How to File a Costing Sheet to Control Business Spending

Understanding and controlling costs is crucial for any organization to thrive. And a well-structured costing sheet serves as an indispensable tool for companies to identify, analyze, and optimize expenses, ultimately laying the foundation for robust financial management.

Whether you're a seasoned businessperson or a budding entrepreneur, comprehending the language of costing sheets is necessary.

This article covers the costing sheet, its key elements, methods, and practices for an effective cost analysis to provide you with valuable insights and tips that elevate your organization's cost management strategy.

What is a Costing Sheet?

The costing sheet is a financial document companies develop to measure and consider the actual cost of developing a product or service.

The sheet includes:

- Direct costs

- Indirect costs

- Overhead costs

- Production costs

Companies use cost estimates to calculate their labor, operational costs, and selling prices to have a profit margin.

The costing sheet also shows historical data and indirect expenses incurred to help managers compare current, past, and projected situations.

Main Objective of an Estimated Cost Sheet

The cost sheet template aims to help companies conceal an appropriate selling price based on previous and current expenses.

It also helps improve the production process, hence profit margins. There are other essential business processes you can optimize using a costing sheet, for example:

Finding determining cost and unit cost.

Giving details about production costs.

Establishing a fixed and profitable selling price.

Comparing historical cost in a bad market situation.

Helping business managers to prepare measures against a rise in raw materials cost.

Monitoring overhead costs and document production cost components.

Providing insights to improve decision-making in the production process.

Benefits of Adding a Costing Sheet to Your Business

Adding a costing sheet to your business to control direct expenses and any indirect cost brings immense value.

Here are the benefits you should consider when using a cost sheet:

Establishes Clear Costs

The cost sheet provides a clear picture of all costs related to the manufacturing process. These will be estimated costs that could change throughout each stage.

You can determine total overall costs, including cost variance, and track expenses through multiple departments.

Determines Fixed and Variable Costs

Businesses must have cost control to ensure a profitable cost of sales. A costing sheet would help you establish a fixed selling price that you can provide to:

Wholesaler.

Retail stores.

Final consumers.

Use the sheet to calculate profit margins, factory costs and determine your actual costs with an in-depth analysis of the money spent.

You can use the sheet to update prime costs if the manufacturing unit cost changes.

Compares Manufacturing Cost Over Time

Businesses can use the document as a historical cost sheet that allows managers to compare the basic cost of a product over time.

Use it to accurately estimate how much your profits change through inflation and how it reflects in raw material prices.

You can see if production elements' costs are stable so that your factory cost doesn’t change and find out if distribution overhead costs will vary in the long term.

Check Unprofitability

These documents show detailed expenses, cost numbers, and other costs to confirm when a raw material doesn’t have profit margins.

The costing sheet can show when direct or indirect material costs are lowering the business’ revenue. Based on that information, you can determine whether to continue producing a product with the same materials or find a replacement.

Types of Costs

Two types of costs are considered in the costing sheet: historical and estimated.

Historical Costs

A historical cost sheet includes the previous data on direct and indirect product development expenses. Compared to other sheets, they don’t have projections.

Estimated Costs

The estimated costing sheet is used when businesses want to forecast the total cost of a product. They can also delimit profit per item and find ideal product costs.

This helps when the company incurs pre-sale strategies and wants to create an ideal price according to work costs.

Elements of a Costing Sheet

A costing sheet has various components; each is important when preparing the document.

Here’s what you should include:

Prime Cost

Prime cost refers to all the costs directly related to finished goods. It’s also called basic cost or flat cost.

It’s all the money spent as a business to start production.

A formula will illustrate better:

Prime cost= Direct Labor + Direct Raw Materials + Direct Expenses.

So imagine you’re a small business and spend $2,000 in materials, $8,000 in salaries, and $1,200 in other expenses. After following the formula, your total would be $11,200.

Works Cost

This is the combination of the prime cost with factory overheads. The latest is indirect costs from operations involved in the production process.

Some examples include taxes and utilities.

Product-Based Cost

The costing sheet must include the costs of creating a product, including equipment, factory rent, work cost, etc.

This formula is represented as follows:

Product-Based Cost= (Work costs + Administration overhead) - (Opening and closing stock for finished products)

Sales Cost

The sales cost is the value that summarizes all the expenses incurred during the production of all the goods sold, including distribution.

This indicator clearly shows the overall production cost and the resources available.

How to Use a Costing Sheet on Your Business

There are many ways you can apply a costing sheet to your business. Sometimes it’s not only about cost control but also about another efficient way to improve processes.

Let’s break this down:

Project Development

Businesses always seek ways to innovate and increase their market share. A clever way to use a costing sheet is to prepare a detailed document with costs and expenses to find an appropriate selling price.

Product managers can also check historical data to understand more about the current market and past projections for similar products to influence their decisions.

Budget Allocation

A costing sheet allows you to set the foundation to delimit a budget for departments and production.

The document shows you an estimated value during the fiscal year. Based on this, you can determine indirect wages and how much a company can spend to make a profit.

You must ensure that every business unit has a percentage of your total budget to work properly. For example:

A business that wants to develop a new product must calculate how much money they’ll need to cover a 5% increase in marketing and administrative tasks. The business can use the costing sheet to understand where to cut resources.

They should check historical data and previously calculated sheets to know if they have enough to cover the new project.

Find Root Causes

Cost sheets allow you to determine if any material consumed has increased or decreased over the years. This will also help you determine if a year was profitable and decide what to do next.

So, for example, a business is determined to verify if its manufacture was profitable. So, the company checks its cost sheet to compare previous years' prices with current ones and notices they have risen over 30%.

This means the business’s profits have decreased by at least 30% compared to previous periods.

Control Sales Tax

The cost sheet allows you to identify how much you sell, your profits, and more. But it also helps you foresee what you can deduct from sales tax.

This is a powerful strategy business use when calculating tributes before paying.

Productivity Software for Small Businesses

Now, considering you must produce a costing sheet, you’ll also need productivity software with access to different tools that help the managing staff to produce accurate estimations.

A reliable solution could be Microsoft Office, especially if you have a Windows computer/laptop. The software is installed as a predetermined software that allows you to review a few documents without activating it.

However, you must purchase a lifetime license if you want to use formulas, dynamic tables, and unique formats. RoyalCDKeys gives you access to an original and cheap solution where you obtain a Microsoft Office 2021 CD Key for less than $20.

With Microsoft Excel or Word, you can create intuitive templates that work as an aggregate for your business operation.

Here are a few costing sheet templates you can use to improve your estimations:

Template #1

Simple Project Costing Template that includes tasks, price and additional information - Download Link

Template #2

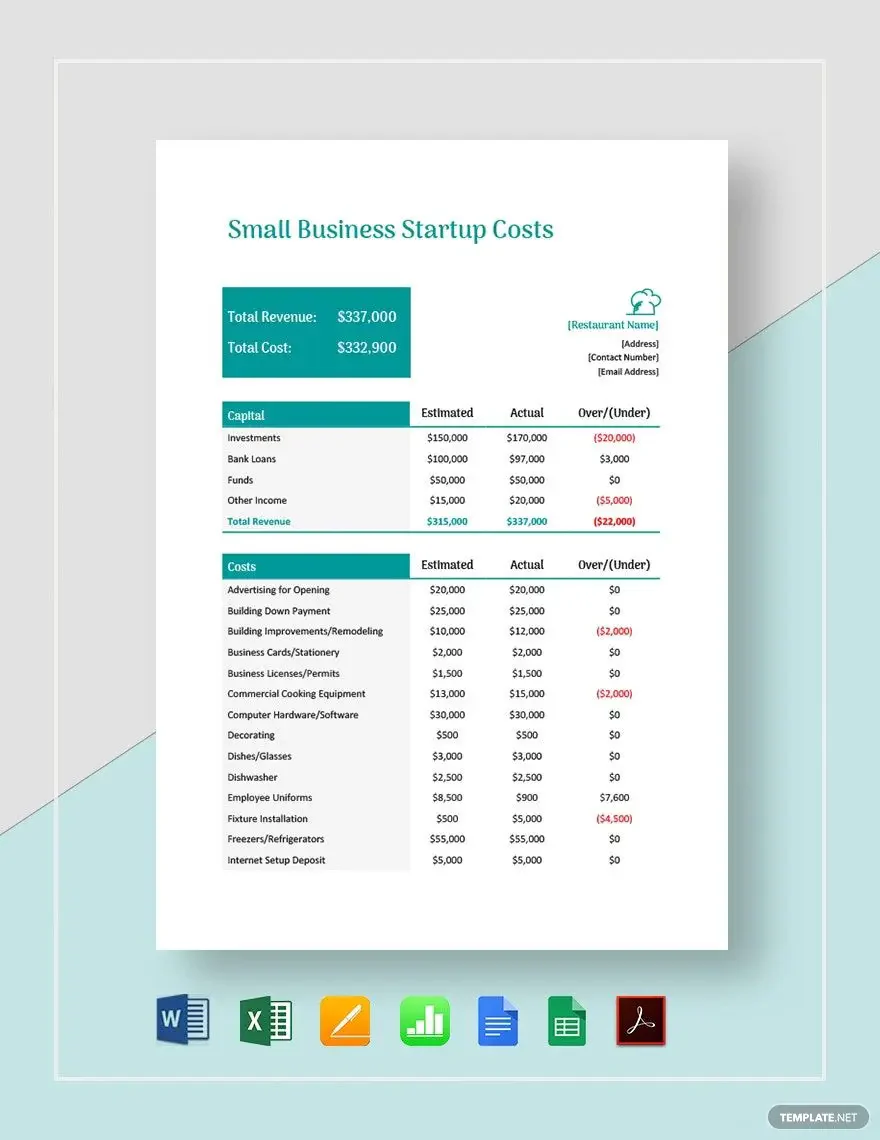

Small Business Startup Template that includes costs, capital and total revenue - Download Link

Template #3

Linear Company Cost Sheet Template. Includes prime cost and work cost incurred - Download Link

Template #4

Costing Sheet For Resellers & Traders. Key to show total purchase and taxes - Download Link

The Costing Sheet, An Essential Tool for Your Administration

Mastering the costing sheet is more than just an optional exercise but a necessity for any business. It provides a clear view of your product's cost landscape and offers insights to inform strategic decisions.

Although it may seem complex at first, with patience and practice, you can unlock its full potential.

A well-structured costing sheet is not just a financial tool but a compass guiding your business toward profitability and success.