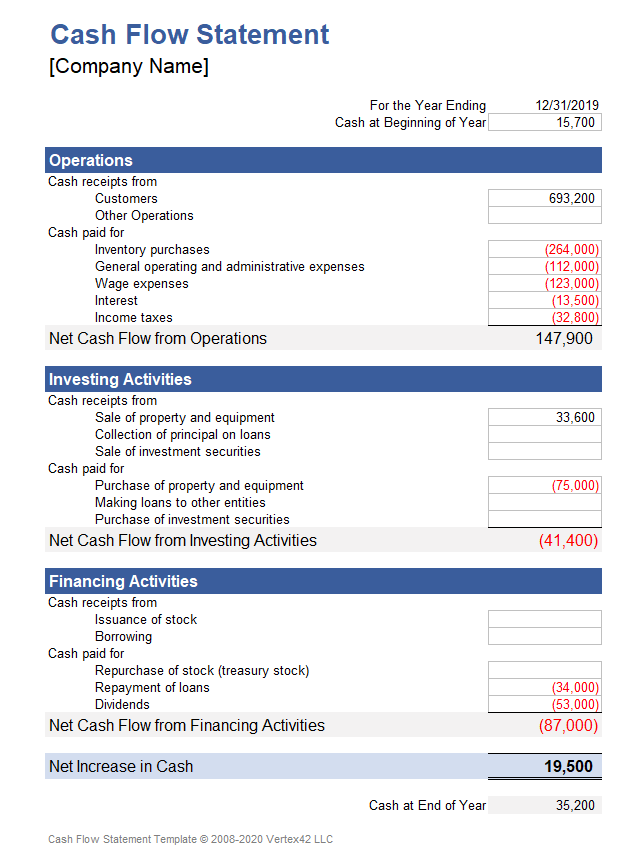

Cash Flow Statement Template #1

This cash flow statement was developed for the small business owner looking for an example of how to format a statement of cash flows. The classifications can be customized to serve your business needs. If you don't like to separate the "cash receipts from" and the "cash paid for" then you can delete the rows containing those labels and reorder the cash flow item descriptions as needed.

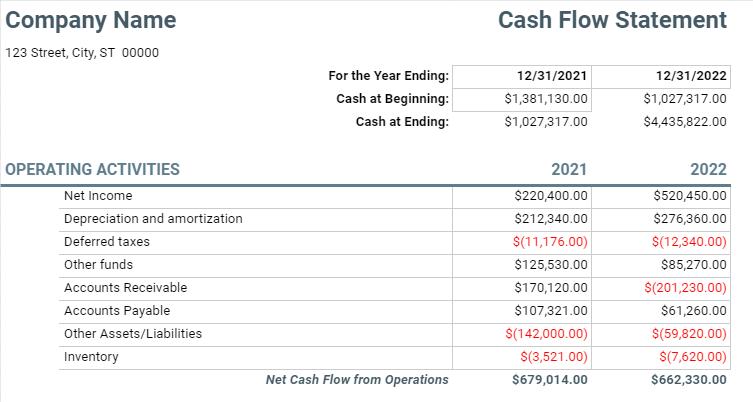

Cash Flow Statement Template #2

This cash flow statement template is divided into three main sections: Operating Activities, Investing Activities, and Financing Activities. Each section has been pre-populated with typical line items which are relevant for a company, such as Depreciation, Net Acquisitions, and Issuance of Stock. However, every business is distinct. This is a flexible template where individual line item categories can and should be edited to suit the needs of your particular business.

Enter Financial Data Into The Template

Once you have your template, you can enter financial data into it. Start with the beginning cash balance, which is the company's amount at the beginning of the particular period. Then, enter the cash received from customers, which is the revenue generated by selling products or services to customers.

Next, add some money paid to suppliers: the cost of goods sold and operating expenses such as rent, utilities, and employee salaries. Be sure to break these expenses down into line items in your template.

In the investing activities section, add any investments the company made during the period, such as purchasing long-term assets or business acquisitions. Also, include any cash received from the sale of assets.

Add any long-term debt, loans, or stock issuances. Also, include any payments made to creditors or shareholders, such as dividends or repaying loans.

Calculate The Net Cash Flows For Each Category

After you’ve entered all the financial data into the template, you can calculate the net cash flows for each category. To calculate the net cash flow, subtract the cash outflows from the cash inflows for each type. For example, to calculate the net cash flow for operating activities, subtract the total operating expenses and the total operating expenses from the total cash received from customers.

Direct and Indirect Methods

The statement of cash flows can be prepared using either the direct method or the indirect method.

The direct method involves reporting all cash inflows and outflows directly from operating activities. This method provides a more detailed view of cash transactions but is more time-consuming to prepare.

The indirect method starts with net income from the income statement and makes adjustments to reflect the cash flows from operating activities. This method is easier and quicker to prepare but provides a less detailed view of cash transactions.

Under both methods, cash flows are classified into three main categories: operating, investing, and financing activities.

Operating activities are cash flows related to a company’s operations, including cash received from customers, payments to suppliers, and payment of operating expenses.

Investing activities are cash flows related to the purchase of stocks and bonds.

Financing activities are cash flows associated with financing a company’s operations, including payments of dividends, repayment of loans, and issuance of stock.

Regardless of the method used, the statement of cash flows is a financial statement that provides a real-time view of a company’s cash flow and ability to meet its financial obligations.

Determine the Closing Cash Balance

Once you’ve calculated the net cash flows for each category, you can determine the closest cash balance to the net cash flows for each category. The closing cash balance is the amount of cash the company has at the end of the period.

Analyze The Cash Flow Statement

The cash flow statement tells you how much money is coming in and going out of the company during a particular period. It also helps you understand how the company’s operations, financing, and investing activities impact its cash balance.

By analyzing the income statement of cash flows, you can gain insights into the company’s financial health, including its liquidity and ability to meet its financial obligations. You can also use the statement of cash flows to create cash flow projections and determine how much cash the company will have available in the future.

Conclusion

In conclusion, the statement of cash flows is an essential financial statement that helps companies track their cash inflows and outflows over a specific period. It provides valuable insights into a company’s financial health, liquidity, and ability to meet its financial obligations.

By creating a statement of cash flows using a template and analyzing it regularly, companies can better manage their cash resources, make informed financial decisions, and plan for future cash needs.

Whether you are a small business or a financial analyst, understanding how to create and analyze a statement of cash flows is an essential skill to have. By following the steps outlined in this article, you can create an account of cash flows that provides a clear and accurate picture of your company’s cash position and use that information to make informed financial decisions.