How to Easily Create a Startup Business Budget Template

Managing estimated fixed costs and other aspects of a business, like bank loans, can take a lot of work for new business owners. Everything can impact the future of your business, from where you spend money to the number of variable costs.

This is why people create a startup budget template. With this tool, you can easily track your startup expenses and understand how to manage them better.

This article will teach you how to create a startup budget template to keep track of your variable and fixed expenses. This way, you can more easily manage your business startup.

What Is a Startup Budget Template

A startup budget template is a sheet used to track business startup costs and help business owners to manage them better. They allow you to estimate variable and fixed expenses, helping you plan your actions, especially in early-stage businesses.

There are many different costs that a startup budget template can include. Some of the most common ones are:

- Office Space

- Inventory

- Marketing Costs

- Employees Salary

- Financial Resources

- Capital Expenditures

Why Is It Important to Create a Startup Business Budget Template

Along with preventing a small business startup from going broke, there are several reasons why creating a startup budget template is vital for better control of startup expenses. The first reason is to have a document that will directly help you when making decisions for your business, from the hiring process to the calculation of business expenses.

Another reason is that having a detailed sheet of your operating costs and estimated expenses is also a great way to land investor funding for your startup. This will help gather investments that can help with your monthly costs and overall startup expenses.

How to Easily Create a Startup Business Budget Template

Now that you know what a startup budget template is and why it is crucial, it is time to start creating your own. Be sure to carefully analyze your startup to see your primary needs to create a template that truly fits them.

Here are the main items you should include in your startup budget template:

List Your Startup Costs

The first thing you need to do when building your template for business startup costs is to list all these costs, no matter their nature. There are different types of costs that a business startup can have.

Each one has a different nature and a different impact. Here are some of the most common types of business startup costs:

Fixed Costs

This is the most common type of cost. It regards recurring bills that your business startup may have. These bills can be monthly, quarterly, or even annually.

Some examples of fixed costs that a business startup may have are:

- Rent and Utilities

- Cleaning Costs

- Advanced Hosting Services

- Software Subscription

- Payrolls

- Benefits

- Website and Social Media Maintenance

Variable Costs

The next category when listing estimated startup costs is the variable cost category. The name is pretty self-explanatory.

This type of cost regards expenses that may vary from month to month. This variation can happen because of a series of factors.

These costs tend to get bigger the more your startup grows. Here are some of the main costs that enter this category:

- Transaction Fees

- Marketing and Advertising costs

- Bills like Water and Electricity

One-Time Costs

This type of cost is also indispensable when calculating startup budgets. They are related to costs and expenses that you will have once without needing subscriptions, fees, or maintenance.

They tend to be more expressive for a new business owner trying to open a startup. Here are some of the most common one-time costs:

- Computers and Electronics

- Furniture

- Licenses

- Consultations

- Purchasing Assets

Revenue Projections

After listing all your actual costs and key expenses, the next step is to calculate your revenue projections. This step is crucial for having a clear picture of your business startup costs because many businesses forget to calculate all the possible incomes and stick only with optimistic presumptions of the business budget.

The problem with this is that sometimes these presumptions can be wrong, and the budget can end up being way lower than expected. This can lead to several issues like extra expenses with bank loans and lawyers, for example.

To prevent this and end up with a precise calculation of your startup budget, you must calculate three basic assumptions: upside scenario, base scenario, and downside scenario. Here is what each one of these assumptions means and how they impact the total startup costs.

Upside Scenario

This is the best scenario for a startup or franchise business. This scenario means that the growth is happening faster than expected, generating more revenue and, consequently, a more significant business budget.

This will directly impact your total startup costs since you will have more money at your disposal for associated costs or any other aspect of the business. As previously mentioned, this scenario must be only a possibility, not the expectation of what will happen.

Base Scenario

This possibility is the average revenue that your business can have. The calculation can be done in the space of time of your preference, like monthly or annually, for example.

In a base scenario, the average growth is exactly what was expected, and you will have sufficient working capital for the already predicted expenses. It is not a bad scenario. It is actually the most realistic one.

Downside Scenario

If your revenue hits this category, it can be alarming for your startup. The downside scenario means a slow or even declining growth of sales or income.

This scenario also directly impacts all aspects of your business, including operating expenses and ongoing costs. Running a business in a downside scenario requires meticulous planning of actions from the owner of the company.

Create a Cash Flow Projection

The last step when creating startup budget templates is to build a cash flow projection for your business. This tool is basically a sheet that will tell how much money will be moved from your startup, in and out.

To do it, you must guarantee that you have correctly done all the other previous steps and listed all your expenses and total costs. This will ensure the revenue and final value of the cash flow are the same when executing it in reality.

Here is a simple way of calculating it:

- Calculate how much money your business has at the beginning of the month in the bank.

- Calculate how much money your business will receive.

- Calculate how much money your business will pay, not just in actual cash.

- Calculate Receivables – Expenses.

- Add your opening balance to the result, and you will have your closing balance for the month.

Where to Create Startup Budget Templates

When trying to create startup budget templates, two options are used worldwide for this task. You must analyze your business to decide which will fit your needs and expectations.

Microsoft Excel

The first one is Microsoft’s solution for almost everything regarding spreadsheets and budget tracking. Excel has one of the best tool sets available in the market and can definitely create the perfect startup budget template for your business.

From the business start to the most advanced stages of a company, Excel will always be present in an organization.

Specialized Software

The other alternative is to subscribe to specialized software. These programs have sets of tools made especially for doing those kinds of documents.

On the other hand, the problem with this kind of software is the price charged for them. You will always need to pay monthly subscriptions. As for a business start, it might be a good alternative, but for more advanced startups, you will end up signing numerous software contracts. This will generate an increase in monthly expenses.

Our Recommendation

Among the two options, we highly recommend sticking with Microsoft Excel when doing your startup budget template. The software not only has the best set of tools and features for editing even the smallest details of a project, but it is also an industry standard used for almost any task in a company. This way, you will have one software capable of doing everything instead of using multiple ones.

If you don’t have a Microsoft Office activation key, you can buy one at RoyalCDKeys for a considerably lower price when compared to Microsoft Store. For example, you can get Microsoft Office 2021 Professional Plus Key Retail Global for only a fraction of the retail price. This way, you save money that can be used for other parts of your startup.

Free Startup Budget Templates

If you don’t want to create your template from scratch, there is no problem. Here are some ready-to-use templates you can download and edit to better suit your needs.

From small business templates to annual budget templates, everything will depend on your needs and goals.

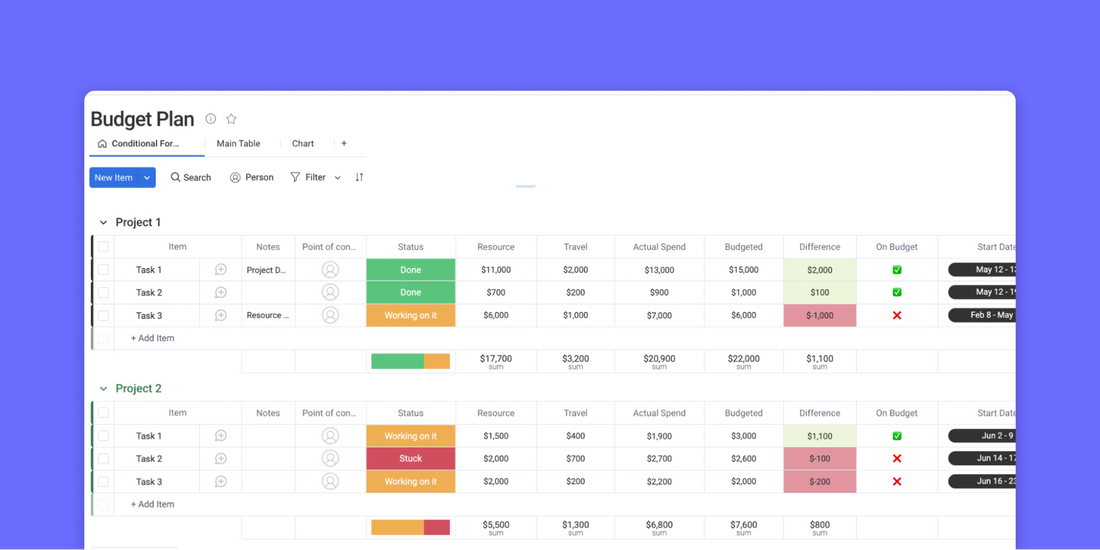

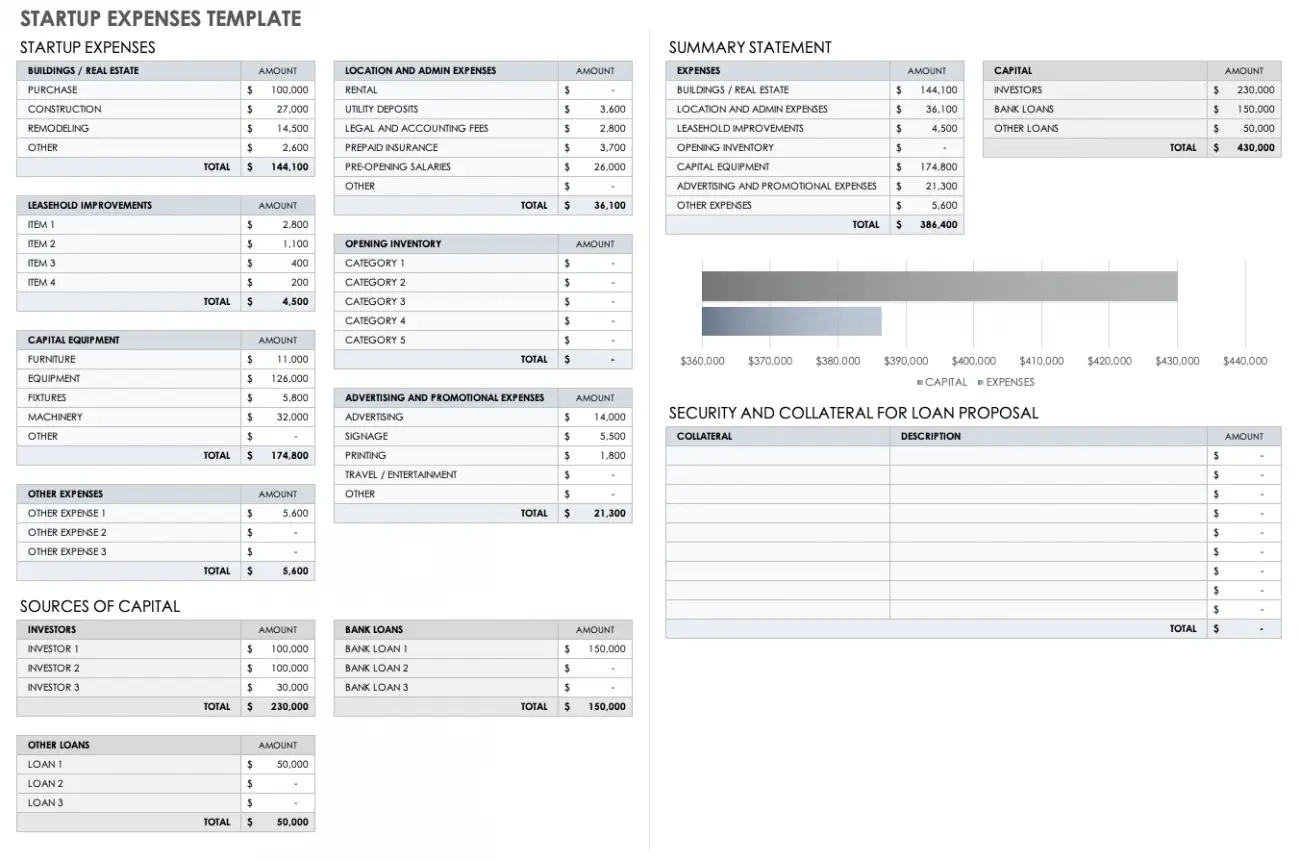

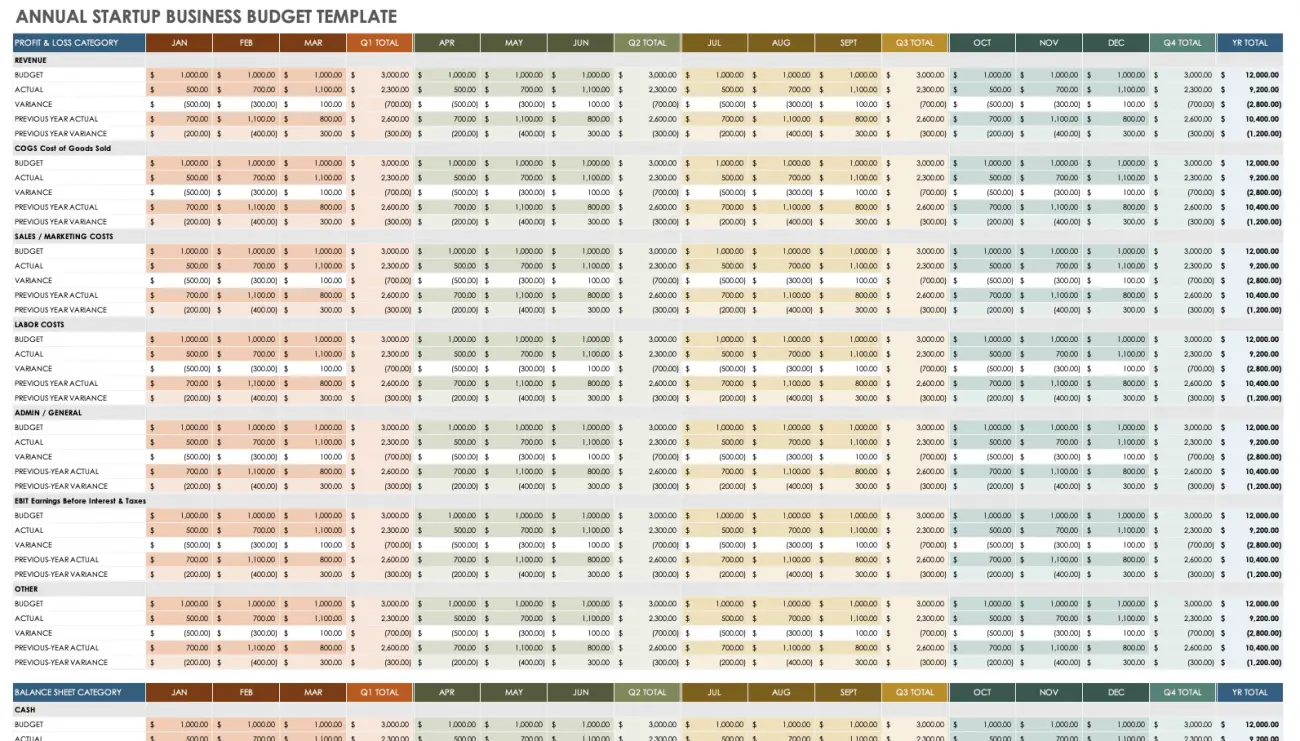

Template #1

Startup expenses template. Perfect for a summary of the budget needed to pay the main bills.

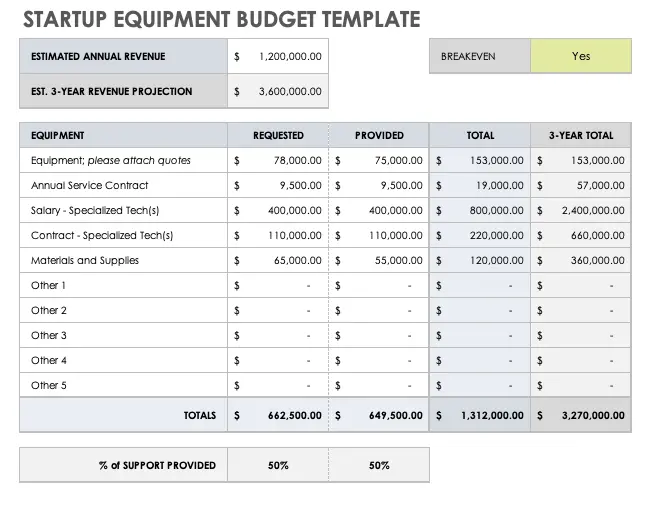

Template #2

Equipment budget template. Indicated for projects that need hiring or buying new equipment.

Template #3

Annual budget template. Perfect when creating a yearly budget for a business plan.

Conclusion on Business Budget Templates

Organizing financial statements and the actual income of a startup can be tricky. Still, it becomes way more manageable once you understand the process and use a tool such as a business budget template. Make a deep analysis of your startup and correctly list all your costs to create a document that genuinely helps you better manage your expenses.

Now that you know everything you need, it is time to create your own startup business budget template. Don’t forget to follow the correct steps and constantly update the document. This way, you will always have a precise cash flow and revenue projection for your company.